MONTGOMERY, ILL. — Parceljet Information Technology LLC has signed a 239,190-square-foot industrial lease at 900 Knell Road in Montgomery. The cross-border logistics company is expanding from its coastal locations to grow its presence in the Midwest. The space is part of a 992,462-square-foot building constructed in 1960 and renovated in 2000. The facility features a clear height of 30 feet, 17 exterior docks and one drive-in door. Parking is available for 184 trailers and more than 600 cars. George Cibula and Rick Daly of DarwinPW Realty/CORFAC International represented the landlord, CenterPoint Properties. Danielle Radtke and Patrick Smith of CenterPoint were instrumental in getting Parceljet into the space in a short timeframe.

Property Type

COLUMBUS, OHIO — Woda Cooper Cos. Inc. has broken ground on Juniper Crossing, an affordable seniors housing community that will be built in two phases in Columbus. Phase I will provide 44 units for residents who earn between 30 and 70 percent of the area median income (AMI), while Phase II will offer 37 units for those who earn up to 60 percent AMI. Amenities will include a multipurpose community room, fitness center, parcel room, laundry facility, lounge room, activity room and picnic area. The property is expected to be certified LEED Silver. The Ohio Housing Finance Agency (OHFA) allocated federal housing tax credits for both phases of the project, and new state credits for Phase II. OHFA also provided the first mortgage for Phase I. Merchants Capital invested in the federal and state tax credits for both phases in exchange for equity financing. Its affiliate, Merchants Bank of Indiana, is the construction lender. Cedar Rapids Bank & Trust provided a permanent first mortgage for Phase II. The City of Columbus approved a 15-year tax abatement on 100 percent of the value for both phases. The city also provided gap financing toward permanent debt, including a HOME loan for soft …

SANTA MONICA, CALIF. — Drawbridge Realty has purchased 2220 Colorado Avenue, a six-story, Class A office building in Santa Monica, from Clarion Partners for an undisclosed price. Universal Music Group (UMG) fully occupies the 225,773-square-foot building on a long-term, net-lease basis. The Netherlands-based company uses the property as its operational headquarters. 2220 Colorado Avenues has two UMG-operated recording studios, several upscale conference facilities, secure parking with direct elevator access, an onsite food commissary and coffee bar, collaboration areas and outdoor decks. Kevin Shannon, Alex Foshay, Ken White, Rob Hannan, Laura Stumm and Michael Moll of Newmark represented the seller in the transaction.

EAST ALTON, ILL. — Contegra Construction Co. has completed a 76,000-square-foot expansion for West Star Aviation’s service facility and headquarters in East Alton, about 25 miles north of St. Louis. The company’s maintenance, repair and overhaul property now totals more than 500,000 square feet. The expansion is projected to create 60 to 80 jobs over the next two years. Located at 2 Airline Court, the three-building expansion project added 50,000 square feet of new hangar capacity, 13,000 square feet of additional back shop space and 13,000 square feet of additional storage space. It also includes 165 parking spaces.

ST. PAUL, MINN. — Marcus & Millichap has brokered the $3.6 million sale of Birmingham Heights, a 28-unit multifamily property in St. Paul. Built in 1983, the community is located at 1424 Case Ave. E in the city’s Greater East Side neighborhood. Matt Shide, Evan Miller, Chris Collins, Eric Wagner and Zack Olson of Marcus & Millichap represented the seller, a local owner. The buyer was an out-of-state 1031 exchange investor looking to build its portfolio of apartments throughout Minnesota. Jon Ruzicka, broker of record in Minnesota, assisted in closing the transaction.

OAKLAND, CALIF. — SITE Centers Corp. has completed the sale of Whole Foods Market Bay Place, a retail asset in Oakland, to an undisclosed buyer for $44.4 million. Whole Foods Market occupies the Class A, 57,218-square-foot property, which was built in 2007, on a long-term basis. The freestanding building is situated on a 2.2-acre corner lot at 230 Bay Place. Eric Kathrein, Geoff Tranchina, Gleb Lvovich and Warren McClean of JLL Capital Markets Investment Sales and Advisory represented the seller and procured the buyer in the deal.

DXD Capital Starts Construction of 706-Unit Self-Storage Facility in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — DXD Capital has broken ground on a self-storage facility totaling 66,750 rentable square feet in Scottsdale. Located at 8888 E. Desert Cove Ave., the four-story property will offer 706 individual storage units and two basement levels. Extra Space Storage will manage the facility, which is slated to open in fourth-quarter 2025. The project team includes TLW Construction as general contractor and Southwest Capital Bank as construction lender. DXD Capital acquired the site in July 2024. To date, DXD has invested in 19 self-storage developments and one seven-facility portfolio acquisition across the United States.

BERKELEY, CALIF. — A joint venture between Canyon Partners Real Estate, The Martin Group and Valiance Capital is set to break ground on The Valiant, a 262-bed student housing development located near the University of California, Berkeley (UC Berkeley) campus. Construction on the project is expected to begin imminently with completion planned for fall 2026. The joint venture recently closed on a senior construction loan for the development that was provided by Kennedy Wilson. Further details on the financing were not disclosed. The eight-story community will feature 83 units and 1,461 square feet of retail space. Shared amenities will include a study lobby, fitness center, rooftop deck lounge, gathering spaces, private study lounges and secured bike stations.

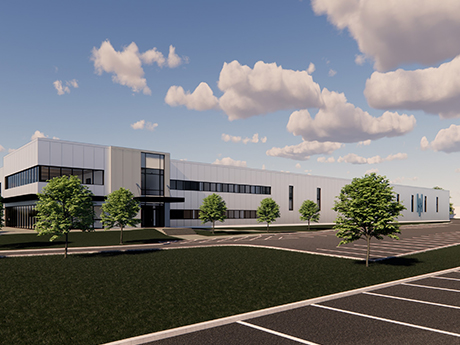

MILFORD, N.H. — Locally based design-build firm PROCON has broken ground on a 57,000-square-foot industrial flex project in Milford, located near the Massachusetts-New Hampshire border. The project is a build-to-suit for Hitchiner, a provider of casting-based components and assemblies for the aerospace and automotive industries, and will serve as a “shared services operations” center on the company’s existing campus. Completion is scheduled for fall 2025.

POUGHKEEPSIE, N.Y. — Tinkelman Brothers Development Corp. has completed 44 Springside, a 28-unit multifamily project located north of New York City in Poughkeepsie. Designed by the firm’s in-house architecture team, 44 Springside offers one- and two-bedroom units that feature quartz countertops, laundry/storage rooms and smart lock/entry systems. Amenities include a community room, rooftop terrace and an indoor pool. Rents start at $2,500 per month for a one-bedroom apartment.