NEW YORK CITY — JLL has negotiated the $54 million sale of a multifamily development site located at 555 Broadway in the Williamsburg neighborhood of Brooklyn. Brendan Maddigan, Stephen Palmese, Ethan Stanton, Michael Mazzara and Winfield Clifford of JLL represented the seller, The Collective, a co-living operator based in the United Kingdom, in the transaction. The team also procured the buyer, a joint venture between The Loketch Group, The Joyland Group and Meral Property Group that plans to develop a 250,000-square-foot community with retail space. In addition, a portion of the units will be reserved as affordable housing. A construction timeline was not disclosed.

Property Type

EASTON, PA. — J.G. Petrucci Co. Inc. has purchased a 107,310-square-foot industrial building located at 3 Danforth Drive in the Lehigh Valley city of Easton. The building sits on 10.6 acres and includes 34 loading dock positions and just under an acre of outdoor storage space. J.G. Petrucci is currently renovating the building, which will be available for leasing in July. Kevin Hagenberg of SSH Real Estate brokered the deal. The seller and sales price were not disclosed.

DUBLIN AND NOVATO, Calif. — Southern California private equity firm IRA Capital has acquired two newly constructed assisted living and memory care facilities totaling 160 units in the Northern California cities of Dublin and Novato for $106.5 million. An active player in the medical office, life sciences and ambulatory surgery space, IRA Capital is growing and diversifying its healthcare real estate portfolio by expanding into seniors housing in high-barrier-to-entry markets on the West Coast. Elegance Senior Living operates the two Class A communities. Elegance at Dublin is an 80-unit community located within walking distance from a variety of shopping centers and restaurants, several hospitals and directly across the street from the Dublin Senior Center. Elegance Hamilton Hill in Novato is an 80-unit community situated in the heart of Hamilton Field’s 414-acre master planned community near shopping centers, restaurants and medical facilities. “The launch of our new seniors housing vertical is consistent with IRA’s goal of pursuing best-in-class assets that drive long-term growth for our investors, while providing quality services for the community,” says IRA Capital co-founder Jay Gangwal. IRA Capital has allocated approximately $1 billion to acquire over 2,000 seniors housing units over the next couple years. As part of …

LEHI, UTAH — Arden Group, in partnership with Vesta Realty Partners, has purchased an office building located at 3400 W. Mayflower Ave. in Lehi. Terms of the transaction were not released. Younique, a health and wellness direct sales firm, fully occupies the 125,000-square-foot property on a lease basis through 2026. Situated on 7.1 acres, Stack Real Estate developed the asset in 2016 as a fully amenitized corporate campus and showcase property for Younique. The property features 25,000-square-foot floor plates, a full-size commercial kitchen, cafeteria, lounge, outdoor seating, auditorium, five balconies with seating, full-service salon and R&D lab.

Lowe Property Group, MVE + Partners Open Dixon Place Apartment Community in Salt Lake City

by Amy Works

SALT LAKE CITY — Lowe Property Group, along with MVE + Partners as designer, has opened Dixon Place, a 49,049-square-foot mixed-used multifamily property in Salt Lake City. Located at 1034 E. Elm Ave., Dixon Place features 35 one-bedroom and 24 two-bedroom units with full kitchens and bathrooms, as well as washers/dryers. The property also includes 2,200 square feet of ground-floor commercial space. Community amenities include a business lounge and conference room for remote workers, a fitness center, bike storage, Bark Park for pets, electric vehicle charging stations, a coffee bar and pool table.

NAMPA, IDAHO — Blueprint Healthcare Real Estate Advisors has arranged the sale of a seniors housing community in the Boise suburb of Nampa. The single-story community features 107 independent living units, 18 assisted living units and 42 licensed skilled nursing beds. The REIT owner and operator collectively decided to divest the property, as it was the operator’s only Idaho location. Cascades Healthcare acquired the asset for an undisclosed price.

Marcus & Millichap Negotiates $4.3M Sale of Shoreline Park Office Building in Shoreline, Washington

by Amy Works

SHORELINE, WASH. — Marcus & Millichap has arranged the sale of Shoreline Park, an office building located at 19940 Ballinger Way NE in Shoreline. A private investor sold the asset to an undisclosed buyer for $4.3 million. Shoreline Park features 13,503 square feet of office space. At the time of sale, the property was 85 percent occupied by a mix of professional tenants. John Marks and Stren R. Lea of Marcus & Millichap’s Seattle office represented the seller in the deal.

GLENDALE HEIGHTS, ILL. — Turner Impact Capital has acquired Ellyn Crossing Apartments, a 1,155-unit workforce housing property in Glendale Heights, a western suburb of Chicago. The sales price of $137 million, as reported by Crain’s Chicago Business, and the number of units mark the biggest suburban Chicago apartment deal ever, according to research firm Real Capital Analytics. With this acquisition, Turner Impact Capital’s housing portfolio now includes nearly 2,800 units in the Chicagoland area and over 11,200 units of workforce housing in metropolitan areas across the nation. These properties serve more than 18,600 low- and moderate-income residents such as teachers, police officers and healthcare workers. These employees often earn too much to qualify for subsidized housing but too little to afford higher-cost housing near their workplaces, according to Turner Impact Capital. “As Americans face double-digit rent increases in markets nationwide, along with limited housing supply and uncertainty surrounding the pandemic, our need for housing solutions is more urgent than ever,” says Bobby Turner, CEO of Turner Impact Capital. “Our scalable investment model has uplifted communities far and wide by putting affordable, quality housing within reach for thousands of families while generating strong risk-adjusted returns for investors. The model proves that …

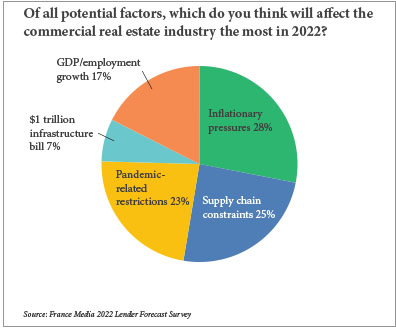

By Matt Valley An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants. More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question. On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent). Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid. Fueled by strong tenant demand, the national …

Institutional Money, Private Investors Continue to Flock to Inland Empire Multifamily Market

by Jeff Shaw

By Eric Chen, Senior Vice President, CBRE Multifamily has been a well-performing real estate segment during the past 18 months as demand for housing continues to trump supply in most of California. The Inland Empire has been the recipient of much of this demand within the Greater Los Angeles and Southern California regions due to their economic and population growth. Tenants are also in search of more affordable, quality dwellings outside the urban core. Due to the confluence of these factors, multifamily vacancies in the area are at an all-time low of less than 5 percent. This is exasperated by the fact that new developments are at the lowest level across the nation, pushing rent growth to No. 1. This dynamic is, of course, ideal for investors who seek stable, income-producing investments with potential upside and little risk of oversupply. We do expect additional apartment properties to be built in the coming year or two, which will create more investment opportunities and provide more options for tenants who are new to the region or relocating from within. Looking back on this year, we have seen a number of large institutional-sized transactions between $25 million and $100 million, with investors ranging …