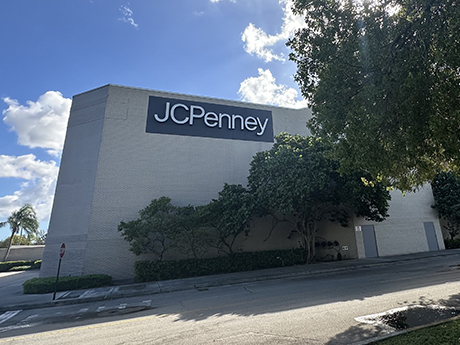

DORAL, FLA. — An affiliate of The Easton Group has acquired a single-tenant department store and adjacent parking lot in the Miami suburb of Doral for $12 million. Situated on a 10-acre site within Miami International Mall, the property totals 150,108 square feet of big box retail space. JCPenney currently occupies the building. Edward Easton, CEO and chairman of Easton Group, says that the company will keep JCPenney in place “as long as the rent payments remain current.”

Property Type

ANNAPOLIS, MD. — Berkadia’s Seniors Housing & Healthcare team has brokered the sale of Gardens of Annapolis, a 106-unit active adult community. A joint venture between Corten Real Estate and Real Asset Industries purchased the property from Crow Holdings, a Texas-based real estate investment and development firm. Cody Tremper, Dave Fasano, Ross Sanders and Mike Garbers of Berkadia Seniors Housing & Healthcare represented Crow Holdings in the transaction. Berkadia also provided $17.4 million in Fannie Mae acquisition financing on behalf of the buyer. The seven-year, fixed-rate acquisition loan features both an attractive interest rate and interest-only period, according to Berkadia. Austin Sacco, Steve Muth and Alec Rosenfeld of Berkadia originated the acquisition financing. Built in 2002, Gardens of Annapolis is located near historic downtown Annapolis and the U.S. Naval Academy. The property features a mix of 42 one-bedroom, one-bathroom units; 23 two-bedroom, one-bathroom units; and 41 two-bedroom, two-bathroom units.

Marcus & Millichap Brokers Sale of New Restaurant in Metro Memphis Leased to Whataburger

by John Nelson

MEMPHIS, TENN. — Marcus & Millichap’s Taylor McMinn Retail Group in Atlanta has brokered the sale of a newly built restaurant in a southern suburb of Memphis. Whataburger occupies the 3,318-square-foot property on a 14-year, corporate-guaranteed ground lease with rent increases in the initial term and extension options. The restaurant serves as an outparcel to a Walmart Supercenter. Don McMinn of Taylor McMinn represented the seller, a Tennessee-based firm that is a preferred development partner of the Whataburger brand, in the transaction. The buyer was an all-cash investor from California that purchased the restaurant for an undisclosed price in a 1031 exchange. “You can’t underestimate the importance in the relationship between price point and cap rates in today’s market,” says McMinn. “Lower price point deals will get significantly more activity and trade more aggressively.”

COLUMBIA, MO. — A joint venture between The Preiss Co. and a private equity real estate fund advised by Crow Holdings Capital has acquired Elevate 231, a 972-bed student housing community located near the University of Missouri campus in Columbia. The development, which has been rebranded The Collective at Columbia, offers 318 cottage-style units in two- through four-bedroom configurations. Shared amenities at the 50-acre property include a newly renovated clubhouse, resort-style swimming pool, dog park, sand volleyball court and outdoor grilling and cornhole areas. The community was fully occupied at the time of sale. The new ownership plans to launch a comprehensive interior renovation for approximately half of the units imminently. Upgrades will include the installation of new cabinets, countertops, lighting and flooring, as well as the addition of modern furniture packages and smart home technology. Ben Roelke and Ian Walker of Newmark arranged $47.5 million in acquisition financing. An undisclosed life insurance company provided the five-year loan, which features a fixed interest rate of 5.56 percent and interest-only payments for the full term. Aspen Square Management was the seller.

CHICAGO — Skender has broken ground on United Yards, a three-building affordable housing development in Chicago’s Back of the Yards neighborhood. Celadon Partners and Blackwood Group are the developers, and DesignBridge is the architect. The project will consist of a 45-unit, six-story apartment building with a ground-floor business entrepreneur hub and youth programming space at 4703 S. Justine St. as well as two three-flat, modular apartment buildings at 1639 and 1641 W. 47th St. Completion is slated for October 2025. Tandem Ventures is managing regulatory compliance, maximizing community engagement and creating local employment opportunities on the project. Other partners include Virgilio & Associates as structural engineer and Element Energy as mechanical, electrical and plumbing engineer.

CHICAGO — Southern California-based private equity firm IRA Capital has acquired a 41,500-square-foot medical outpatient facility in Chicago’s South Loop. The purchase price was $21.8 million, according to Crain’s Chicago Business. Located at 1411 S. Michigan Ave., the facility occupies five floors of a 15-story building and is fully leased to Rush University Medical Center. Constructed in 2018 as a build-to-suit for Rush, the facility is one of the healthcare provider’s largest outpatient centers, offering both adult and pediatric primary care as well as more than 20 medical specialties. The multispecialty clinic includes 61 exam and procedure rooms and is supported by a team of over 60 physicians.

HARRISONVILLE, MO. — STRIVE has brokered the sale of Harrisonville Crossing, a 45,260-square-foot retail center in Harrisonville, a southern suburb of Kansas City. The sales price was undisclosed. The property, located off Route 291, is 82 percent leased. Hudson Lambert of STRIVE represented the seller, a California-based investor, and procured the buyer, a Pennsylvnia-based investor.

WHEATON, ILL. — Hyper Kidz has signed a 26,941-square-foot retail lease at Main Street Plaza in the Chicago suburb of Wheaton. Brad Belden and Chris Irwin of Colliers represented the landlord, RMS Properties Inc. Brendan Watt of Great Street Realty represented Hyper Kidz, which offers an indoor playground, attractions and play zones. The lease brings the 116,759-square-foot property to 75 percent occupancy. Jewel-Osco is the anchor tenant.

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates: Absorption Is Positive Across All Property Types According to Third-Quarter Report

Perhaps the most salient information within Lee & Associates’ 2024 Q3 North America Market Report pertains to the office market. The third quarter of 2024 ended nine continuous quarters of negative net absorption in the office sector. However, additional occupancy losses may be on the horizon for the office market, even as supply pressures ease for this property type. Positive retail news has led to positive industrial news, as rising demand for retail goods has bolstered tenant demand for industrial space just as additional industrial inventory is coming on line. Steady economic growth and continuing impediments to home ownership have created strong absorption in the multifamily sector. Rent growth and vacancy rates have largely plateaued. Lee & Associates has made their complete third-quarter report available here (with more detailed information broken down according to property type). Below is an overview of the strengths and challenges in the industrial, office, retail and multifamily sectors. Industrial Overview: U.S. Demand Spikes Industrial demand across the United States dramatically improved in the third quarter. There were 52.8 million square feet of positive net absorption in the country in the third quarter, a 76 percent jump from the same period a year ago and more than double the …

LaSalle Investment Management Sells 280-Unit Stonemeadow Farms Apartments in Bothell, Washington for $93.1M

by Amy Works

BOTHELL, WASH. — LaSalle Investment Management has completed the disposition of Stonemeadow Farms, an apartment community in Bothell, a suburb of Seattle. An undisclosed buyer acquired the asset for $93.1 million. Situated on 29 acres at 23028 27th Ave. SE, Stonemeadow Farms offers 280 apartments spread across 20 residential buildings. Originally constructed in 1999, the garden-style property underwent renovations from 2014 to 2018. Each apartment features private balconies, wood-style flooring, deep soaker-style bathtubs, stainless steel appliances, Shaker-style cabinets, mosaic and subway tile backsplashes, black quartz countertops and undermount kitchen sinks. Community amenities include a 24-hour fitness center, clubhouse with a kitchen and lounge, resort-style pool and an outdoor terrace with firepits and barbecue areas. David Young, Corey Marx and Chris Ross of JLL Capital Markets Investment and Sales Advisory represented the seller in the deal. JLL also represented the buyer in the transaction.