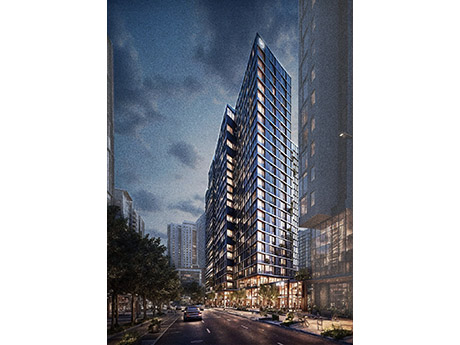

ATLANTA — A joint venture between Core Spaces and Capstone Communities is set to break ground on a multi-phase mixed-use project located near the Georgia Tech campus in Midtown Atlanta. The first phase of the development — which is being led by Core Spaces — will include 1,600 beds of student housing and 5,000 square feet of ground floor retail. The community will also feature a third-floor amenity deck. Dwell Design Studio has been selected as the architect for Phase I, which is scheduled for completion in 2029. Capstone Communities will lead Phase II of the project, a timeline for which was not released.

Property Type

PHOENIX — Lena Centers, a subsidiary of Longpoint Partners, has purchased Stetson Village, a grocery-anchored shopping center at 3780-3890 W. Happy Valley Road in Phoenix, from Pederson Group for $71 million. Ryan Schubert, Michael Hackett and Zach Aulick of CBRE represented the seller and buyer in the transaction. Built in 2007, the 144,192-square-foot Stetson Village is fully occupied by a variety of tenants, including Capriott’s, Nekter Juice Bar, UPS Store, First Watch and Great Clips.

MARINA DEL RAY, CALIF. — BWE has secured $43.4 million in acquisition financing for Villa Del Mar, a multifamily property in Marina del Ray. Initially constructed in 1872, Villa Del Mar consists of four three-story apartment buildings over at-garage parking, a five-story parking structure and a 209-slip marina. The property offers 198 one- and two-bedroom apartments with hardwood-style flooring, marina-view balconies and in-unit washers/dryers. Community amenities include a clubhouse, fitness center, pool and spa, basketball and tennis courts and barbecue areas. Mike Guterman of BWE arranged the acquisition financing from a life company on behalf of VDM Partners. The loan features a five-year, fixed-rate term with prepayment flexibility and two years of interest-only payments.

AURORA, COLO. — JLL has directed the sale of Parkside Collective, a three-building retail strip center in Aurora. Parkside Aurora LLC sold the asset to a partnership of Spark & Halo, Two Arrows Group and OlivePoint Capital for an undisclosed price. Constructed in 2021, the 24,985-square-foot property was 86 percent leased at the time of sale. Current tenants include Five Guys, Cheba Hut and Einstein Bros. Bagels. The retail center is part of a larger mixed-use development that includes a 216-unit apartment complex. Jason Schmidt and Austin Snedden of JLL represented the seller in the deal.

SAN MARCOS, TEXAS — Walker & Dunlop has brokered the sale of The Edge, a 553-bed student housing property located near the Texas State University campus in San Marcos. The community offers 173 units in a mix of one-, two-, three-, four- and five-bedroom configurations. Shared amenities include a 24-hour fitness center, study rooms, a gaming room, resort-style pool, basketball and volleyball courts and a dog park. Chris Epp, Matthew Chase, Craig Miller, Holden Penn, Ben Sarna and Sarah Foronda of Walker & Dunlop represented the seller, 29th Street Capital, in the transaction. Campus Realty Advisors acquired the property for an undisclosed price. BWE arranged acquisition financing for the deal.

SAN DIEGO — Voit Real Estate Services has arranged the $5.3 million purchase of a medical office building located at 8623 Spectrum Center Blvd. in the Kearny Mesa submarket of San Diego. San Diego-based Cal Coast Credit Union sold the property to an undisclosed San Diego-based buyer. Situated within San Diego Spectrum, the single-story freestanding building offers 8,000 square feet of Class B medical office space. Tim Cajka and Myles Martinez of Voit Real Estate Services represented the buyer in the deal.

Hanley Investment Group, Oaks Commercial Arrange $4.6M Sale of Retail Pad Site in Diamond Bar, California

by Amy Works

DIAMOND BAR, CALIF. — Hanley Investment Group Real Estate Advisors and Oaks Commercial Real Estate have brokered the sale of a multi-tenant retail pad property located at 22438 Golden Springs Drive in Diamond Bar. A Las Vegas-based private partnership acquired the asset from a Los Angeles-based private non-exchange investor for $4.6 million. Starbucks Coffee, Jimmy John’s and Crumbl Cookies fully occupy the 4,767-square-foot property, which was built in 2016. Bill Asher and Jeff Lefko of Hanley Investment Group, along with Fred Encinas of Oaks Commercial Real Estate in Eastvale, Calif., represented the seller, while Arman Mahmoodi of BeachRock Group at Keller Williams in Beverly Hills, Calif., represented the buyer in the transaction.

FORT WORTH, TEXAS — PGIM Real Estate has provided a $24 million mezzanine loan for a 464-unit multifamily project that will be located in North Fort Worth. The name and address of the project were not disclosed, but the development will consist of two buildings on an 8.5-acre site. Units will be furnished with stainless steel appliances, granite countertops, individual washers and dryers and private patios. Amenities will include a pool, fitness center and a resident clubhouse. Jesse Wright of JLL arranged the loan on behalf of the borrower, Miami-based developer Resia (formerly known as AHS Residential). Bank OZK provided a $58 million senior loan for the project.

ST. LOUIS PARK, MINN. — KPR Centers, a New York-based retail real estate development and investment group, has acquired Shoppes at Knollwood, a 451,700-square-foot grocery-anchored shopping center in the Minneapolis suburb of St. Louis Park. The property is nearly 99 percent leased and anchored by Cub Foods, DSW, HomeGoods, Nordstrom Rack, Old Navy, Total Wine & More, TJ Maxx and Ulta Beauty. Christian Williams, Richard Frolik and Michael Wilson of CBRE represented the seller. Delivered in 1955 as Knollwood Mall, the asset has undergone several renovations over the decades, including its transformation into an enclosed mall in 1980. The center reverted to its open-air design in 2015 through a $30 million investment. KPR now owns and self-manages approximately 10 million square feet of retail space in 20 states. This purchase signals the owner’s entry into the Minnesota market. Over the last 18 months, KPR has acquired 12 centers totaling nearly 3 million square feet of space for approximately $400 million.

DALLAS — Atlanta-based Stonemont Financial Group has acquired a 224,060-square-foot industrial service facility in southwest Dallas. The site at 3912-4012 W. Illinois Ave. spans 24.8 acres and functions as a heavy equipment and fabrication facility with nearly 10 acres of stabilized outdoor storage space. The facility was fully leased at the time of sale. The seller and sales price were not disclosed.