FORT MYERS, FLA. — National CORE has announced plans to develop Oak Park Senior Living, an affordable seniors housing project in Fort Myers. Upon completion, the four-story community will feature 144 apartment units for residents age 62 and older earning between 30 and 65 percent of the area median income. Residences will include 124 one-bedroom apartments and 20 two-bedroom apartments. Amenities will include a community room, cybercafe, swimming pool, fitness room, community garden and a pickleball court. Residents will have access to computer training, daily activities and free assistance with light housekeeping, grocery shopping and laundry through AGPM, National CORE’s property management partner. KeyBank Community Development Lending and Investment has provided $16 million in low-income housing tax credit (LIHTC) equity. KeyBank’s Commercial Mortgage Group privately placed $22 million in tax exempt bonds for the construction and originated a $7.4 million Freddie Mac Forward commitment for permanent financing, which will be funded upon stabilization of the community. Florida Housing Finance Corp. has committed $22 million to the project in the form of a Multifamily Mortgage Revenue Note, as well as $9.5 million from the Rental Recovery Loan Program, $1.2 million of Extremely Low-Income funding and $1.9 million in 4 percent LIHTC …

Property Type

KARA Hospitality Opens 92-Room Extended Stay America Hotel in Charlottesville, Virginia

by John Nelson

CHARLOTTESVILLE, VA. — KARA Hospitality has opened Extended Stay America Premier Suites – Charlottesville, a 92-room, four-story hotel in Charlottesville. The hotel features free Wi-Fi, complimentary breakfast, cable TV, a 24-hour fitness room, onsite guest laundry and a lobby with additional vending options. All suites include fully equipped kitchens with full-size refrigerators, microwaves, stovetops, cookware, utensils and dishes, as well as recliners and work areas.

TEMPLETON, MASS. — A partnership between metro Boston-based MPZ Development and Capstone Communities will undertake a $36 million multifamily adaptive reuse project in Templeton, about 65 miles northwest of Boston. Designed by ICON Architecture, the project will convert the historic Baldwinville Elementary School, which was originally built in 1923, into a 54-unit apartment complex that will be known as Baldwinville School Apartments. Residences will come in studio, one-, two- and three-bedroom floor plans, and the majority (49) of the units will be reserved for households earning between 30 and 60 percent of the area median income. Amenities will include a children’s playground, fitness center, electric vehicle charging stations, onsite laundry facilities and a community walking trail and green space. Rockland Trust provided $21.5 million in construction financing for the project. A groundbreaking ceremony will take place in May.

TINICUM TOWNSHIP, PA. — Cushman & Wakefield has arranged a $34 million loan for the refinancing of Airport Logistics Center, a 627,252-square-foot industrial facility located within the Philadelphia metro area. The property, which was 83 percent leased to 20 tenants at the time of the loan closing, consists of four buildings with clear heights ranging from 30 to 65 feet and three acres of outdoor storage space. John Alascio, Chuck Kohaut and Meredith Donovan of Cushman & Wakefield arranged the loan through private equity firm Blue Owl Capital on behalf of the borrower, a partnership between Ivy Realty and institutional investment firm Lubert-Adler.

BALA CYNWYD, PA. — Federal Realty Investment Trust (NYSE: FRT) and CBG Building Co. have topped out a 217-unit multifamily redevelopment project in Bala Cynwyd, a northwestern suburb of Philadelphia. The project, which represents the second phase of a larger redevelopment known as Bala Cynwyd on City Avenue, is a conversion of the former 120,000-square-foot Lord & Taylor department store into an apartment complex with 16,000 square feet of ground-floor retail space. Federal Realty received zoning approval for the project in February 2024 and broke ground a few months later. The company expects to complete construction of this phase next summer.

NEW YORK CITY — Whole Foods Market will open a 10,000-square-foot store in Manhattan’s East Village on Wednesday, May 14. The small-format store will be located within the StuyTown development at 409 E. 14th St. At the opening, Whole Foods will present Harlem-based supplier Uncle Waithley’s with a low-interest loan to help grow its operations and support expansion to more Whole Foods Market stores.

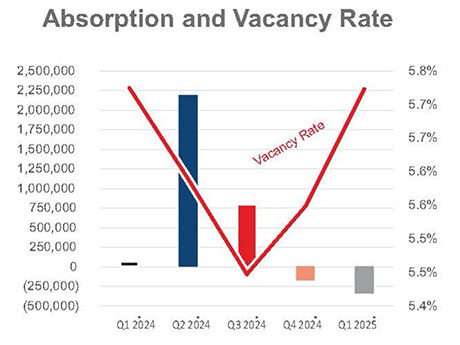

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …

PLANO, TEXAS — Aligned Data Centers LLC, a data center developer and operator based in Plano, has partnered with Lambda Inc., a cloud computing company backed by Nvidia. Lambda will occupy DFW-04, Aligned’s newest data center under construction in its home market. The Dallas Morning News reported that the facility represents an investment of $700 million. Lambda’s AI Cloud platform will be integrated into the new data center, which is anticipated to be available in 2026. Situated at 401 N. Star Road, DFW-04 will comprise 425,000 square feet and support Lambda’s highest-density graphics processing units (GPUs), essential tools for AI and machine learning users. The new 44-acre facility will have an onsite substation and will feature Aligned’s proprietary air and liquid cooling technologies. DFW-04 will also have more than 5,000 megawatts of future capacity. The new facility will be situated within three miles of DFW-01 and DFW-02, which also serves as Aligned’s corporate headquarters. Aligned is also currently underway on DFW-03, a 27-acre data center project in Mansfield, Texas, that is set to deliver later this year. “Aligned is the ideal partner to help Lambda build large, flexible space that meets the AI demands of today and tomorrow,” says Ken …

By Katie Sloan AUSTIN, TEXAS — The ‘State of the Industry’ panel at the 17th annual InterFace Student Housing conference held more of a trepidatious tone than heard in recent years. While pre-leasing levels and rental rates are still above historical norms, the industry is seeing a slight deceleration in pre-leasing speed and rate growth, leading some to question what the industry has in store for the year ahead. The discussion — held on April 10 in Austin, Texas — was moderated by Alex O’Brien, CEO with Cardinal Group. The best way to characterize the industry this year is hesitant according to Ryan Lang, executive vice chairman with Newmark, who believes investor reluctance is largely due to pre-leasing numbers falling a couple of points behind levels seen at this time last year. Still, levels are trending far ahead of pre-leasing levels seen in 2019, lending to confidence overall in the sector. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “The past two years were unprecedented from a leasing perspective with properties leasing up the fastest and with the highest rents growths …

ANNA, TEXAS — Locally based firm ONM Living will develop Cottages at Century Farms, a 290-unit build-to-rent community that will be located in the North Texas city of Anna. The development will be situated on a 23-acre site within a master-planned community and will offer studio, one-, two- and three-bedroom homes that will range in size from approximately 350 to 1,400 square feet. Homes will feature fenced yards, covered front porches, granite countertops, stainless steel appliances, walk-in showers, full-size washers and dryers and smart technology. Amenities will include a fitness center, pool, pickleball and other sports courts, dog park and walking trails. Leasing is scheduled to begin late next year.