INOLA, OKLA. — Emirates Global Aluminium plans to open a $4 billion manufacturing plant near Tulsa in northeastern Oklahoma, an initiative that is expected to facilitate the direct creation of about 1,000 new jobs. A timeline for opening was not announced, but Recycling Today reports that construction could begin as soon as the end of next year. The facility will be located on more than 350 acres at Tulsa Port of Inola, a 2,200-acre industrial park with access to rail and nautical transportation networks. Once complete, the facility will be the largest of its kind in the country, producing billets, sheet ingots, high-purity aluminum and foundry alloys. The new Emirates facility is also expected to be responsible for the creation of 1,800 indirect jobs. According to ChemAnalyst, at full capacity, the plant will be able to annually produce 600,000 tons of the metal, a figure that reflects a virtual doubling of the current domestic aluminum production. The project team says this facility represents the first manufacturing plant for this material to come on line in the United States in the past 45 years. The news follows that of the $300 million investment from CBC Global Ammunition, which also selected Oklahoma …

Property Type

Atlanta’s retail market is proving it knows how to adapt, evolve and outperform, even in the face of macroeconomic headwinds. Despite a moderation in leasing and investment sales activity in recent quarters, the city’s fundamentals remain strong. Vacancy rates are at historic lows, rent growth is outpacing the national average and population and income growth continue to fuel long-term demand. Demand and demographics With vacancy rates consistently under 4 percent, Atlanta remains one of the tightest retail markets in the country. The appetite for well-located retail space hasn’t waned, even as broader economic uncertainty has slowed transaction velocity. In fact, strong absorption numbers and a limited supply pipeline have bolstered landlord confidence and pricing power across the metro. What’s driving this resilience? A booming population, rising household incomes and a steady influx of corporate relocations. Employers like Microsoft, Google and Cisco are expanding their footprints, bringing with them jobs, workers and spending power. Some of this growth has been particularly noticeable in Midtown. Redevelopment playbook Instead of ground-up development, Atlanta’s growth strategy has increasingly focused on reinventing aging retail centers in prime locations. With construction costs high and land increasingly scarce, developers opt to reimagine what already exists. These projects …

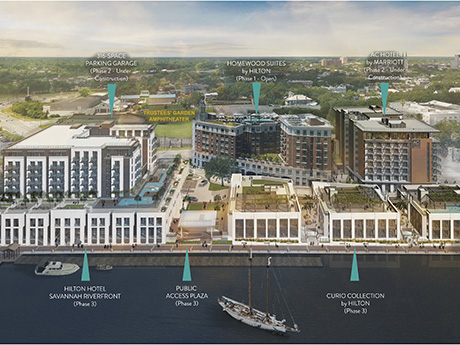

North Point Hospitality Completes $105M Second Phase of River Street East Development in Savannah

by John Nelson

SAVANNAH, GA. — North Point Hospitality has completed the $105 million Phase II of River Street East, a three-phase mixed-use district located along the Savannah River. The second phase includes a 171-unit AC Hotel by Marriott Savannah Historic District hotel and a 316-space public parking garage, which is now open. Additionally, 3,300 square feet of street-level retail space is available for lease. AC Hotel by Marriott features a rooftop restaurant and bar, as well as flexible meeting spaces. Phase I of the development included the Homewood Suites by Hilton Savannah Historic District/Riverfront hotel, which was delivered in 2015 and renovated in 2024. Phase III of River Street East will include a 300-unit full-service, dual branded luxury and lifestyle hotel, which will feature a ballroom for private events, world-class spa and multiple dining experiences.

AUSTIN, TEXAS — San Antonio-based owner-operator EMBREY will develop The Hatchery, a 344-unit lakefront apartment community that will be located just east of downtown Austin. Designed by San Antonio-based Lake | Flato Architects and Dallas-based GFF, The Hatchery will offer studio, one- and two-bedroom units. Amenities will include a rooftop pool and clubhouse, fitness center, a residential lounge with coworking space, game room, grab-and-go market, central courtyard and outdoor kitchens and gaming lawns. Frost Bank is financing construction of the project, the first units of which are expected to be available by mid-2027. Full completion is slated for mid-2028.

Housing Trust Group Opens $100M Mixed-Use Affordable Housing Development in Hollywood, Florida

by John Nelson

HOLLYWOOD, FLA. — Housing Trust Group (HTG) has opened the Apartments at University Station, a $100 million mixed-used affordable housing community located in downtown Hollywood. The development features 216 income-restricted units of affordable and workforce housing — 108 one-bedroom and 108 two-bedroom apartments — ranging in size from 621 square feet to 899 square feet. The property’s affordable component will apply to all households earning between 22 and 80 percent of the area median income. The complex comprises two residential towers, a 635-space public-private parking garage, more than 2,000 square feet of retail space and a new 12,210-square-foot campus for Barry University’s College of Nursing and Health Services. Amenities at the complex include a multipurpose room with a catering kitchen and bar, fitness center, resort-style swimming pool and a game room, as well as elevated pedestrian bridges connecting the residential buildings to the parking garage. Developed in a public-private partnership with the City of Hollywood, the project team includes general contractor ANF Group Inc., Corwil Architects, HSQ Group (civil engineer), B. Pila Design Studio (interior design), Witkin Hults + Partners (landscape architect), BNI Engineers (structural engineer), RPJ Inc. (MEP engineer) and Kaller Architecture (Barry University interiors). Financing sources for the development …

AUSTIN, TEXAS — Dallas-based investment firm Entrada Partners has acquired a 243-bed student housing property located near the western portion of the University of Texas at Austin campus. Built in 2012 and known as 24Longview, the property offers a mix of one-, two-, three- and four-bedroom floor plans across 70 units. The amenity package comprises a pool, fitness center, lounge area, study rooms, green space and onsite laundry facilities. Kent Myers and Jordan Featherston of Institutional Property Advisors, a division of Marcus & Millichap, represented the undisclosed seller in the transaction. De’On Collins, Jayme Nelson and Samantha Jay of JLL arranged acquisition financing for Entrada Partners, which plans to implement capital improvements at 24Longview.

Carr Properties Receives Site Plan Approval for Office-to-Multifamily Conversion Project in Metro D.C.

by John Nelson

CLARENDON, VA. — Carr Properties has received site plan approval for the redevelopment of 3033 Wilson Blvd. in the Washington, D.C., suburb of Clarendon. Situated across from the Clarendon Metro Station, the former 160,000-square-foot office building will be transformed into a 309-unit multifamily complex with 6,000 square feet of ground level retail space. Carr Properties will participate in Arlington’s Green Building Incentive Program while also aiming for LEED Gold certification for 3033 Wilson. Architecture firm SK+I and interior design firm Edit Lab by Streetsense will design the redeveloped property, which will include a fitness center, coworking lounge, rooftop pool deck, clubroom, landscaped courtyard and 324 underground parking spaces with 13 electric vehicle charging stations. The project team also includes landscape architect ParkerRodriguez, civil engineer Bohler DC and McGuireWoods as land-use counsel. 3033 Wilson is anticipated to break ground in early 2026, with completion slated for 2027.

CHARLOTTE, N.C. — Deriva Energy, formerly known as Duke Energy Renewables, has relocated to a 33,606-square-foot office space at One South on the Plaza, a 40-story office tower located in Uptown Charlotte. The new office will serve as the headquarters for Deriva, which plans to move in by late fall. Chris Schaaf and Jamie Boast of JLL represented Deriva Energy in the lease negotiations, while Rhea Greene of Trinity Partners represented the undisclosed landlord. One South on the Plaza totals 850,000 square feet and features a 22,000-square-foot tenant amenity level on the third floor, street-level retail space housing tenants such as Tupelo Honey and Eddie V’s and a connection to the Overstreet Mall. Since 2015, ownership has invested $100 million to renovate the building’s lobby, plaza and exterior. More than 92,000 square feet of office leases have been executed at One South on the Plaza, including Dole Food’s U.S. headquarters, Shumaker, Robert Half, Protiviti, Huntington National Bank, The Siegfried Group, Krazy Curry, Ace No. 3 and Pet Wants.

LEWISVILLE, TEXAS — Chicago-based REIT First Industrial Realty Trust Inc. (NYSE: FR) has broken ground on a 176,000-square-foot speculative project in the northern Dallas suburb of Lewisville. The building will be the sixth and final structure within First Park 121, a 1.2 million-square-foot development located at the corner of Midway Road and FM 544. Building features will include 36-foot clear heights, 36 dock-high door positions, two ramps, an ESFR sprinkler system and parking for 118 cars and 249 trailers. Alliance Architects is designing the project, and Cerris Builders is serving as the general contractor. Westwood is providing civil engineering services, and Lee & Associates is the leasing agent. Construction is expected to last 12 to 14 months.

BOYNTON BEACH, FLA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Cross Creek Center, a 37,201-square-foot shopping center located in the Fort Lauderdale suburb of Boynton Beach. Built in 1988 and renovated in 2014, the center was 97 percent leased at the time of sale to tenants including Stanton Optical, The UPS Store, Smoothie King and Metro by T-Mobile. Drew Kristol and Kirk Olson of IPA represented the seller, Davie, Fla.-based Janoura Realty, and procured the buyer, Cincinnati-based Phillips Edison & Co., in the transaction. The sales price was not disclosed.