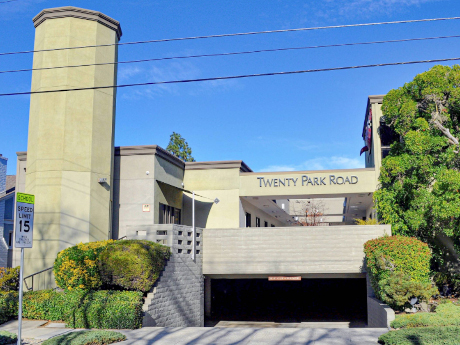

BURLINGAME, CALIF. — Matthews Real Estate Investment Services has arranged the sale of The Clock Tower, an office building in Burlingame. Sazze Partners, a venture capital firm from South Korea, acquired the asset for $5.4 million and plans to establish a U.S. office at the site. Located at 20 Park Road, The Clock Tower offers 6,815 square feet of office space. Marko Buljan of Matthews facilitated the transaction.

Property Type

WYLIE, TEXAS — Locally based brokerage firm STRIVE has arranged the sale of a 23,900-square-foot warehouse in Wylie, a northeastern suburb of Dallas. According to LoopNet Inc., the property at 1141 Bozman Road comprises four buildings that were delivered in phases over the past several years, with Phase I completed in 2022 and Phase II completed in early 2024. Bryan Meyer and Jennifer Pierson of STRIVE represented the seller and procured the buyer, both of which were California-based investors that requested anonymity.

MINNEAPOLIS — Dwight Mortgage Trust, the affiliate REIT of Dwight Capital, has provided a $49.2 million bridge loan to refinance Moment Apartments in downtown Minneapolis. The 222-unit luxury apartment complex rises 10 stories with 14,713 square feet of ground-floor retail space that is leased to Starbucks and New Horizon Academy. There are seven studios, 159 one-bedroom units and 56 two-bedroom apartments. Amenities include a fitness center, pet play area, business center, golf simulator, coworking space, sauna, pet spa, swimming pool, conference rooms, grilling stations and outdoor terraces. Loan proceeds will be used to retire existing debt, fund reserves and cover transaction-related costs. Daniel Malka and Jonathan Pomper of Dwight originated the financing on behalf of the borrower, Sherman Associates.

KANSAS CITY, MO. — National law firm Lathrop GPM LLP will move its Kansas City headquarters to a new 47,000-square-foot office at Stanton Road Capital’s 2323 Grand Boulevard. The firm is relocating from its roughly 111,000-square-foot space at 2345 Grand Boulevard, where it has been based since the 1970s. The new office will be designed to adopt the firm’s companywide shift toward a hybrid work approach and is slated for occupancy in summer 2026. Lathrop’s office will be located on floors seven and eight with nine conference rooms, private offices, open workspaces and employee wellness rooms. Located in the heart of downtown, 2323 Grand Boulevard sits at the intersection of the Crossroads Art District and Crown Center, directly across from Union Station and the new RideKC streetcar station. The 320,976-square-foot, 11-story building offers onsite parking, flexible floor plates and spec suites. Stanton Road Capital acquired the property in late 2017 and has updated the amenities, including a conference center, gym, tenant lounge, dining area and outdoor patio. Additionally, Grand Coffee Co. will open a location within the building. Travis Helgeson and Miles McCune of Range Realty Partners are the property’s leasing agents. Scott Bluhm of Newmark Zimmer represented Lathrop GPM …

WEST CHESTER, OHIO — CBRE has arranged the $13 million sale of a 183,178-square-foot industrial property in West Chester near Cincinnati. Located at 9113 LeSaint Drive, the building served as the former headquarters of The O’Gara Group. Built in 1986 and renovated in 2023, the property features seven dock doors and eight drive-in doors on a 10.9-acre site. At the time of sale, the asset was fully occupied by three tenants. Will Roberts, Steve Timmel and Tim Schenke of CBRE represented the seller, TradeLane Properties. Plymouth Industrial REIT Inc. was the buyer.

ALVARADO, TEXAS — Bradford Commercial Real Estate Services has negotiated a 16,000-square-foot lease at an industrial flex building in Alvarado, a southern suburb of Fort Worth. The tenant, Legend Conversion, which provides custom automotive build-outs, will occupy the entire building at 4209 Longhorn Drive, which features 25-foot clear heights, four grade-level doors and two dock-high doors. Todd Lambeth and Cade Navarro of Bradford represented the landlord, AAN Development LLC, in the lease negotiations.

CHICAGO — Greenstone Partners has negotiated the $7.4 million sale of a 48,500-square-foot flex office and industrial building located at 1100 W. Monroe St. in Chicago’s Fulton Market neighborhood. The three-story property features efficient floor plates, industrial storage, three exterior docks on the first floor and 37 surface parking spaces. The asset, which was well maintained by an owner-occupant for more than 20 years, is located two blocks south of McDonald’s global headquarters. Jason St. John of Greenstone Partners represented the buyer, Alexander West Capital, the family office of the Leopardo family. The property will serve as the new home for Leopardo Construction’s Chicago operations. Andrew Davidson, Jay Beadle and David Kimball of Transwestern represented the seller, 1100 West Monroe LLC, an affiliate of Kolcraft Enterprises.

ROSEMONT, ILL. — Kiser Group has brokered the $3.9 million sale of 35 condominium units in a bulk transaction in Rosemount, a suburb of Chicago. The value-add asset was 97 percent occupied at the time of sale and provides convenient access to Chicago O’Hare International Airport, Rivers Casino and the Rosemont Fashion Outlets. Andy Friedman and Jake Parker of Kiser brokered the sale, which involved multiple sellers. The buyer was a local investor.

DALLAS — Clear Technologies Inc., a provider of data storage and management services, has signed an 8,286-square-foot office lease at The Quorum, a five-story, 86,750-square-foot building in North Dallas. Michael Doherty of Lincoln Property Co. represented the tenant, which is relocating from the nearby building at 16415 Addison Road, in the lease negotiations. Sunwest Real Estate Group owns The Quorum.

FARMINGVILLE, N.Y. — BRP Cos. has completed Arboretum at Farmingville, a 292-unit multifamily project on Long Island. The 62-acre site at 20 Maple Lane is located within the Town of Brookhaven and includes a public park with walking trails and picnic areas. The development consists of 82 two-bedroom flats, 82 lofts, 63 two-bedroom townhomes, 14 three-bedroom townhomes and 51 three-bedroom single-family houses, with 30 units reserved for workforce housing. The amenity package comprises a fitness center with a yoga room, pool and cabana area, clubhouse with an entertainment kitchen, courts for tennis, pickleball and bocce ball, a putting green, playground, dog run and a business center with conference rooms. Santander Bank financed construction of the project, which began in summer 2022, and Basis Investment Group was the preferred equity investor. Rents start at $3,495 per month for a two-bedroom, market-rate apartment.