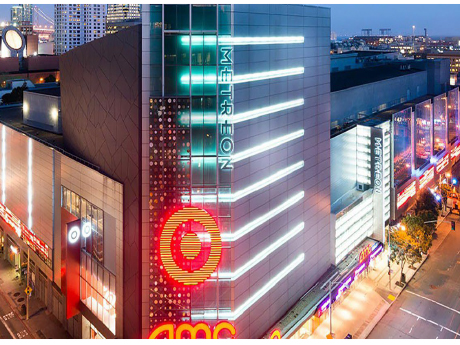

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

Property Type

AUSTIN, TEXAS — Locally based general contractor OHT Partners has broken ground on The Martin, a 375-unit multifamily project in East Austin. The Martin will offer one- and two-bedroom units that will range in size from 550 to 1,400 square feet, with 37 residences to be set aside as affordable housing for households earning up to 50 percent of the area median income. Amenities will include two pools, a jumbotron, fitness center, golf simulator, a karaoke and multimedia room, podcast rooms, dog park, coworking spaces and a dedicated rideshare lounge. Completion is slated for fall 2028. Project partners include architect Omniplan, civil engineer 360 Professional Services, structural engineer Urban Structure, MEP consultant Basharkhah Engineering, interior designer Ink + Oro and landscape architect KW Landscape Architects.

ROWLETT, TEXAS — SRS Real Estate Partners has arranged the $13.7 million sale of a 40,000-square-foot retail building in Rowlett, a northeastern suburb of Dallas, that is leased to Crunch Fitness. The gym opened at the building at 3601 Lakeview Parkway last fall under a 15-year, corporate-guaranteed lease. Matthew Mousavi and Patrick Luther of SRS represented both the seller, a multi-state developer, and the buyer, a publicly traded REIT, in the transaction. Both parties requested anonymity.

WASHINGTON, D.C. — Newmark has arranged a $99 million loan for the refinancing of the Intercontinental Washington, D.C. – The Wharf, a 278-room hotel located within The Wharf, a 3.5 million-square-foot mixed-use development on the southwest Washington, D.C., waterfront. Jordan Roeschlaub, Nick Scribani, Tyler Dumon and Tate Keir of Newmark arranged the loan through Morgan Stanley on behalf of the borrower, CarrAmerica, a locally based real estate investment, development and management firm. Completed in 2017, the 250,000-square-foot hotel spans 12 stories and features a first-floor restaurant, as well as 6,000 square feet of retail space. Guest amenities include a 5,000-square-foot ballroom, 4,000 square feet of meeting space, a spa, fitness center, restaurant bar and lounge, rooftop pool and bar and an underground parking garage.

MIAMI — A joint venture between locally based Torose Equities and Irvine, Calif.-based Sabal Investment Holdings has sold 3480 Main Highway, a 55,000-square-foot office and retail property located in Miami’s Coconut Grove neighborhood. Miami-based Azora Private purchased the property for $61 million, or $1,100 per square foot. The building is fully leased to food-and-beverage concepts Amal and Level 6, which are located on the ground floor and rooftop, as well as three office tenants. In 2025, an affiliate of CGI Merchant Group lost the office building through a UCC auction over $32.5 million in debt, in which Torose Equities and Sabal purchased the loan, according to South Florida Business Journal.

TEMPLE, TEXAS — Extended Stay America has opened a 116-room hotel in the Central Texas city of Temple. Developed by Provident Hospitality, the Extended Stay America Premier Suites – Temple is a four-story building with rooms that feature fully equipped kitchens with refrigerators, stovetops and microwaves, as well as dedicated dining and work areas. Amenities include fitness and business centers, as well as onsite laundry facilities.

MONROE, N.C. — Northmarq has negotiated the sale of Yardly Monroe, a 151-unit build-to-rent (BTR) community located in Monroe, roughly 30 miles outside Charlotte. Trevor Koskovich, John Currin, Jesse Hudson and Austin Jackson of Northmarq represented the seller, a joint venture between developer Taylor Morrison and equity partner Värde Partners. Faron Thompson and Grant Harris, also with Northmarq, originated $24.8 million in Freddie Mac acquisition financing on behalf of the buyer, FCP. The five-year, interest-only loan features a 35-year amortization schedule. Yardly Monroe, which has been rebranded as the Cottages of Monroe, is situated on nearly 25 acres and features one- and two-bedroom homes ranging in size from 717 to 1,030 square feet, according to Apartments.com. Each home features a private backyard with a pet door, full-sized washer/dryer, stainless steel appliances, high-speed internet, smart thermostat, doorbell camera, 10-foot ceilings, pantry, walk-in closet, vinyl plank flooring and a kitchen island. Community amenities include a swimming pool, dog park and a fitness center.

Crescent Communities, AEW Capital Sell 247,000 SF Industrial Building in Metro Charlotte

by Abby Cox

CONCORD, N.C. — Crescent Communities and AEW Capital Management have sold one of three rear-load industrial buildings within AXIAL Bonds Farm, a newly constructed, 810,000-square-foot industrial campus located in Concord, a northeast suburb of Charlotte. Brian Crutcher and Anne Johnson of CBRE represented the sellers in the transaction. Thomas Hipp of Whiteside Properties represented the buyer, National Kitchen & Bath Cabinetry Inc., which will fully occupy the building. The sales price was not disclosed. The project team for AXIAL Bonds Farm included Merriman Schmitt Architects (architect), Oak Engineering (civil engineer), Landmark Builders (general contractor), AEW Capital Management (equity), Canadian Imperial Bank of Commerce (lender) and CBRE (leasing). AXIAL Bonds Farm spans 70 acres and contains three buildings that measure 414,000, 247,000 and 148,720 square feet. The campus also includes 36-foot clear heights, rear-load configuration, 1,099 car parking spaces and 199 trailer parking spaces.

DALLAS — Westwood Management has signed a 30,000-square-foot office lease renewal in Uptown Dallas. The boutique asset management firm will remain a tenant at The Crescent, where it has occupied space since 1990, through 2036. Paul Whitman, Brad Selner and Blake Waltrip of JLL represented the tenant in the lease negotiations. Tony Click and Jordyn Allen represented the landlord, Crescent Real Estate, on an internal basis.

NEW YORK CITY — Affinius Capital has provided a $115 million loan for the refinancing of 162 East 36th Street, a 22-story multifamily project that is under construction in Manhattan’s Murray Hill neighborhood. The 160-unit building will ultimately house 87 studios, 46 one-bedroom apartments and 27 two-bedroom residences, as well as 3,700 square feet of retail space. Amenities will include a rooftop lounge, fitness center, resident’s club, pet spa, coworking spaces and rentable storage space. Henry Bodek of Galaxy Capital arranged the loan on behalf of the borrower, a partnership between Ranco Capital and the Gilardian Family. Proceeds will be used to complete construction and stabilize occupancy.