AUBURN, WASH. — Fortress Investment has acquired a seven-acre industrial property in Auburn from MK Holdings for $22 million in an off-market transaction. Matt Murray and Matt McLennan of Kidder Mathews brokered the deal. Located at 904 W. Main St., the land includes a 24,000-square-foot building. Utility Trailer Sales of Washington Co. occupies the property.

Property Type

LAKEWOOD, COLO. — Blue West Capital has brokered the sale of a shopping center located at 10750 W. Colfax Ave. in Lakewood. A Colorado-based private real estate company sold the asset to a California-based investor for an undisclosed price. Harbor Freight Tools, JoAnn Fabric and Guitar Center are tenants at the fully occupied, 42,755-square-foot property. Tom Ethington of Blue West Capital represented the seller in the deal.

By Tad Loran, Vice President, Retail Specialist, Avison Young | Western Alliance Commercial Inc. The Reno retail market was hard hit overall by the pandemic, with the service industry at the top of the list. Some notable businesses that closed in Reno last year include Santa Fe Basque Restaurant, Truckee River Bar & Grill, An — Asian Kitchen & Bar, Little Nugget Diner, True NY Pizza Co., Rounds Bakery Storefront, Jos A. Bank, St. James Infirmary, 24 Hour Fitness and Pier 1 Imports. Big box national retailers picked up virtually no new space in 2020. The good news is retail demand and leasing activity has rebounded this year. Northern Nevada’s retail vacancy rate saw positive absorption. It currently sits at 5.8 percent, while asking rental rates have increased. They are currently at $19.08 per square foot (triple net) on an annual basis for second-generation space and $42 per square foot (triple net) on an annual basis for new construction. Notable business openings this year include Sport Clips, the Human Bean, C-A-L Ranch, In-N-Out Burger, Starbucks, Chipotle, Firehouse Subs, Truckee Bagel, Base Camp Pizza, SUP and Chase Bank. Commercial sales in Northern Nevada were nominal in 2020. This was driven by the pandemic, a lack of …

CBRE Investment Management Agrees to Acquire Logistics Portfolio in US, Europe from Hillwood for $4.9B

by John Nelson

NEW YORK CITY AND DALLAS — CBRE Investment Management has agreed to acquire a portfolio of logistics real estate assets in the United States and Europe from Hillwood Investment Properties, an industrial developer and owner based in Dallas. Under terms of the $4.9 billion acquisition agreement, affiliates of New York City-based CBRE Investment Management will purchase the 57-property, 28.4 million-square-foot portfolio from Hillwood. The transaction is subject to customary closing conditions, and CBRE Investment Management expects to close on the assets in stages. The portfolio includes 33 properties in the United States totaling 19.2 million square feet and 24 assets in Germany, Poland and the United Kingdom totaling 9.2 million square feet. “This milestone transaction reflects our ability to leverage the strong financial capacity of our parent company to secure compelling opportunities that help to drive strategic real assets solutions for our clients,” says Chuck Leitner, CEO of CBRE Investment Management. “Backed by a $35 billion AUM global logistics platform and a skilled team with deep domain expertise, we are positioned to be one of the world’s leading investors and operators of logistics assets.” The portfolio is one of several multi-market portfolio transactions in the industrial sector in the past …

TAMPA, FLA. — Current Rocky Point LLC, an affiliate of Tampa-based Caspers Co., has acquired The Current Hotel, an Autograph Collection hotel by Marriott in Tampa. The price was $85 million. Dave Weymer, Michael Weinberg, Preston Reid and Wyatt Krapf of Berkadia Hotels & Hospitality represented the seller, Rocky Point Holdings LLC, in the transaction. American Momentum Bank provided a $55 million loan to the buyer. Built in 2019, The Current Hotel features 180 rooms, the Julian Restaurant, Rox Rooftop Bar and a lobby bar. The hotel property also includes a private beach, infinity pool and waterfront views from every guestroom. Located at 2545 N. Rocky Point Drive, the hotel is 4.8 miles from the Tampa International Airport, 0.5 miles from East Tampa Beach and 15 miles from Clearwater. The property is also situated near restaurants such as Whiskey Joe’s Bar & Grill and Oystercatchers.

CHARLESTON, S.C. — Los Angeles-based Trion Properties has acquired Latitude at West Ashley, a 312-unit multifamily community in Charleston, for $51.8 million. The seller was not disclosed. Constructed in two phases in 1968 and 1973, Latitude at West Ashley offers one-, two- and three-bedroom floorplans averaging 954 square feet with approximately half of the units set up as townhomes. The apartment community includes 22 two-story wood-framed buildings. Community amenities include a pool deck with BBQ grills and cabanas, a fitness center and onsite laundry facilities. Located at 1735 Ashley Hall Road, Latitude at West Ashley is situated by the Ashley and Stono rivers. The property is also situated seven miles west of downtown Charleston, 2.8 miles from Citadel Mall, the area’s only indoor mall, and near Interstate 526.

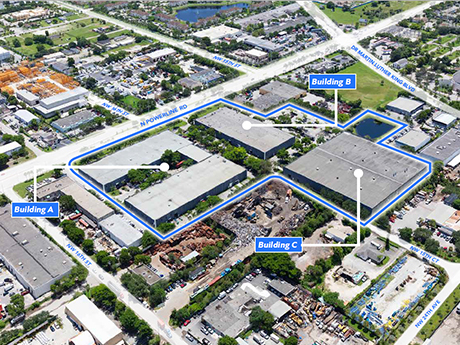

POMPANO BEACH, FLA. — Bridge Industrial has purchased Pompano Beach Commerce Park, a 336,852-square-foot industrial campus in Pompano Beach. Jose Lobon of CBRE National Partners represented the undisclosed seller in the transaction. The price was not disclosed. Located on Powerline Road, Pompano Beach Commerce Park comprises three buildings spanning 140,094 square feet, 124,894 square feet and 71,864 square feet, respectively. The facilities include features such as 24-foot clear heights and multiple points of ingress and egress along its 800 feet of linear frontage on Powerline Road. Following the acquisition, Bridge Industrial plans to launch a comprehensive capital improvement program at the property, including upgrades to the landscaping, parking lot, signage and roof. The campus is located less than two miles from Interstate 95 and just 1.4 miles from the Florida Turnpike. The property also sits 15 miles from Port Everglades and the Fort Lauderdale-Hollywood International Airport, and approximately 40 miles from the Port of Miami and Miami International Airport.

MIAMI — Cushman & Wakefield has arranged the sale of a 51,392-square-foot industrial facility located at 7480 NW 48th St. in Miami. Wayne Ramoski and Miguel Aclivar of Cushman & Wakefield represented the seller, DFJ Properties West LLC, in the transaction. RLIF East 5 LLC was the buyer. The price was $14.8 million. Sitting on more than four acres, 7480 NW 48th St. is a warehouse and showroom property that is fully leased to Ferguson Enterprises, a Newport News, Va.-based distributor of plumbing supplies, waterworks and fire and fabrication products. The facility is situated on two lots offering a variety of industrial and commercial uses in South Florida’s airport submarket. The property includes features such as 23.8-foot clear heights, more than 50 striped parking spaces and proximity to Miami International Airport. The property is currently zoned for industrial and heavy manufacturing use.

BURLINGTON, N.C. — Several new tenants are set to open at Church Street Commons, a recently constructed shopping center located at the intersection of Huffman Mill Road and Church Street in Burlington. Morgan Cos. purchased the 9.6-acre property where Church Street Commons now stands in February 2019. The property was formerly the site of a Sears department store. The owner and developer of the center, Morgan Cos., recently welcomed a new Publix supermarket. My Eyelab, an optical retailer, also opened at the center in December. The retailers that will soon open at Church Street Commons includes The Habit Burger Grill, a burger restaurant; Aspen Dental, a dental services provider; Popeye’s, a New Orleans-based fast food chain; uBreakiFix, a same-day electronics repairs provider; and Church Street Nails, a nail salon and spa. The retailers are expected to open in the first quarter of this year.

DES PLAINES, ILL. — Kiser Group has brokered the $117 million sale of Park Ridge Commons in Des Plaines, a northwest suburb of Chicago. The garden-style multifamily property consists of 752 units across 47 buildings. Amenities include a clubhouse, lap pool, fitness center, tennis courts and laundry facilities. Matt Halper, Danny Mantis and Lee Kiser of Kiser Group represented the buyer, Bayshore Properties, and the seller, H.A. Langer & Associates. The seller had owned the property for 25 years. Dan Sacks and Eric Rosenstock of Greystone originated $103 million in acquisition financing through Fannie Mae.