JACKSON TOWNSHIP, N.J. — SRS Real Estate Partners has brokered the $7.5 million ground-lease sale of a newly constructed Wawa convenience store in Jackson Township, located near the Jersey Shore. The site spans 1.9 acres, and the building totals 4,736 square feet. Patrick Nutt and William Wamble of SRS represented the seller, an East Coast-based developer, in the transaction. The buyer was a New Jersey-based private investor. Both parties requested anonymity.

Property Type

NEW YORK CITY — Lendlease has begun preleasing and revealed new renderings for The Riverie, an 834-unit apartment development in the Greenpoint neighborhood of Brooklyn. The project is slated to open in October. Of the total unit count, 30 percent are designated as affordable housing. The development will also feature 13,000 square feet of retail and restaurant space, state-of-the-art amenities and new public greenspace. Spanning an entire city block along the East River, The Riverie features two towers rising 37 and 20 stories, as well as a mid-rise podium with frontages along India, West and Java streets. Residences range from studios to three bedrooms, including select penthouses and townhomes. Marvel was the project architect. INC Architecture & Design handled the interior design, while Crème designed the townhomes. At the core of The Riverie’s sustainability strategy is its vertical closed-loop geothermal system, comprised of 320 boreholes beneath the site. This feature makes it the largest geothermal residential building in New York state and is believed to be the largest high-rise geoexchange system in the country, according to Lendlease. Combined with its fully electric design, The Riverie is expected to reduce annual carbon emissions from heating and cooling by 53 percent when …

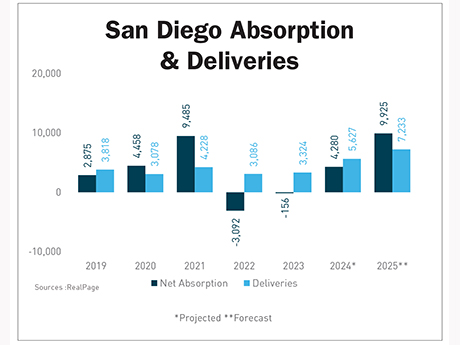

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

STRAWN, TEXAS — An entity doing business as Big Bear Partners LP has begun construction on Phase I of an 80-acre mixed-use project in Strawn, about 75 miles west of Fort Worth. The larger development will be known as Big Bear Crossing, and the first phase, which will be known as Big Bear Travel Center, will feature hospitality, retail and industrial uses, as well as an RV park and a 12,000-square-foot fueling station. Completion of Phase I is slated for next summer. Avison Young is marketing various parcels of Big Bear Crossing for sale and build-to-suit development opportunities.

HOUSTON — Locally based investment firm Triten Real Estate Partners has acquired a portfolio of four light industrial properties totaling 482,523 square feet in Houston. Two of the buildings are located on the city’s east side, and two buildings are located on the city’s northwestern side. The portfolio, which was fully leased at the time of sale, was acquired in an off-market transaction. Information on the seller and sales price, as well as the involvement of third-party brokers, was not disclosed.

Centennial Bank Provides $73M Construction Loan for Elysian Apartments in Winter Garden, Florida

by John Nelson

WINTER GARDEN, FLA. — Centennial Bank has provided a $73 million construction loan for Elysian, a 323-unit luxury apartment development in the Orlando suburb of Winter Garden. Robby Barrows and David Druey of Centennial Bank originated the loan on behalf of the borrower, Unicorp National Developments Inc. The locally based developer plans to break ground on Elysian soon and wrap up construction in approximately 18 months. Site clearing is complete and pipe installation is currently underway. Designed by Krieger Klatt Architects, Elysian’s amenities will include a wine bar; fitness center with yoga, Pilates and cycling studios; steam room with a sauna; resort-style pool with cabanas; and a clubhouse with a fireplace and movie theater. Information on the property’s floorplans was not released. The Elysian loan grows the financing relationship between Centennial Bank and Unicorp to more than $500 million.

WESLACO, TEXAS — CBRE has negotiated the sale of Valley Crossing, a 178,594-square-foot shopping center located in the Rio Grande Valley city of Weslaco. The center was 97 percent leased at the time of sale to tenants such as J.C. Penney, T.J. Maxx and Petco. Mark Witcher, Harrison Tye and Jolie Duhon of CBRE represented the seller, an entity doing business as Capcor Weslaco Ltd., in the transaction. The buyer was Otima Investments.

HUNT VALLEY, MD. — Locally based St. John Properties Inc. has purchased a three-building office portfolio within North Park, a business park in Baltimore County. The properties span 295,000 square feet combined and are located at 4, 6 and 10 N. Park Drive in Hunt Valley. The portfolio is leased to tenants including Travelers Insurance, RCM&D, AP Benefits Advisors and AECOM. Onsite amenities include a conference center with catering kitchen, fully equipped fitness center, walking trails and a full-service deli. Gerry Trainor, Jim Cardellicchio and Rowan Miller of Transwestern represented the undisclosed seller in the transaction, and Sean Doordan and Alex Lyons represented St. John Properties internally. The sales price was also not disclosed. The new ownership plans to invest in capital improvements within the newly acquired portfolio, including new HVAC equipment, landscaping, signage and updated common areas. The North Park acquisition brings St. John Properties’ Baltimore County holdings to more than 4.6 million square feet.

Joint Venture Acquires 381-Bed Student Housing Community Near Louisiana State University

by John Nelson

BATON ROUGE, LA. — A joint venture between affiliates of Monument Square Investment Group and a New York-based single-family office has acquired University Grove, a 381-bed student housing community located 2.7 miles south of the Louisiana State University (LSU) campus in Baton Rouge. Developed in 2024, the property offers 127 cottage-style units in three-bedroom configurations with bed-to-bath parity. Capital improvements are planned for the property, including upgrades to landscaping and amenity spaces. The community was 98.5 percent leased at the time of sale. The seller and terms of the transaction were not released.

PALM BEACH GARDENS, FLA. — Northmarq has arranged the $43 million refinancing for Oakbrook Center, a three-building, 243,350-square-foot office campus located at 11760, 11770 and 11780 U.S. Highway 1 in Palm Beach Gardens. Deutsche Bank provided the five-year CMBS loan to the borrower, a joint venture between MHCommercial Real Estate Fund and Waterfall Asset Management. Built in 1985, Oakbrook Center is situated on 11.4 acres in South Florida’s Palm Beach County and includes covered parking; professional onsite property management; a fitness center with Peloton bikes, cardio weight equipment and showers; stacked, private terraces; floor-to-ceiling windows; and a courtyard.