THORNTON, COLO. — Pinnacle Real Estate Advisors has directed the sale of Shops at Highpointe Park in Thornton. A Colorado-based private investor sold the asset to a Pennsylvania-based institutional investor for $6.3 million. Located at 9740 and 9760 Grant St., Shops at Highpointe Park consists of two adjacent retail strip centers built in 2008 and totaling 19,622 square feet. Justin Krieger represented the seller and procured the buyer in the deal.

Property Type

TUCSON, ARIZ. — Cushman & Wakefield | PICOR has arranged the sale of Wildflower Apartments, a multifamily property in Tucson. An entity doing business as Wildflower Apts LLC acquired the asset from Aim Higher Properties LLC for $2.5 million. Located at 2850 N. Alvernon Way, Wildflower features 28 apartments. Allan Mendelsberg and Joey Martinez of Cushman & Wakefield | PICOR represented the buyer and seller in the deal.

PHILADELPHIA — BridgeInvest has provided a $54.3 million loan for the refinancing of The Avery, a 796-bed student housing property in Philadelphia. The Avery, which serves students at Temple University, features one- and two-bedroom units and amenities such as a fitness center, community kitchen, lounge areas, game rooms and study spaces. The property also houses 5,900 square feet of ground-floor retail space. The undisclosed sponsor acquired The Avery in 2021 and implemented capital improvements and rebranded it from The Edge.

HOBOKEN, N.J. — Locally based intermediary G.S. Wilcox & Co. has arranged a $5.4 million loan for the refinancing of a 48,268-square-foot retail and healthcare property in the Northern New Jersey community of Hoboken. The property was fully leased at the time of the loan closing to a pharmacy, bank and a primary care provider. David Fryer of G.S. Wilcox arranged the loan, which carried a seven-year term with full-term interest-only payments, through an undisclosed life insurance company. The name of the borrower was also not disclosed.

NEW YORK CITY — Cushman & Wakefield has placed a $24 million acquisition loan for The Plant, a 246,343-square-foot office building located at 321 W. 44th St. in Midtown Manhattan. The building was 56 percent leased at the time of the loan closing to tenants such as Broadway Dance Center, TagWall, AKA NYC Limited, Sony Records and Sunlight Studios. Chase Johnson and Caleb Riebe of Cushman & Wakefield originated the debt through an undisclosed life insurance company. The name of the borrower was also not disclosed.

SHELTON, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Huntington Townhomes, a 99-unit multifamily property in Shelton, located in southern coastal Connecticut. Built on seven acres in 2008, the property features 86 townhomes and 13 two- and three-bedroom apartments with an average size of 1,414 square feet. Amenities include a pool, fitness center and outdoor grilling and dining stations. Victor Nolletti, Eric Pentore, Wes Klockner and Ross Friedel of IPA represented the seller, Inland Private Capital Corp., and the buyer, Beachwold Residential, in the transaction.

Amid a slump in investment sales volume, investors eagerly welcomed the Federal Reserve’s interest rate cut in September. The half-percentage point decrease was more than what many in the industry had anticipated, but Fed Chairman Jerome Powell recently indicated that additional rate cuts this year will likely not be as aggressive. The move by the Fed came after a spike in the federal funds rate from near zero in March 2022 to a range of 5.25 to 5.5 percent in July 2023 — a period during which the central bank raised the federal funds rate 11 times. Ultimately, the higher interest rate environment has led to a major slowdown in the sales volume of net lease properties this year, says Randy Blankstein, president of The Boulder Group based in Wilmette, Illinois. “Transaction volume is down approximately 60 percent from 2022 levels,” he says. In a net lease transaction, the tenant pays a portion or all of the taxes, insurance fees and maintenance costs for a property in addition to rent. For the 12-month period that ended in June, net lease investment volume across property types decreased by 34 percent from the same period a year ago to $35.4 billion, according …

MINNEAPOLIS — A partnership between locally based developer Mortenson and The University of Minnesota Foundation Real Estate Advisors (UMFREA) is in the planning stages of a 12-acre mixed-use village on the eastern edge of the University of Minnesota’s Twin Cities campus. The project, which will span 3 million square feet, is named The Minnesota Innovation Exchange, or “The MIX.” Located in Minneapolis, the development site is bounded to the north by the school’s Biomedical Discovery District and the football stadium, Huntington Bank Stadium. The MIX is bounded to the south by the university’s future clinical campus expansion. Mortensen and UMFREA, which oversees the real estate decisions of the University of Minnesota Foundation, recently selected commercial real estate services giant CBRE to lease The MIX. At full build-out, the private development will include research-and-development space, creative offices, hotel rooms, apartments, shops and restaurants. The project team, which includes architectural firm HGA, hopes to attract life sciences users to The MIX to capitalize on the Twin Cities’ reputation as a hub for health and science activity, including a concentration of medical device manufacturers headlined by Medtronic and 3M. “This is an incredibly exciting opportunity for prospective tenants to participate in the most unique …

Amidst economic uncertainty, Louisville stands out for its resilience, establishing itself as a stalwart in today’s market. According to Apartments.com, Louisville ranked No. 1 in the nation for rent growth in the second quarter of 2024. Factors such as Louisville’s non-cyclical job growth, expanding industries including EV production and the burgeoning River Ridge project in Southern Indiana all contribute to its growth. When we inspect the data, we see a basic yet fundamental market factor at play: supply and demand. Louisville’s supply is low relative to the growth in renters, resulting in upward pressure on rents despite a nationwide market that is largely declining. Supply dynamics The bulk of Louisville’s development pipeline is concentrated in Southern Indiana, with 1,039 units under construction in the Jeffersonville submarket. The Southern Indiana region has experienced solid growth with over 10,500 incoming jobs due to the economic activity from River Ridge. River Ridge Commerce Center reported an economic impact of $2.93 billion for calendar year 2023, up over $2.7 billion compared with 2022, according to Inside INdiana Business. Notable development projects in Southern Indiana include: • The Flats on 10th, 3300 Schosser Farm Way (300-units by Schuler Bauer Real Estate) • The Warren, 4501 …

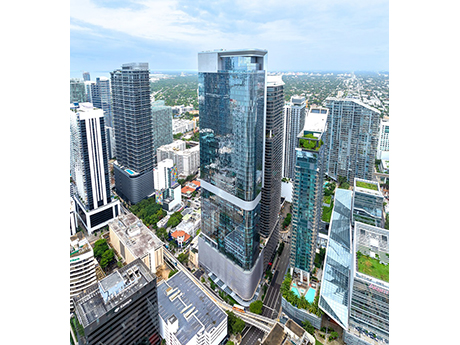

MIAMI — OKO Group and Cain International have completed the development of 830 Brickell, a 57-story office tower located in Miami. Totaling 640,000 square feet, the fully leased building has now received its temporary certificate of occupancy (TCO) from the City of Miami. Tenants — which include Microsoft, Citadel, Kirkland & Ellis LLP, Marsh Insurance, Sidley Austin LLP, CI Financial (Corient), Thoma Bravo, Santander Bank and A-CAP — will now begin build-outs and take occupancy of their respective spaces. Roughly 20 percent of the building is already occupied and operational. The project team includes architect Adriam Smith + Gordon Gill and interior designer Iosa Ghini Associati. Amenities at the building will include a Mediterranean restaurant with a private terrace, bar and private club, health and wellness center, conference facilities, an outdoor terrace and cafés and street-level retail space. Construction of 830 Brickell began in 2020.