EXTON, PA. — Kimberton Whole Foods will open a new, 14,000-square-foot store in Exton, roughly 30 miles outside Philadelphia. Construction on the building will begin before the end of October, with the opening scheduled for spring 2026. The store will be situated within the 800-acre Eagleview mixed-use development. Hankin Group is the developer and landlord. The store will be the eighth overall for the family-owned organic grocer.

Property Type

PEARLAND, TEXAS — A partnership between South Florida-based Eastham Capital and local owner-operator Mosaic Residential has purchased Amber Oaks and Park Place, two adjacent apartment complexes totaling 164 units in the southern Houston suburb of Pearland. Built in 2015, Amber Oaks comprises 16 one-bedroom units and 47 two-bedroom apartments across two three-story buildings. Constructed in 1972, Park Place consists of 21 one-bedroom apartments, 72 two-bedroom residences and eight three-bedroom units across 14 two-story buildings. Residents at both properties have access to shared amenities, including a pool, outdoor grilling and dining stations and onsite laundry facilities. The seller was not disclosed.

PLANO, TEXAS — AOG Living, the Houston-based developer and operator formerly known as Allied Orion Group, has broken ground on Novum Plano, a 147-active adult project that will be located on the northeastern outskirts of Dallas. Designed by FK Architecture, the property will offer studio, one- and two-bedroom units that will be reserved for renters age 55 and above. Amenities will include a saltwater pool, pickleball court, fitness center, hair and nail salon, theater and game lounge, dog park, community gardens and outdoor kitchens. CBRE arranged construction financing for the project, completion of which is slated for late 2025.

RICHARDSON, TEXAS — Locally based brokerage firm Disney Investment Group (DIG) has arranged the sale of Arapaho Village, a 101,507-square-foot shopping center located in the northeastern Dallas suburb of Richardson. A 43,256-square-foot Tom Thumb grocery store anchors the center, which was roughly 92 percent leased at the time of sale. Other tenants include Papa John’s Pizza, Dutch Bros Coffee, WellMed and Anytime Fitness. David Disney and Adam Crockett of DIG represented the seller, New York City-based WASA Properties, in the transaction. An affiliate of Weitzman acquired the center for an undisclosed price. JLL arranged a six-year-fixed-rate acquisition loan through an undisclosed life insurance company for the deal as well as joint venture equity from an unnamed partner.

ALVARADO, TEXAS — Dallas-based brokerage firm Bradford Commercial Real Estate Services has negotiated the sale of a 33,750-square-foot industrial complex in Alvarado, located southeast of Fort Worth. The property consists of three newly constructed buildings on a five-acre site that were 67 percent leased at the time of sale. Shane Benner of Bradford represented the buyer, an entity doing business as Blue Mound Business Park LLC, in the transaction. Jake Petrie of LanCarte Commercial represented the undisclosed seller.

NIXON, TEXAS — Marcus & Millichap has brokered the sale of a 23,957-square-foot retail building in Nixon, about 60 miles east of San Antonio. The building, which sits on 4.4 acres and was completed earlier this year, is occupied by Tractor Supply Co. via a 15-year, corporate-guaranteed lease. Zack House, Mark Ruble and Chris Lind of Marcus & Millichap represented the seller, a limited liability company, in the transaction. Tim Speck of Marcus & Millichap assisted in closing the deal.

ATLANTA — The Cobb-Marietta Coliseum and Exhibit Hall Authority, owner and operator of the Cobb Galleria Centre in Atlanta, has selected a team of locally based firms to manage the expansion and renovation of the convention center. Impact Development Management will serve as the authority’s representative and project manager for the overhaul, Rule Joy Trammell + Rubio will serve as the project architect and Holder Construction will be the construction manager. The development team plans to break ground on the project in fall 2025, with completion slated for early 2027. The Cobb Galleria Centre was originally built by the authority in 1994. The facility currently totals 320,000 square feet, including 144,000 square feet of exhibit space, a 25,000-square-foot ballroom, 20 meeting rooms and four executive boardrooms. Also on the campus is Galleria Specialty Shops, an enclave of small retail shops that currently houses tenants including HOKA Shoes and a Subway kiosk. The master plan for the expansion project includes: Cobb Galleria Centre is centrally located near the intersection of I-75 and I-285 in Atlanta’s Cumberland-Galleria submarket. The convention center is connected via two elevated walkways to Simon’s Cumberland Mall and The Battery Atlanta, the mixed-use village surrounding Truist Park, home of the Atlanta …

By Taylor Williams Successfully executing a commercial conversion project is like hitting a six-leg parlay in sports betting: A lot of dominoes have to fall the right way, and without a little luck and outside help, it’s probably not happening. Take the embattled office sector. Even working professionals from outside the office real estate market who read the plethora of mainstream news articles recognize that it’s no small feat to turn those buildings into apartments. After all, when you’re dealing with thousands of tons of steel, glass and concrete in any capacity, things are bound to get messy. But theoretically, if the demand for more housing is there — and there can be little arguing that it is — and cities recognize that office usage has forever changed, then why aren’t we seeing more of these projects come to fruition in our cities? Setting aside the fact that office-to-residential conversions are incredibly expensive and fraught with risk even in the absence of a tight and constrained lending market like we currently have, there are still numerous reasons as to why these deals don’t proliferate. Does the city in question have flexible zoning? Does the community have a reputation for NIMBYism? …

By Taylor Williams AUSTIN, TEXAS — Sources of institutional capital are slowly trickling back into buyer pools of deals for multifamily properties in Austin, a move that marks an inflection point within the sector as a whole and speaks to investors’ long-term faith in that market’s fundamentals. And faith is perhaps just what the doctor ordered. In some ways, Austin has become a victim of its own success over the past decade, a sort of cautionary tale of growth gone too heavy too fast. The feverish attempts of multifamily developers to keep pace with demand during that time have come to a head, and the market now languishes in a state of oversupply. With rents softening and interest rates only just now showing concrete signs of decreasing, institutional capital has been more than content to sit on the sidelines of this market for the past 18 or so months. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. But that is starting to change, at least according to a panel of multifamily investment sales professionals who spoke …

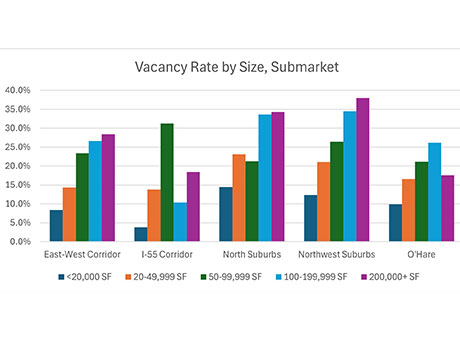

By Adam Johnson, NAI Hiffman For years, you’ve read headlines saying the U.S. office market is struggling with record-high vacancy that threatens to push many owners into default. And that is absolutely true. But there’s another side to the story that isn’t getting as much attention, and is playing out not only in Chicago, but also in metros across the country: that smaller, multi-tenant office properties — particularly in suburban locations closer to where workers live — continue to not only survive but thrive following the pandemic. Throughout suburban Chicago, office buildings with less than 50,000 square feet have considerably higher occupancy rates than larger ones. For instance, at the smallest buildings — those under 20,000 square feet — vacancy was as low as 3.8 percent as of the second quarter of 2024, whereas for the largest properties over 200,000 square feet, vacancy climbed as high as 38 percent, according to NAI Hiffman research. By comparison, mid-size, office buildings between 20,000 to 50,000 square feet reported vacancy rates ranging from 14.3 percent in the western suburbs to 23.1 percent north of the city. Small tenants, big impact We’ve all heard about larger office properties going back to their lenders. Look …