NEWARK, N.J. — CBRE has brokered the $36.5 million sale of 24 Jones, a 152-unit multifamily property located in Newark’s University Heights neighborhood. Built in 2016, the property offers studio, one- and two-bedroom units and amenities such as a fitness center, lounge, outdoor grilling stations and concierge services. Jeffrey Dunne, Jeremy Neuer, Steve Bardsley, Stuart MacKenzie, Eric Apfel and Travis Langer of CBRE represented the seller, Tucker Development, in the transaction. The team also procured the buyer, RJ Block Properties.

Property Type

EAST RUTHERFORD, N.J. — Locally based investment firm Devli Real Estate has purchased a 175,000-square-foot industrial facility in East Rutherford, located in Northern New Jersey. The facility sits on a six-acre site within The Meadowlands submarket. Devli Real Estate will lease back the space to the undisclosed seller/tenant on a short-term basis. Yanni Marmarou of B6 Real Estate brokered the transaction. Michael Klein and Max Custer of JLL arranged acquisition financing through First Bank on behalf of Devli Real Estate.

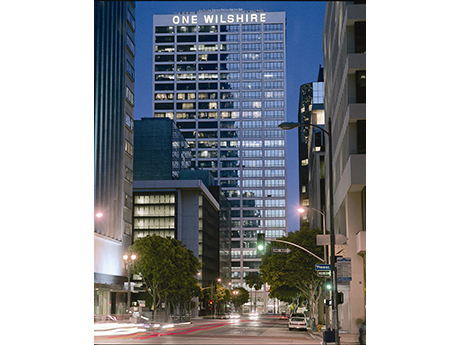

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …

The Washington, D.C., and Baltimore markets, when combined, represent the fourth-largest metropolitan region in the nation by population, and retailers are taking notice again. Grocery-anchored projects are the most prevalent in the headlines. For example, the first of nearly 20 Amazon Fresh locations has opened in the area. Additionally, Wegmans’ smaller format rollout plan is active with its first location in Stonebridge’s Carlyle Crossing in Alexandria opening spring 2022, along with Roadside Development’s City Ridge Project at the former Fanny Mae Headquarters in Northwest D.C. Former Shoppers Food Warehouse boxes also continue to get absorbed by new grocers. A less-covered sector of the grocery market is the international markets category, which remains very active in the region. There are 29 different banners across the region that exceed 10,000 square feet in size, with the newest entrant being Oh! Markets in Northern Virginia. Other international market newcomers, including 99Ranch and Enson Market, are also searching for space. With the immense ethnic diversity of the region, we expect investors to start taking notice of this sector with their acquisition appetite, just as they have in other regions like Texas and Florida. Publix, a customer favorite, is in the early stages of identifying …

SAN ANTONIO — Newmark has brokered the sale of Encore SoFlo, a 339-unit apartment building located at 326 S. Flores St. in downtown San Antonio. Built in 2019, the property offers studio, one- and two-bedroom units with an average size of 809 square feet. Amenities include a pool with a bar, courtyards with fire pits and grilling stations, clubhouse with a media room, business center with conference facilities, a fitness center, game room and a dog run. Matt Michelson and Patton Jones of Newmark represented the seller, Encore Multifamily, in the transaction. Hank Glasgow and Braden Harmon of Newmark arranged acquisition financing on behalf of the buyer, Dallas-based private equity firm SPI Advisory. Encore SoFlo was 92 percent occupied at the time of sale.

MCKINNEY, TEXAS — JLL has arranged a $37.5 million loan for the refinancing of Hidden Springs of McKinney, a 194-unit seniors housing community located on the northern outskirts of Dallas. The property was built in 2020 and offers assisted living, independent living and memory care services. Amenities include a pool, fitness center and a dog park. Joel Mendes and Jason Skalko of JLL arranged the nonrecourse, fixed-rate loan through an undisclosed life insurance company on behalf of the borrower, a joint venture between CREC Real Estate and Madison Marquette.

DENVER — MG Properties has purchased 3300 Tamarac Apartments, a multifamily community located in Denver’s Hampton neighborhood. Gelt sold the asset for $141 million. 3300 Tamarac features 564 apartments within walking distance of a variety of shopping and dining options, as well as parks and recreation opportunities. David Martin and Brian Mooney of Northmarq represented the seller, and Northmarq’s Scott Botsford and Joe Giordani arranged the financing for the buyer.

Contour Real Estate Buys 112-Acre Site for Industrial Development Near Mesa Gateway Airport

by Amy Works

MESA, ARIZ. — An entity controlled by California-based Contour Real Estate has acquired an approximately 112-acre industrial site at the southwest corner of Warner and Sossaman roads in Mesa. Structures Investment sold the asset for an undisclosed price. Contour plans to develop a master-planned industrial park with eight buildings totaling more than 1.5 million square feet of manufacturing, logistics and e-commerce space. The property will be developed in two phases. Paul Borgesen and Dylan Sproul of SVN Desert Commercial Advisors negotiated the transaction on behalf of the buyer and seller.

Berkadia Negotiates $73.2M Sale of Bungalows on Estrella Apartments in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Berkadia Institutional Solutions has arranged the sale of The Bungalows on Estrella, a garden-style apartment community located at 15545 W. Hudson Way in Goodyear. Arizona-based Cavan Cos. sold the asset to Georgia-based St. Clair Holdings for $73.2 million. The Bungalows on Estrella features 183 one-, two- and three-bedroom apartments with in-unit washers/dryers, 10-foot ceilings and walk-in closets. Community amenities include a swimming pool, fitness center, clubhouse, dog park and covered parking. Mark Forrester and Andrew Curtis of Berkadia Phoenix completed the sale on behalf of the seller.

PUEBLO, COLO. — Avison Young has brokered the sale of 9.1 acres of vacant land located at the southwest quadrant of US Highway 50 and Interstate 25 in Pueblo. 610 RLLLP sold the property to Conifer, Colo.-based BEP Pueblo LLC, an affiliate of Blueline Equity Partners, for an undisclosed price. The buyer plans to develop of the land into a mixed-use project, including residential, hospitality and possibly retail space. Completion is slated for 2023. Rick Egitto of Avison Young’s Denver office represented the seller in the deal.