ANDOVER, MASS. — Boston-based mortgage banking firm EagleBridge Capital has arranged $14.6 million in debt and joint venture equity financing for 6 Riverside Drive, a 77,000-square-foot flex building in the northern Boston suburb of Andover. The property sits on 8.6 acres and houses both office and research and development space. Ted Sidel of EagleBridge Capital arranged the financing on behalf of the undisclosed borrower. The breakdown of debt and equity components was also not disclosed.

Property Type

MEDFORD, MASS. — Locally based private equity firm Brookwood Financial Partners has purchased Ten Cabot, a 107,026-square-foot office building in the northwestern Boston suburb of Medford. The Class A, transit-oriented property was 97 percent leased at the time of sale. The seller and sales price were not disclosed.

PHOENIX — Davlyn Investments has purchased The Boulevard, an apartment property in Phoenix, for $112.5 million. The California-based buyer plans to rebrand the 294-unit community as Boulders at Lookout Mountain. Built in 1994 on 16.7 acres, the property features central heating and air conditioning, in-unit laundry, wood-burning fireplaces, walk-in closets with built-in shelving, arid landscaping, parking and an expansive community amenity package. Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap, represented the undisclosed seller. Eric Flyckt of Northmarq arranged acquisition financing, which New York Life provided.

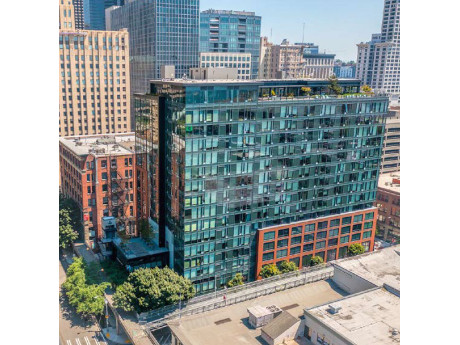

PCCP Provides $75M Acquisition, Repositioning Loan for The Post Apartments in Downtown Seattle

by Amy Works

SEATTLE — PCCP has provided a $75 million senior loan to Griffis Residential for the acquisition and repositioning of The Post, a 16-story multifamily community located at 888 Western Ave. in downtown Seattle. Situated in the Seattle Central Business District, Waterfront and Pioneer Square submarkets, The Post features 208 apartments with quartz countertops, vinyl-plank flooring, steel appliances, floor-to-ceiling windows and views of downtown Seattle, Elliott Bay and the Olympic Mountains. Community amenities include a rooftop deck with grilling areas and a reflection pool, multiple rooftop lounges, a media room, dog run, yoga studio, library and fitness center.

BUCKEYE, ARIZ. — An entity controlled by Contour Real Estate has acquired an approximately 77-acre industrial site at the southeast corner of Apache and Southern Avenue roads in Buckeye. The Napolitano Family sold the property, which is adjacent to the Cardinal Glass and Walmart distribution facilities, for $14.5 million. Contour plans to develop a 1.2 million-square-foot, Class A, cross-dock facility targeting e-commerce and logistics tenants in needs of a regional distribution hub. Ware Malcomb is serving as architect and civil engineer for the project. Paul Borgesen and Dylan Sproul of SVN Desert Commercial Advisors represented the buyer in the deal. Marc Hertzberg of JLL’s Phoenix office will handle leasing for the completed facility.

Lument Funds $25.1M in Fannie Mae Financing for Affordable Housing Portfolio in Colorado

by Amy Works

LAKEWOOD, ARVADA, DENVER AND FOUNTAIN, COLO. — Lument has closed five Fannie Mae conventional multifamily housing loans totaling $25.1 million to refinance the Archway Portfolio, five affordable housing communities near Denver and Colorado Springs. The borrower is Archway Communities, which manages the portfolio. Andrew Ellis of Lument led the transactions. Fountain Ridge, the largest of the portfolio, received a 10-year loan with a fixed interest rate and a 30-year amortization schedule. The other four loans feature fixed interest rates, 12-year terms, two years of interest-only payments and 30-year amortization schedules. The portfolio includes the 72-unit Foothills Green in Lakewood, the 60-unit Willow Green in Arvada, the 65-unit Sheridan Ridge in Arvada, the 60-unit Arapahoe Green in Denver and the 111-unit Fountain Ridge in Fountain.

LAKE OSWEGO, ORE. — CBRE National Senior Housing has arranged a refinancing for The Springs at Lake Oswego, a 216-unit independent living, assisted living and memory care community in Lake Oswego. The borrower is a joint venture between Harrison Street and The Springs Living. Aron Will, Austin Sacco and Tim Root arranged the non-recourse, four-year, floating-rate loan with three years of interest-only payments through a national bank. CBRE previously arranged construction financing for the community in 2017. The amount was not disclosed. The community opened in 2019 in a highly affluent city approximately eight miles south of downtown Portland.

AUSTIN, TEXAS — Regent Properties, an investment and management firm headquartered in Dallas and Los Angeles, has acquired 816 Congress, a 435,000-square-foot office building in downtown Austin. The 20-story building offers amenities such as a fitness center, conference facilities and a sky lounge with a terrace. Regent plans to implement a capital improvement program that includes repositioning the lobby and courtyards, as well as the activation of roughly 12,000 square feet of retail space. The seller and sales price were not disclosed.

DALLAS — Locally based developer Billingsley Co. is underway on construction of a new, 260,000-square-foot headquarters campus in Dallas for home improvement retailer At Home. The property will be located within Billingsley’s Cypress Waters development and will consist of 182,000 square feet of office space and a 78,000-square-foot design center. Amenities will include training rooms, wellness facilities, coworking spaces and a barista bar. Architecture firms GFF and Corgan designed the project. Completion is slated for December. At Home, which is currently headquartered in Plano, employs a corporate staff of about 400 in Dallas and plans to expand to over 1,000 over the next 10 years. The retailer operates about 230 stores across 40 states.

HOUSTON — Houston-based developer BHW Capital has sold The Park at Tour 18, a 241-unit apartment community located on the city’s northeast side. Units at the property come in one- and two-bedroom floor plans that, according to Apartments.com, range in size from 700 to 1,198 square feet. Amenities include two pools, a fitness center, game room, dog park, indoor and outdoor grilling stations and a conference room. Dallas-based Civitas Capital acquired the asset for an undisclosed price.