DENVER — JLL Capital Markets has arranged $54.3 million in financing for Civica Cherry Creek, an office property in Denver. Located at 250 Fillmore St., the 116,187-square-foot building features floor-to-ceiling glass, a great room with fireside lounge, private wine cellar, secure bike storage, rooftop terrace, building concierge and underground executive parking. The LEED Silver-certified property was built in 2018. Eric Tupler and Leon McBroom of JLL Capital Markets secured the five-year, floating-rate loan with a national bank on behalf of the borrower, a MetLife Investment Management-managed entity.

Property Type

NEW YORK CITY — Los Angeles-based investment firm CIM Group, in partnership with locally based developer LIVWRK, has sold a 320-unit apartment community located at 85 Jay St. in Brooklyn’s Dumbo neighborhood for $220 million. The community is part of a larger development that includes 407 for-sale condos, 140,000 square feet of retail space that is anchored by a 77,000-square-foot Life Time Fitness and a 660-space parking garage. New York City-based RXR Realty purchased the rental complex. CIM Group has retained ownership of the condos and retail space.

NEWARK, N.J. — JLL has arranged a $110 million permanent loan for an 850,000-square-foot warehouse and distribution center in Newark. Thomas Didio, Thomas Didio Jr. and Ryan Carroll of JLL arranged the nonrecourse loan, which carried a fixed interest rate and a 15-year term, through a correspondent life insurance company. The borrower was not disclosed.

NEW YORK CITY — Roku (NASDAQ: ROKU) has signed a 240,000-square-foot office lease to occupy the top eight floors at 5 Times Square in Midtown Manhattan. The California-based streaming services provider will backfill space previously occupied by Ernst & Young as part of its relocation from a 70,000-square-foot space at 114 West 41st Street. The move-in is slated for the fourth quarter. Bob Alexander, Ryan Alexander, Mike Affronti, Alex Benisatto, Taylor Callaghan and Nicole Marshall of CBRE represented the landlord, RXR Realty, in the lease negotiations along with internal agents Dan Birney and Alexandra Budd. Sacha Zarba and Frederick Fackelmayer of CBRE represented Roku.

SOMERSET, N.J. — CBRE has brokered the $30.7 million sale of a 15-acre site in Somerset, located in the northern-central part of the Garden State, that currently houses a 209,000-square-foot office building. The undisclosed buyer plans to redevelop the property, which was built in 1986, into a warehouse and distribution center. Mark Silverman, Elli Klapper, Charles Berger, Jeremy Wernick and Kevin Dudley of CBRE represented the buyer in the transaction. The seller was also not disclosed.

WARRINGTON, PA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Warrington Plaza, an 87,581-square-foot shopping center located on the northern outskirts of Philadelphia. A 35,000-square-foot Avalon Floor & Tile anchors the property. Brad Nathanson of IPA represented the seller, Valley Forge Investment Corp., in the transaction. New York-based Realty Resource Capital Corp. purchased the asset for $22.5 million.

AREP, Harrison Street to Develop Six Properties in Virginia’s Data Center Alley for $1B

by Katie Sloan

ASHBURN AND ARCOLA, VA. — A joint venture between American Real Estate Partners (AREP) and Harrison Street has announced plans to develop six powered shell data centers in Virginia’s Data Center Alley for $1 billion. The campuses will span 2.1 million square feet across two sites in Ashburn and Arcola. The first project will include a portion of the former AOL headquarters on Pacific Boulevard in Ashburn. The development will feature four built-to-suit data centers delivering 300 megawatts (MW) of electrical power capacity. The second development will be located on Arcola Boulevard, directly across the street from a new development by Google and near Dulles International Airport in Arcola. The campus will include two built-to-suit data centers offering approximately 100 to 125 MW of electrical power capacity. The new buildings will range from 265,000 to 440,000 square feet in size. A timeline for the developments was not announced. The joint venture has also broken ground on ABX-1 at Beaumeade, a 265,000-square-foot, two-story, powered shell data center located on Loudoun County Parkway along the Ashburn Fiber Ring in Ashburn. The partnership acquired the site in January 2021 and has not announced a timeline for the project. A number of large-scale data …

Yardi Matrix: Student Housing Leasing Surpasses Pre-Pandemic Levels, Outlook Bright for 2022

by Katie Sloan

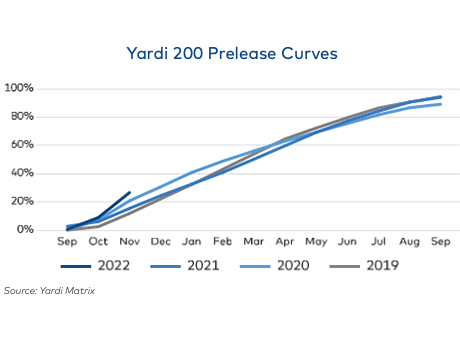

Often lauded as a recession-resistant asset class, the student housing sector was able to add another feather to its cap over the course of the past year, proving that it is also pandemic-resistant. The fall 2021 pre-leasing period ended in September at an occupancy rate of 94 percent, up from 89 percent in 2020 and 0.4 percent from levels seen prior to the start of the COVID-19 pandemic in fall 2019, according to the Yardi Matrix National Student Housing Report January 2022. These numbers were seen within the company’s ‘Yardi 200’ markets, which include the top 200 investment-grade universities across all major collegiate conferences. Pre-leasing for the fall 2022 term is already underway with levels at 27 percent as of November — an 11 percent increase over the same time in 2020, and a 6 percent increase over levels seen in 2019. Yardi reports that the top five universities with the greatest year-over-year growth in percentage of beds pre-leased are the University of Wisconsin-Madison with 66 percent growth; the University of Nevada-Las Vegas with 48 percent growth; Purdue University with 43 percent growth; the University of Pittsburgh with 31 percent growth; and the University of North Carolina at Chapel Hill …

2021 was a historic year for Kansas City industrial real estate. The local market size eclipsed 300 million square feet of space, representing the 16th-largest industrial market in the U.S. Class A building inventory is nearly 44 million square feet, ranking 15th in the nation. Of the industrial building inventory, 14.4 percent is Class A, ranking ninth-highest in the country, suggesting the inventory that we have is quality compared with other U.S. markets. Capital markets are firm influencers with soft voices. Nationally, the amount invested is a record high. Rental rate growth is at an all-time high and investors are confident that this growth will sustain. While you may not read about where capital is being deployed, the institutional development and investment activity provide the output to see where institutions have comfort. Cap rates in the Kansas City area broke records and saw compression in the last year of 50 to 150 basis points depending on the asset class. This is a result of investors seeking return and believing in the long-term strength of tier II industrial markets and yield premium afforded in these markets compared with gateway cities. Well-positioned assets traded with cap rates in the low to …

GLENDALE, CALIF. — Northbrook, Ill.-based Pine Tree, in partnership with a U.S. state pension fund, has purchased Glendale Marketplace in downtown Glendale for $64 million. The name of the seller was not released. A mix of national credit tenants occupy the 154,049-square-foot property, including LA Fitness, HomeGoods, Ross Dress for Less, Five Below, Buffalo Wild Wings and Old Navy. JLL Capital Markets brokered the transaction. The acquisition brings Pine Tree’s shopping center portfolio footprint in the Los Angeles area to 1.1 million square feet.