FRESNO, CALIF. — A partnership between CenterCal Properties and DRA Advisors has acquired Fig Garden Village, a 300,000-square-foot lifestyle center located in Fresno. Originally developed in 1956 as part of the historic Fig Garden residential area, the center serves as a retail anchor for the broader Central California market. Tenants at the property include Pottery Barn, Williams-Sonoma, Banana Republic, lululemon, Whole Foods Market, Anthropologie, Madewell and Paper Source. The center was previously owned by Brookfield Properties.

Property Type

WEST PALM BEACH, FLA. — Plaza Advisors has brokered the sale of Paradise Place, a 72,961-square-foot shopping center located on an 8.5-acre site in West Palm Beach. Built in 2003, the center was 98 percent leased at the time of sale to tenants including Publix, Sage Dental, Dunkin’ and Goodwill. Jim Michalak and Jeff Berkezchuk of Plaza Advisors represented the seller, Collett Capital, in the transaction. Forge Capital Partners purchased Paradise Place for an undisclosed price.

Slatt Capital Arranges $19.7M Refinancing for Sun Garden Retail Center in San Jose, California

by Amy Works

SAN JOSE, CALIF. — Slatt Capital has arranged a $19.7 million loan for the refinancing of Sun Garden Retail Center, a 107,899-square-foot retail property located in San Jose. Slatt Capital secured the fixed-rate, 12-year loan through a life insurance company on behalf of the borrower. Walmart anchors Sun Garden Retail Center, which occupies the former site of the Sun Garden Packing Co., a legacy cannery connected to San Jose’s agricultural roots. Other tenants at the property include Big 5 Sporting Goods, Chipotle Mexican Grill, Starbucks Coffee, Chevron and Jack in the Box.

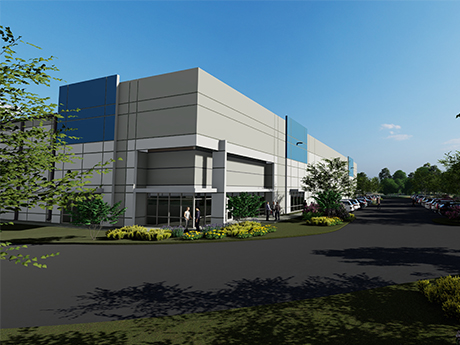

JOHNS CREEK, GA. — Dermody has broken ground on LogistiCenter at South Forsyth, a 93,960-square-foot industrial facility located at 7515 New Boyd Road in Johns Creek, a northern suburb of Atlanta. Located in the South Forsyth/North Fulton market, the Class A facility is situated on a 10-acre site within Johns Creek Technology Park. Reed Davis, Bob Currie, Brad Pope and Hannah Dillard of JLL are handling leasing for LogistiCenter at South Forsyth, which is available for preleasing and slated for occupancy in the fourth quarter. The facility will feature 2,500 square feet of speculative offices, 32-foot clear heights, 54- by 60-foot column spacing, 22 dock-high doors, two drive-in doors, 99 parking stalls, ESFR fire protection and LED lighting.

Marcus & Millichap Capital Corp. Arranges $6.5M Refinancing for Industrial Park in Fort Mill, South Carolina

by John Nelson

FORT MILL, S.C. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $6.5 million loan for the refinancing of Society Lane Industrial Park in Fort Mill, a South Carolina suburb of Charlotte. The 11-building property was fully leased at the time of financing to 13 tenants. Duke Dennis of MMCC’s Dallas office arranged the five-year loan through an undisclosed bank on behalf of the owner, Phoenix Industrial Redevelopment. The loan was structured at 250 basis points above the 5-year Treasury yield, with a 25-year amortization schedule and stepdown prepayment options.

Red Development, Globe Corp. Welcome Three New Retail Tenants to Goodyear Civic Square in Arizona

by Amy Works

GOODYEAR, ARIZ. — A partnership between Red Development and Globe Corp. has signed three new retail tenants to Goodyear Civic Square (GSQ), its 150-acre mixed-use development located in the Phoenix suburb of Goodyear. Trader Joe’s will open a 13,500-square-foot store — the first in Goodyear — while Black Rock Coffee Bar will open a 1,460-square-foot drive-thru coffee shop. Additionally, Firebirds Wood Fired Grill will open a 5,658-square-foot standalone building that also houses a 700-square-foot outdoor patio. All new tenants are scheduled to open in 2026. The first phase of GSQ features a newly constructed city hall and library, 2-acre park, two parking garages, as well as office space. An outpatient medical building is currently under construction and a 132-room hotel is also planned for the development. Other tenants already open at the property include Bacchus Wine & Debauchery, BJ’s Restaurant & Brewhouse, Cheddar’s Scratch Kitchen, Copper & Sage, F45 Training, Harkins Theatres and Miyu Nails and Spa.

WENTZVILLE, MO. — McCarthy Building Cos. has broken ground on Mercy Hospital Wentzville, a 400,000-square-foot hospital in Wentzville, a far west suburb of St. Louis. The project marks Missouri’s first new acute care hospital campus in nearly a decade, according to McCarthy. The development will include 75 inpatient acute care beds and a 26-bed emergency department with two trauma areas and four behavioral health rooms. The advanced medical campus will offer a broad range of inpatient and outpatient care, including surgical and specialty options such as cardiovascular, cancer and orthopedics as well as outpatient imaging, diagnostic and treatment services. Crews began preparing the site in late March and will begin work on the central utility plant this summer, with the hospital tower work beginning in early 2026. Construction of the hospital is expected to be completed in four years. The project team includes CannonDesign for architecture and design and IMEG as engineer. Mercy is one of the 15 largest U.S. health systems.

DEARBORN, MICH. — District Capital has secured a $25.1 million first mortgage loan for a 622-bed student housing community at the University of Michigan – Dearborn. Mike Lemon of District Capital arranged the nonrecourse loan through a bank. The loan features a five-year term, fixed interest rate, one year of interest-only payments and a 30-year amortization.

CHICAGO — Walker & Dunlop Inc. has arranged $22.6 million in equity for Parkside 5, the fifth and final phase of the Parkside at Old Town development, a 99-unit community located on the former Cabrini-Green public housing site in Chicago’s Near North Side. Jennifer Erixon led the Walker & Dunlop team that syndicated Low-Income Housing Tax Credits and Illinois Donation Tax Credits on behalf of the borrower, Holsten Real Estate Development Corp. Walker & Dunlop Affordable Equity syndicated the equity to JP Morgan, resulting in $22.6 million of equity to support the development. In addition to syndicating the credits, JP Morgan is also providing a construction loan. The funding will support the construction of a mix of market-rate and affordable units, with 37 of the units benefitting from a 20-year Section 8 Housing Assistance Payment contract. The affordable units will be reserved for households earning between 50 and 60 percent of the area median income. Parkside 5 will feature three three-story, walk-up buildings and an eight-story mid-rise structure with townhome units at its base. Planned amenities include a community room, fitness center and onsite social services for residents. A playground and dog park will be open to the community.

CORONA DEL MAR, CALIF. — Corona Del Mar-based Hanley Investment Group Real Estate Advisors has brokered the sales of seven net-leased retail properties totaling $18.4 million on behalf of a Minnesota-based 1031 exchange buyer. Jeff Lefko and Bill Asher of Hanley Investment Group represented the buyer in the transactions, which included a mix of newly constructed single-tenant and multi-tenant assets. Midwest transaction highlights include a 4,616-square-foot property occupied by Total Access Urgent Care in Oakville, Mo., and a 7 Brew ground lease in Des Moines, Iowa. Hanley Investment Group represented the buyer and sellers in association with John Shuff of Pace Properties and ParaSell Inc. for the Missouri and Iowa properties, respectively.