FREDERICK, COLO. — Evergreen Devco has completed construction of site infrastructure and two multi-tenant retail buildings at Silverstone Marketplace, a 35-acre shopping center located at Highway 52 and Colorado Boulevard in Frederick. A 123,000-square-foot King Soopers Marketplace, including a French bakery, apparel, fuel station and drive-thru pharmacy, anchors the development. The location is the first King Soopers in Frederick. Silverstone Marketplace also includes 20,000 square feet of shop buildings that are 93 percent leased. Currently signed tenants include Wingstop, Club Pilates, Domino’s Pizza, Cold Stone Creamery, Great Clips, Blue Sky Nails & Lash, Five Guys, Pacific Dental and Chipotle. Chase Bank, Wendy’s and Valvoline will occupy pad sites, starting in early 2026, at the property. G3 Architecture served as architect, Galloway provided civil engineering design, Mark Young Construction handled site work and Epic Construction served as contractor for the shop buildings.

Property Type

WRIGHT CITY, MO. — American Foods Group has opened an $800 million beef processing facility adjacent to I-70 in Wright City, about 50 miles west of downtown St. Louis. The 800,000-square-foot facility is known as America’s Heartland Packing LLC. The project was the focus of a FreightWeekSTL panel discussion hosted by the St. Louis Regional Freightway. Cattle are primarily shipped to the facility on trucks through the interstate highway system, as well as the associated packaging equipment needed for shipping outbound products. On average, the property receives about 10 trucks of cattle every weekday, with the plant harvesting about 400 cattle per day. The plant produces varying types of beef, including ground beef and different cuts of steaks. The facility ships out eight to 10 trucks of finished products per day to grocery stores, further processors, food service providers and schools. The Missouri Department of Transportation is investing $2.8 billion to add a third lane in each direction along nearly 200 miles of I-70 between St. Louis and Kansas City, a major project that is expected to benefit the new beef facility. Operations are expected to increase significantly at the facility in the future. Full operational capacity is anticipated to …

BOLINGBROOK, ILL. — Brookline Real Estate has partnered with Rhino Investments Group to renovate The Promenade Bolingbrook, a 778,000-square-foot shopping center in the Chicago suburb of Bolingbrook. Brookline has been hired to oversee leasing and lead a new vision for the open-air lifestyle center with a refreshed mix of retail, service, restaurants and experiential offerings. Rhino recently acquired an interest in The Promenade Bolingbrook, which is located at Boughton Road and I-355.

WEST BLOOMFIELD, MICH. — WB Pub has signed a lease to open at the 2,625-square-foot former Smashburger space at The Boardwalk shopping center in West Bloomfield Township, a northwest suburb of Detroit. Michael Murphy of Gerdom Realty & Investment represented the landlord and tenant. The new pub will offer food as well as a full bar. Space remains available for lease at the property.

DALLAS — The evolution of active adult product is in the third inning of a nine-inning game, but some markets are clearly ahead of the curve, says Zach Crowe, managing director of U.S. real estate for private equity giant The Carlyle Group. “There are markets like Dallas, Las Vegas and Denver that have had active adult for 20 years at this point, and the product is well known. The consumer understands what it is. There are other markets with very few properties, and people have no idea what it is. It’s still incredibly early [in the game],” reports Crowe, who is based in Washington, D.C., and focuses on real estate investment opportunities in multifamily, 55+ housing and medical office properties. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. The insights from Crowe came during the CEO panel at the fifth annual InterFace Active Adult conference. The daylong conference, which took place May 7 at The Westin Los Colinas in Dallas, attracted more than 300 industry professionals. Moderated by Ryan Maconachy, vice chairman of health and alternative assets for Newmark, the …

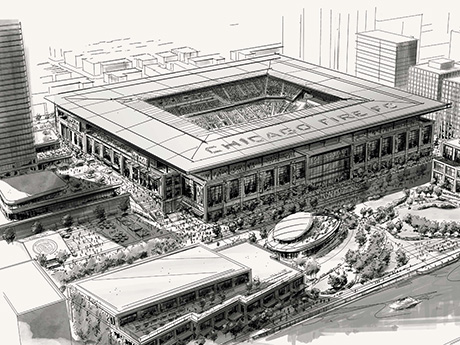

Chicago Fire FC Unveils Plans for New $650M Riverfront Soccer Stadium, Opening Set for 2028

by John Nelson

CHICAGO — The Chicago Fire FC, a Major League Soccer (MLS) franchise, has unveiled plans for a new, privately funded soccer stadium in downtown Chicago. The Wall Street Journal reports the project would cost roughly $650 million to execute. The club and its owner and chairman, Joe Mansueto, plan to debut the new stadium in spring 2028, along with a surrounding entertainment district. “Soccer is the world’s game, and a world-class city like ours deserves a world-class club — with a world-class home to match,” says Mansueto, who purchased the club in 2018. “This new home will serve as a catalyst for job creation, economic development and vibrant community life.” The Chicago Fire did not release financial terms of the development, but Mansueto says that no public funds will be used in the development of the venue, which is designed to seat approximately 22,000 fans for matches. The stadium’s seating capacity can also be expanded for concerts or other community events, according to the project’s website, DearChicago.com. The venue will be situated along the Chicago River just south of Roosevelt Road. The stadium will serve as an anchor of The 78 as it is anticipated to be Chicago’s 78th neighborhood. The …

— By Adam Schmitt of CBRE — The Las Vegas multifamily market is experiencing a significant transformation that’s shaped by new construction trends and evolving market dynamics. As the city continues to expand and adapt, it is essential for current investors, developers and capital allocators to understand the opportunities and barriers for growth. The multifamily market has seen substantial fluctuations since the onset of COVID-19. Rents surged by 24.6 percent in 2021, buoyed by government interventions. However, as these supports diminished, vacancy rates rose sharply, climbing from an average of 3.4 percent in 2021 to 7.35 percent in 2023. Recent trends, however, indicate a recovery. Vacancy rates have decreased to 6.5 percent as of February, which hint that multifamily fundamentals may be regaining stability and moving toward normalized averages. The single-family housing market is another critical element influencing the overall health of Las Vegas’ economy. The market produced 160,092 single-family homes between 2003 and 2008. However, only 142,455 were built between 2009 and 2024. This slowdown has led to soaring home prices, even amid rising mortgage rates approaching 7 percent. Consequently, the growing disparity between renting and owning has created favorable conditions for rental housing demand, further solidifying the multifamily …

HOUSTON — JLL has secured an undisclosed amount of construction debt and joint venture equity for Autry Park One, a 127,651-square-foot office project that will be located along Allen Parkway and the Buffalo Bayou in West Houston. Autry Park One will offer private offices, meeting space, mid-building outdoor decks, an indoor/outdoor rooftop deck, fitness facility and 10,500 square feet of retail space. Colby Mueck, Cortney Cole and Kevin McConn of JLL worked with Hanover Co. and LOCAL to secure joint venture equity for the project and separately arrange a syndicated construction loan with two regional banks.

HOUSTON — Locally based brokerage firm Oxford Partners has arranged the sale of a 104,957-square-foot industrial building in North Houston. According to Crexi.com, the building at 12001 Hirsch Road was built on 11.7 acres in 2010. Ryan Hartsell, Matt Rogers and Stephen Hazen of Oxford Partners represented the buyer, TF Warren Group, in the transaction. Carlton Anderson and Nathan Mai of Mohr Partners represented the undisclosed seller.

LAREDO, TEXAS — Lee & Associates has brokered the sale of a 59,252-square-foot industrial building in the South Texas city of Laredo. The front-load building sits on a 5.6-acre site within Unitec Business Park and includes 4,000 square feet of office space. Enrique Volkmer of Lee & Associates represented the seller, Vimex Ltd., in the transaction. The buyer was a company specializing in the manufacturing, distribution and servicing of heavy industrial trucks.