MCALLEN, TEXAS — Faris Lee Investments has arranged the $7 million sale of a 65,000-square-foot retail property in McAllen that is triple-net leased to Floor & Décor for a term of 55 years. The store, which will be the Atlanta-based home improvement retailer’s first in the Rio Grande Valley, is under construction and slated to open on March 3. Jeff Conover and Scott DeYoung of Faris Lee represented the Texas-based developer and seller in the transaction. The buyer was a Texas-based 1031 exchange investor. Both parties requested anonymity.

Property Type

SAN ANTONIO — Austin-based Oracle has signed a 35,000-square-foot office lease at The Spectrum Building, a 10-stoy property in San Antonio. About 260 employees will work in the space, which features glass-walled conference and breakout rooms and multiple kitchens and coffee bars. Kacie Skeen of Hartman Income REIT Management represented the landlord in the lease negotiations on an internal basis. Oracle was also self-represented.

NEW YORK CITY — New York City-based investment management firm Clarion Partners has provided a $415 million mezzanine loan for the refinancing of a national portfolio of 110 industrial buildings totaling 15.7 million square feet. The portfolio consists of properties in 15 markets, including Dallas-Fort Worth, Phoenix, Baltimore and Atlanta. At the time of the loan closing, the portfolio was approximately 93 percent leased to a roster of 300-plus tenants. The borrower was Blackstone.

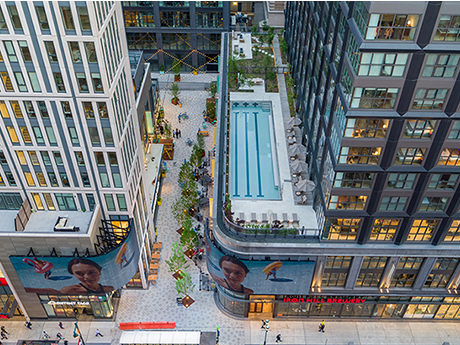

PHILADELPHIA — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors. The developer also plans to convert a traditional office building on the site into a boutique hotel and medical facility.

WESTPORT, CONN. — CBRE has brokered the $43 million sale of two waterfront office buildings totaling 94,647 square feet in Westport, located in Fairfield County. Jeffrey Dunne, Steven Bardsley, Jeremy Neuer, David Gavin and Stuart MacKenzie of CBRE represented the seller, a partnership between Baywater Properties and an investment fund advised by True North Management Group, in the transaction. The team also procured the buyer, The Feil Organization. Tenants at the buildings include Raymond James, Sterling Investment Partners and IXM Trading.

EGG HARBOR CITY, N.J. — New Jersey-based brokerage firm The Kislak Co. Inc. has negotiated the $7 million sale of a 5,585-square-foot retail property in Egg Harbor City, located in Atlantic County. The property is under construction and is preleased to convenience store operator Wawa for 20 years on a triple-net basis. Jason Pucci and Justin Lupo of Kislak represented the buyer, Kamson Corp., in the transaction. The seller was not disclosed.

BONDURANT, IOWA — Avison Young’s capital markets group has brokered the sale of a 2.7 million-square-foot fulfillment center occupied by Amazon in Bondurant, a city northeast of Des Moines, for more than $325 million. The newly constructed, four-story property sits across the street from a 270,000-square-foot Amazon sortation facility. Jonathan Hipp, James Hanson and Richard Murphy of Avison Young represented the seller, Mesirow Realty Sale-Leaseback Inc. Earl Webb of 9th Green Advisors also advised Mesirow on the sale. Virginia-based Capital Square was the buyer.

MOUNT PLEASANT, WIS. — In April, Ashley Capital is scheduled to break ground on Buildings V and VI at Enterprise Business Park in Mount Pleasant. Both speculative industrial buildings will span 390,000 square feet each and are scheduled for completion in the fourth quarter. The developer has already completed three buildings totaling more than 1.2 million square feet at the business park, which is situated near I-94 and about 30 miles south of Milwaukee. Terry McMahon and Cody Ziegler of Cushman & Wakefield/Boerke and John Sharpe and Tom Boyle of Lee & Associates are the leasing agents for Enterprise Business Park.

NEWARK, N.J. — General contractor SJP Properties has completed a 30,000-square-foot office project in Newark that is a build-to-suit for KS Engineering. The new space includes a boardroom and reception area at the entry, huddle rooms, a café with a virtual golf and gaming area, a wellness room and a library/lounge. Design-build firm Ware Malcomb provided interior and exterior design services for the project.

ZMX, Forbes Plunkett Secure Construction Financing for $67.7M Multifamily Project in Metro Nashville

MADISON, TENN. — Nashville-based ZMX Inc. and Forbes Plunkett Real Estate & Development has secured construction financing for The Northern, a 297-unit, garden-style multifamily development in Madison. Atlanta-based Patterson Real Estate Advisory Group arranged the development financing with Origin Investments and Fifth Third Bank for the $67.7 million project. Construction is slated for completion by early 2024. The Northern will offer studio, one-, two- and three-bedroom floorplans ranging from 592 square feet to 1,285 square feet. Community amenities will include a pool, fitness center, clubhouse with outdoor grilling areas, several green spaces and pocket parks, dog park and a dog spa. The project is located close to downtown Nashville.