HESPERIA, CALIF. — Newcastle Partners has broken ground on an industrial development located at 9260 Mesa Linda St. in Hesperia. Situated on 18.3 acres with immediate access to I-15, the project will offer 406,138 square feet of Class A industrial space. Ryan Lal and Dante Borruso of Voit Real Estate Services are overseeing all marketing, sales and leasing efforts for the property.

Property Type

Marcus & Millichap Arranges $24M Sale of Vacant Retail Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap has arranged the sale of a vacant retail building located on 2.4 acres at South Central Avenue and Chevy Chase Drive in Glendale. Aria Investments LLC sold the asset to the City of Glendale for $24 million. The city plans to develop a park and recreation center on the site, which includes a 33,818-square-foot retail building formerly occupied by JoAnn Fabrics. Sheila Alimadadian of Marcus & Millichap represented the seller and procured the buyer in the deal.

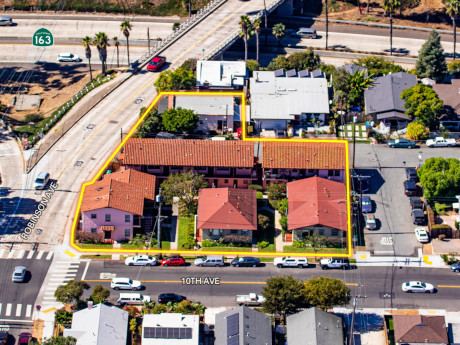

SAN DIEGO — Pacific Coast Commercial Real Estate has negotiated the sale of Del Oro Apartments, a value-add multifamily property in San Diego’s Hillcrest neighborhood. John Lopez and Cheryl Lopez acquired the asset from an undisclosed seller for $4.5 million. Citizens Private Bank provided acquisition financing for the buyers. Located at 3748-3772 Tenth Ave. and 918 Robinson Ave., Del Oro Apartments consists of an 18-unit apartment building and an adjacent duplex. The properties offers 15 studios averaging 326 square feet and five one-bedroom/one-bath units averaging 447 square feet. Zoned RM-3-9, the property also features nine garages. Ken Robak and David Dilday of Pacific Coast Commercial represented the seller, while Patti McKelvey of Coldwell Bank West represented the buyers in the transaction. Chicago Title Co. managed escrow and title services.

DENVER — Pinnacle Real Estate Advisors has directed the $2.9 million sale of an industrial building located at 4571 Ivy St. in Denver. Mark Alley of Pinnacle handled the transaction. The names of the buyer and seller were not released. The 15,500-square-foot building features a secure yard for outdoor storage.

EDEN PRAIRIE, MINN. — JLL Capital Markets has arranged joint venture equity and construction financing totaling $55.6 million for The Fox and The Grouse Phase II, a 188-unit apartment development in the Golden Triangle neighborhood of Eden Prairie. Josh Talberg, Scott Loving, Joe Peris, Matthew Schoenfeldt, Colin Ryan and Will Hintz of JLL represented the borrowers, Greco and Eagle Ridge Partners. JLL arranged a $39.1 million three-year, floating-rate loan through MidWestOne Bank and sourced $16.5 million in joint venture equity from Amstar Group. Construction is scheduled to begin immediately. The six-story development will offer a mix of studios, one-, two- and three-bedroom units, with 25 percent of the homes designated as affordable at 50 to 80 percent of the area median income. The project features 167,312 square feet of rentable space and 263 parking stalls. Amenities will include an outdoor pool, golf simulator, wellness center, work-from-home spaces, a theater room, clubroom, private dining area and underground parking. There are more than 9 acres of wetlands. Designed by BKV Group, the project represents the second phase of a transit-oriented development that will be directly connected to the Golden Triangle Station on the Southwest Light Rail Transit Green Line Extension, scheduled to …

BLOOMINGTON, ILL. — Marcus & Millichap has brokered the $13.4 million sale of Bloomington Commons, a grocery-anchored shopping center located at 1701 E. Empire St. in Bloomington. Anchored by Schnucks, the 15-suite property totals 132,966 square feet. Tenants include Barnes & Noble, The UPS Store, Kumon Math & Reading Center, Chuck E. Cheese and H&R Block. Schnucks, anchor tenant since 1989, recently renewed its lease for 10 years. Sean Sharko and Austin Weisenbeck of Marcus & Millichap represented the seller, a local developer that sold the property after an eight-year hold period. The buyer was a West Coast-based doctor acquiring his first asset in the Midwest.

KANSAS CITY, MO. — Conexon, a Kansas City-based provider of high-speed internet for rural communities, is moving its headquarters to a new 48,827-square-foot office at Stanton Road Capital’s 2323 Grand Boulevard in Kansas City. The company was previously headquartered at nearby 2001 Grand Boulevard, also known as the Firestone Building. Conexon will take over the entire fourth and a portion of the third floor at 2323 Grand. Located in the heart of downtown, the office building sits at the intersection of the Crossroads Arts District and Crown Center, directly across from Union Station and the new RideKC streetcar station. In addition to Conexon, Lathrop GPM recently announced an upcoming relocation of its headquarters to 2323 Grand. Existing tenants Glass Lewis and Brown & Ruprecht have inked lease renewals in the past quarter. Grand Coffee Co. opened a new location within the building. In total, the property has received 110,414 square feet of new leases and renewals in 2025. The owner has invested in the building’s amenities, including a conference center, updated gym, employee lounge and dining areas. The 320,976-square-foot, 11-story building offers onsite parking, flexible floor plates and spec suites. Stanton Road Capital acquired the property in late 2017. Travis …

FARMINGTON HILLS, MICH. — Bernard Financial Group (BFG) has arranged a $4 million loan for the refinancing of an 89,691-square-foot office property in the Detroit suburb of Farmington Hills. Joshua Bernard of BFG arranged the loan on behalf of the borrower, an entity doing business as HRFG Acquisition LLC. A life insurance company provided the loan.

JERSEY CITY, N.J. — Locally based financial intermediary G.S. Wilcox & Co. has arranged $85 million in financing for Overlook Flats, a 297-unit apartment building located in the Journal Square area of Jersey City. Designed by Michels & Waldron with interiors by Builders Design, the 16-story building houses studio, one-, two- and three-bedroom units, as well as 40,000 square feet of commercial space. Residences are furnished with stainless steel appliances, designer cabinetry and quartz countertops. Outdoor amenities include a rooftop deck with a pool, kitchen, lounge area, picnic areas, bocce ball court and a pet play area. Inside, residents have access to coworking spaces, a children’s playroom, fitness center, golf simulator and a package room. Wesley Wilcox, Al Raymond and Will Gallagher of G.S. Wilcox arranged the five-year, fixed-rate loan through an undisclosed life insurance company.

WILMETTE, ILL. — Egg Harbor Cafe will open at Optima Verdana, a six-story, 100-unit luxury apartment complex in downtown Wilmette, on Tuesday, Aug. 26. Optima Inc. owns the property. The 4,100-square-foot restaurant maintains seating for 140 and is situated directly across from Wilmette’s Metra commuter rail station. Currently fully leased, the residences at Optima Verdana opened in 2023. Floor plans range from 660 to 2,790 square feet. Specializing in breakfast, brunch and lunch, Egg Harbor Cafe operates in Illinois, Wisconsin and Georgia. The new Wilmette location represents the second Egg Harbor within an Optima community, joining the Streeterville location that opened in 2019 at the 490-unit Optima Signature high-rise in downtown Chicago. Optima is planning a new 128-unit luxury building just south of Optima Verdana. Known as Optima Lumina, the project will replace the long-vacant former Imperial Motors car dealership. The developer intends to retain the existing Starbucks within the project’s 5,900 square feet of new commercial space. Optima Verdana and Optima Lumina will be separated by a new public, landscaped plaza.