HONOLULU — Greystar has completed the fee-simple sale of Hale Mahana, a student housing property located at 2615 S. King St. in Honolulu. A joint venture between Timberline Real Estate Ventures and an Ares Management Real Estate fund acquired the asset, which is 0.2 miles from the University of Hawaii at Manoa campus, for an undisclosed price. Built in 2018, the 191-unit Hale Mahana offers 589 beds, study rooms, a computer lab, covered parking, fitness center, rooftop deck with grilling stations and ground-level retail space, including Raising Cane’s Chicken Fingers and Jersey Mike’s Subs. The complex offers one-, two-, three- and four-bedroom, fully furnished units with equipped kitchens featuring stainless steel appliances. JLL Capital Markets represented the seller and procured the buyer in the transaction.

Property Type

NORTHBROOK, ILL. — Medline Industries LP has signed a long-term office lease for 214,560 square feet at 2375 Waterview Drive in the Chicago suburb of Northbrook. The privately held medical-surgical product manufacturer and supplier plans to move into its new space in mid-2025 and will occupy the north building of the campus. Kyle Robbins, Andrew Davidson and David Burkards of Transwestern Real Estate Services represented the owner of the 432,000-square-foot property. Of the two buildings at the campus, there is approximately 80,000 square feet of available space remaining inside the south building. Tenants have access to a cafeteria, 400-person multi-purpose meeting space, fitness center and outdoor terraces. A new tenant lounge is set to open next year. James Otto, Jon Milonas, Paul Diederich and Peter Livaditis of CBRE represented Medline.

Marcus & Millichap Facilitates $19M Sale of Self-Storage Facility in Tacoma, Washington

by Amy Works

TACOMA, WASH. — Marcus & Millichap has negotiated the sale of 12th Street Storage, a self-storage facility in Tacoma. An undisclosed limited liability company sold the asset to a fund manager for $19 million. Located at 1018 E. Highland Ave., 12th Street Storage offers 91,546 square feet of self-storage space. The facility, which was developed in 2020 and 2021 by a local investment group, was acquired by an international real estate firm based in London and Los Angeles. Christopher Secreto of Marcus & Millichap’s Seattle office represented the seller and secured the buyer in the deal.

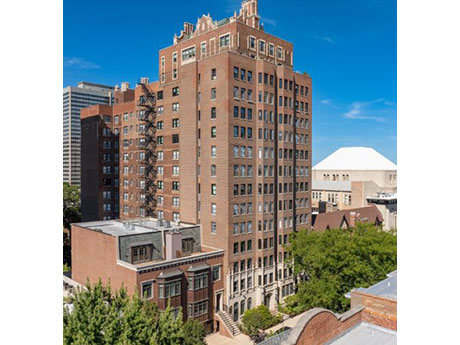

CHICAGO — Greystone has provided an $18.2 million Fannie Mae loan for the acquisition of Cornelia-Stratford in Chicago. Originally constructed in 1927, the 139-unit multifamily property features studio, one-, two-, three- and four-bedroom units. Amenities include bike storage, laundry facilities and a tenant lounge. Clint Darby and Andrew Remenschneider of Greystone originated the nonrecourse loan, which features a fixed interest rate, 15-year term and five years of interest-only payments. The borrower was undisclosed.

ROSEVILLE, MINN. — A next-generation Dick’s Sporting Goods store totaling 80,000 square feet is scheduled to open later this month at Rosedale Center in the Minneapolis suburb of Roseville. The store will feature golf hitting bays with TrackMan technology, a HitTrax multi-sport cage, House of Cleats, equipment services counter, expanded footwear selection and apparel, accessories and equipment. Holly Rome and Lane Walsh of JLL handle leasing efforts at Rosedale Center and secured the lease with Dick’s. JLL’s retail development partner, Poag Development Group, led construction of the project at the parcel formerly occupied by Herberger’s. Rosedale Center is a 1.1 million-square-foot shopping center.

HIGHLAND PARK, ILL. — Colliers has arranged the $7.4 million sale of a 55,033-square-foot commercial building in the Chicago suburb of Highland Park. Located at 1770 1st St., the property features 17 apartment units on the upper three floors and 36,000 square feet of medical office space home to Robb Orthodontics, Highland Park Maxillofacial & Implant Surgery and Pediatric Dentistry of the North Shore. The apartment units are fully leased, and the medical office portion is 61 percent leased. Constructed in 1988, the building sits atop a 447-space public parking garage and is across the street from the Highland Park Metra stop. Alissa Adler, John Homsher, Tyler Hague and Lauren Stoliar of Colliers represented the seller, Fulton Design + Build. QMR Partners was the buyer.

CHICAGO — Workbox, a national workspace operator founded in 2019, has moved its corporate headquarters to Chicago’s Fulton Market neighborhood. In less than three years, the company has grown from nine employees to over 35 nationwide and is relocating a majority of its Chicago-based team to 220 N. Green St. At over 60,000 square feet, Workbox Chicago – Fulton Market is the company’s sixth and largest workspace in Chicago. The Workbox team will share its new corporate space with its member base.

MATTHEWS, N.C. — Pappas Properties has broken ground on Cadia Matthews, an 82-acre mixed-use development in Matthews, a southeastern suburb of Charlotte. Upon completion, the community will feature residential units, 85,000 square feet of retail space and 18,000 square feet of office space. Amenities at the development will include a wellness center, multi-modal paths, a community park with a performance stage and additional open space. All residents will have access to the wellness center and other community amenities. Priority for the housing at Cadia Matthews will be given to first responders, teachers, active-duty and veteran military members, as well as those who work in Matthews. “The foundation of Cadia Matthews is based on our commitment to providing wellness-oriented, residential master-planned communities that promote health through social, environmental and physical wellness,” said Tom Walsh, managing director of Pappas Properties. Phase I of the project is currently underway and will comprise 45 single-family homes, 80 for-sale townhomes and 14 apartments. Additional residential space at the development will include active adult cottage homes and apartments, for-lease duplexes and market-rate apartments. A construction timeline for Cadia Matthews was not disclosed. Founded in 1999, Pappas Properties is based in Charlotte and has completed 14 master-planned …

AUSTIN, TEXAS — Merchants Capital has provided debt and equity financing for Travis Park Apartments, a 199-unit affordable housing complex in south-central Austin. The sponsor, Sena Affordable Communities, will use the proceeds to acquire and rehabilitate the property, which comprises 22 buildings. Merchants provided a $69.1 million Freddie Mac 4 Percent Low-Income Housing Tax Credit (LIHTC) Immediate TEL loan and $37.6 million in LIHTC equity as the syndicator, as well as a $29 million equity bridge loan for the rehabilitation period. Renovations are expected to take about 18 months to complete and will include the addition of new outdoor recreation areas and playgrounds; accessibility upgrades; window replacement; new boiler and cooling towers; kitchen and bathroom improvements; new energy star appliances; replacement of original fan coil units for heating and cooling; building envelope upgrades; and roof replacement and new signage. Michael Milazzo led the transaction for Merchants Capital.

SAN ANTONIO — Dallas-based developer Palladium USA has broken ground on a $79 million, 321-unit mixed-income multifamily project in San Antonio. Palladium Old FM 471 will be located on an 11-acre site on the city’s west side and will offer one-, two- and three-bedroom units that will be reserved for households earning between 30 and 80 percent of the area median income. Amenities will include a pool, fitness center, conference room, dog park, business center and a children’s playroom. Cross Architects is designing the project, and Brownstone Group is serving as the general contractor. HPA Design Group is handling interior design. Palladium is developing the project in partnership with the Bexar Management Development Corp. PNC Bank provided $32 million of equity and more than $35 million in long-term debt to the development team, and Texas Department of Housing and Community Affairs issued $36 million in tax-exempt bonds to finance the project. Preleasing is scheduled to begin next fall.