WAITE PARK, MINN. — JLL Capital Markets has brokered the sale of Park Villas Apartments, a 95-unit community situated on 7 acres in Waite Park, a city in central Minnesota. The property features 71 one-story, cottage-style units and 24 two-story townhomes for residents age 55 and older. The community was built in 1991 and renovated in 2008. Units average 931 square feet. Josh Talberg, Joseph Peris, Ken Dayton, Pat McMullen and Jack Graveline of JLL represented the seller, Podawiltz Development Corp., and procured the buyers, Noel Johnson and Jamison Kohout of Venture Development Group.

Property Type

CHICAGO — BIG Construction and architect Ware Malcomb have completed a new 24,230-square-foot office for ZS at 222 Merchandise Mart Plaza in Chicago. Founded in 1983, ZS is a global management consulting and technology firm. ZS maintains more than 13,000 employees in over 35 offices worldwide. The Chicago office features a mix of open work zones, closed office areas, meeting rooms and gathering spaces. A central café stands as a focal point of the design.

CHICAGO — CRC Group has signed a 20,000-square-foot, full-floor office lease at 123 N. Wacker Drive in Chicago. The wholesale specialty insurance distributor will occupy the building’s 19th floor. Sterling Bay assumed leasing and management responsibilities of the property last year. Tenant amenities include a newly renovated lobby, tenant lounge, fitness center, coffee bar, conferencing center and upcoming ground-floor retail.

MARION, IND. — Marcus & Millichap has negotiated the $4.9 million sale of Park Forest Apartments in Marion, which is located about midway between Indianapolis and Fort Wayne. The 64-unit multifamily property at 1005 N. Park Forest Drive features two-bedroom units. Each 900-square-foot residence has undergone recent renovations, including new balconies, windows, HVAC systems and water heaters. Quentin Benedetto, Kyle Stengle and Jack Stanton of Marcus & Millichap represented the seller, Pentagon Investment Group. Benedetto and Stanton procured the buyer, Ross McCarthur, co-founder of Follow The Deal Investments.

AURORA, ILL. — Quantum Real Estate Advisors Inc. has arranged the $2.8 million sale of a 14,238-square-foot retail center in Aurora. At the time of sale, the property at 2380 S. Eola Road was 90 percent leased to tenants such as Subway, Dunkin’, Wing Snob and Smile Family Dental. Dan Waszak and Brett Berlin of Quantum represented the seller, a public REIT based in Florida. The buyer was a private investor based in Illinois.

Spectrum Retirement Receives $330M Refinancing for Seniors Housing Portfolio in Midwest, Southwest

by John Nelson

DENVER — Spectrum Retirement, a Denver-based seniors housing owner-operator, has received $330 million for the refinancing of a portfolio of eight seniors housing properties that are located across the Midwest and Southwest United States. Ryan Stoll and Taylor Mokris of BWE, a national commercial and multifamily mortgage banker, arranged the financing on behalf of Spectrum Retirement. The nonrecourse debt was structured with full-term interest-only payments and a “competitive” interest rate. “We are honored that Spectrum chose BWE to represent them in the debt capital markets for such a complex transaction,” says Stoll, national director of BWE’s Seniors Housing and Care team. “It is a privilege to partner with one of the industry’s most respected owners and operators, and Spectrum exemplifies the highest standard of excellence.” The direct lender was not released, but BWE disclosed that the lender was a “global private credit investor.” BWE also said the transaction drew interest from multiple capital sources, including agencies, life insurance companies, banks and private credit firms. The eight-property portfolio spans major metropolitan areas in four states, all of which benefit from attractive demographics and sustained demand for high-quality senior living, according to BWE. The properties include Green Oaks Senior Living and Palos Heights …

By Katharine Lau, CEO and co-founder, Stuf Following a period of slower activity throughout 2023 and 2024, the self-storage industry is showing clear signs of restored momentum in 2025. According to StorageCafé’s Q1 2025 U.S. Self Storage Sales Report, investment sales volume in the sector hit $855 million nationwide — a notable 37 percent increase from the first quarter of 2024 — suggesting a fresh wave of investor and consumer confidence. While the commercial real estate market continues to face uncertainties, particularly with regard to persistent office vacancies, self-storage is emerging as a stable, demand-driven sector of the industry, propelled by shifting consumer behaviors, flexible business needs and creative adaptive reuse in urban markets. Self-storage demand continues to follow lifestyle shifts. At Stuf, we’re consistently seeing strong growth in the seven markets in which we operate, especially among millennial and gen Z renters, small business owners and remote workers who prioritize proximity, convenience and security when choosing a storage solution. Consumers are increasingly prioritizing smarter spaces that fit into their regular routines. The StorageCafé report shows that interest from large-scale, institutional investors in self-storage has rebounded in 2025, with several eight-figure transactions dotting the map in the first quarter. The …

TAMPA, FLA. — Costis-Lifsey Development LLC and American Land Ventures LLC have announced plans to develop Residences at Rocky Point, a $187 million apartment high-rise located at 2425 Rocky Point Drive in Tampa. The 21-story tower is being constructed on the waterfront site of the Rusty Pelican restaurant. Designed by Cube 3 and RSP Architects, the 252-unit apartment tower will feature units with two-level floorplans averaging 1,175 square feet in size. Amenities will include a structured parking garage, two-story lobby, a waterfront infinity pool, beachside cabanas and a rooftop area headlined by an 8,000-square-foot restaurant. The design-build team, which includes civil engineer Kimley-Horn, plans to break ground in early 2027 and wrap up construction by mid-2028.

Dwight Mortgage Trust Funds $110M Refinancing for LC Line and Low Apartments in Charleston

by John Nelson

CHARLESTON, S.C. — Dwight Mortgage Trust, an affiliate of Dwight Capital, has provided a $110 million bridge loan for the refinancing of LC Line and Low, a new 277-unit apartment development in Charleston. Brandon Baksh, Noah Greenwald and Talisse Thompson of Dwight Mortgage Trust originated the loan on behalf of the sponsor, Lifestyle Communities, which will use the loan to refinance existing construction debt and fund remaining construction expenses. LC Line and Low features a main residential building, train shed with loft-style apartments, historic single-family homes with private courtyards and seven retail suites totaling 15,000 square feet. The retail component houses tenants including The Goat Restaurant & Bar and Morning Ritual Coffee Shop, with another restaurant and a cocktail bar in the planning stages. Amenities include a resort-style pool, clubhouse, fitness center with saunas and cold plunges, coworking lounge and a parking deck.

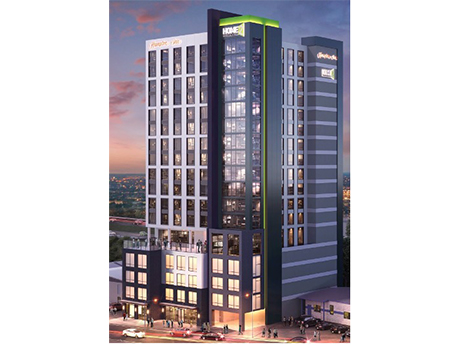

Arriba Capital Provides $67M Construction Loan for Dual-Branded Hotel Project in Nashville

by John Nelson

NASHVILLE, TENN. — Arriba Capital has provided a $67 million construction loan for a dual-branded hospitality project in Nashville’s East Bank district. The hotel development, which will sit adjacent to Oracle’s upcoming $2 billion campus, will feature rooms branded under Hilton’s Home2 Suites and Hampton Inn flags. The borrower is a Southeast-based developer that plans to deliver the hotel project in early 2027.