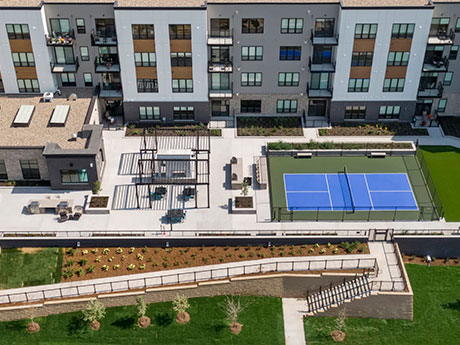

MAPLE GROVE, MINN. — JLL Capital Markets has provided a $33.2 million Fannie Mae loan for the refinancing of Risor of Maple Grove, a luxury 55+ community in the Minneapolis suburb of Maple Grove. The 169-unit property, completed in June 2023, rises four stories with a mix of studios, one- and two-bedroom units averaging 1,002 square feet. Amenities include a clubroom, golf simulator, wine bar, indoor pool and spa, pickleball court and top-floor sky lounge. Scott Loving, Scott Streiff, Gary Marchiori and Will Hintz of JLL originated the five-year, fixed-rate loan on behalf of the borrower, Roers Cos.

Property Type

MADISON, WIS. — Midloch Investment Partners and Fountain Real Estate Capital have acquired Tradesmen Industrial, a 131,558-square-foot industrial property in Madison. The purchase price was undisclosed. Midloch and Fountain are co-investors in the facility, which can accommodate warehouse, distribution and manufacturing uses. The asset is fully leased to three tenants. Completed in 2023, the property is located at 5525 Tradesmen Drive and features a clear height of 32 feet, 14 loading docks and direct access to I-39, I-90, Highway 12 and Highway 18. Fountain will handle leasing and management for the property. Judd Welliver of CBRE brokered the sale. Mike Vannelli of CBRE arranged a new mortgage loan through Magnifi Financial on behalf of the buyers.

RAYTOWN, MO. — Block & Co. Inc. Realtors has secured a 35,000-square-foot location for Me 2 You Career Academy in the Kansas City suburb of Raytown. The fast-track healthcare program that provides debt-free education has moved to 9808 E. 66th Terrace and 9817 E. 66th St. Me 2 You is a Missouri Department of Higher Education-accredited institution established in 2021. The new location provides a larger and improved space to support the academy’s employees, students and overall program growth. Garrett Cohoon of Block & Co. represented the tenant in the lease, while Bill Maas of Block & Co. represented the undisclosed landlord.

BENSENVILLE, ILL. — Lee & Associates has negotiated a 25,631-square-foot industrial lease at 1071 Thorndale Ave. in the Chicago suburb of Bensenville. The lease brings the property to full occupancy. Chris Nelson of Lee & Associates represented the landlord, Prologis. Jeff Fischer of KBC Advisors represented the tenant, McDonald Associates Inc., an Elk Grove-based electrical manufacturer’s representative company focused on providing sales and warehousing solutions for clients.

MIAMI — The Miami-Dade County Commission has granted final approval for Little River District, a $3 billion mixed-use development in Miami’s Little River and Little Haiti neighborhoods. SG Holdings, a joint venture between Swerdlow Group, SJM Partners and Alben Duffie, is the developer. Spanning 63 acres, the project is slated to include more than 5,700 affordable and workforce housing units alongside big box retail stores, small businesses, a major grocery operator, green public space and transit infrastructure with the addition of a new train station. Construction is expected to begin in 2026, with a projected development timeline of eight years. Little River District is considered the largest affordable housing development in Miami-Dade County’s history, according to a news release. Plans call for 2,284 affordable housing units for residents earning up to 60 percent of the area median income (AMI), 1,398 workforce rental units for those making 120 percent of AMI and 2,048 potential workforce condo units, which would allow the buyers to obtain significant subsidies to meet the purchase price at up to 140 percent AMI. Current residents of existing public housing complexes situated within the development site are guaranteed the right to return to new units at Little River …

SAN ANTONIO — Locally based owner-operator Paradigm Management has completed the $11 million renovation of Sol Cypress, a 131-room hotel in San Antonio’s River Walk district. Designed by San Antonio-based DTM Architects and Los Angeles-based KNA Design, the hotel is part of the Tribute Portfolio Hotel by Marriott family of brands and is named after the Texas Bald Cypress trees that have long lined the banks of the San Antonio River. The renovation lasted 24 months. Paradigm has rebranded the property as a Wyndham Garden Inn. Amenities include an onsite restaurant and bar, dog park and 4,000 square feet of meeting and event space.

MANVEL, TEXAS — Lowe’s Home Improvement will open a 107,135-square-foot store in Manvel, a southern suburb of Houston. The store, which will include a 34,442-square-foot garden and nursery, will be located within Manvel Town Center, a 273-acre mixed-use development by Weitzman. A 108,000-square-foot H-E-B grocery store anchors the initial phase of the development, and a slew of additional retail and food-and-beverage users have either recently or will soon open stores at Manvel Town Center. Lowe’s is slated to open in late 2026.

WACO, TEXAS — Blueprint Healthcare Real Estate Advisors has arranged the sale of a vacant, 106-unit seniors housing property in Waco. Built in 2015, the community offered assisted living and skilled nursing care before closing in 2018. Amenities at the facility include an outdoor courtyard, patio and a putting green. Amy Sitzman and Giancarlo Riso of Blueprint represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed.

GEORGETOWN, TEXAS — Transwestern has negotiated an 84,633-square-foot industrial lease in Georgetown, a northern suburb of Austin. The tenant is 84 Lumber, which already operates a lumberyard in Georgetown and is the process of expanding. The space is located within Blue Springs Business Park, a three-building, 604,064-square-foot development. Nash Frisbie of Transwestern and Carter Thurmond of Endeavor Real Estate Group represented the landlord, Chicago-based Molto Properties, in the lease negotiations. The tenant was self-represented.

LS GreenLink Closes on Land Acquisition in Chesapeake, Virginia for New $681M Power Cable Manufacturing Facility

by John Nelson

CHESAPEAKE, VA. — LS GreenLink USA Inc., a subsidiary of LS Cable & System Ltd., has closed on the purchase of 96.6 acres in the Hampton Roads city of Chesapeake. Situated along the Elizabeth River near the Port of Virginia, the site will house a new submarine power cable manufacturing facility spanning 750,000 square feet and a 660-foot VCV (vertical continuous vulcanization) tower that is expected to be the tallest structure in the state upon completion. LS GreenLink plans for the new facility to involve more than $681 million in investment and to be fully operational by early 2028. The company will manufacture insulated power cables at the facility that will be used to connect offshore wind farms, such as the Coastal Virginia Offshore Wind (CVOW) project underway off the coast of nearby Virginia Beach. Construction on the new manufacturing facility, which was announced last year, will take place this month. LS GreenLink plans to use roughly half of the newly acquired site for the manufacturing facility and VCV tower, reserving the remaining land for future phases of development. Woods Rogers Vandeventer Black PLC and JLL represented the seller, International Bio-Energy Virginia Real Estate LLC, in the land sale. K&L …