MADISON, WIS. — Developer Subtext and Harrison Street have completed VERVE Madison, a 12-story student housing development located two blocks from the University of Wisconsin-Madison. ESG Architecture & Design served as the architect for the 536-bed, 142-unit community. The project team also included Stevens Construction Corp., civil engineer JSD Professional Services and landscape architect Damon Farber. Harrison Street served as the lead investor, while Old National Bank was the lender. The 278,143-square-foot property offers fully furnished one-, two-, three-, four- and five-bedroom units. The rooftop features a pool, hot tub, cabanas and gardens. Additional amenities include a multipurpose turf and game zone, fitness center with sauna, second-floor terrace courtyard and study areas. VERVE Madison is fully leased.

Property Type

PALATINE, ILL. — S&C Electric Co. has opened a new 275,000-square-foot manufacturing facility in Palatine, a northwestern suburb of Chicago. The expansion created 200 production and engineering jobs. The property is situated about 25 miles from S&C’s headquarters and manufacturing campus in Chicago’s Rogers Park neighborhood. Production in Palatine includes circuit-washers, devices that protect transmission substation transformers and other grid-hardening equipment.

MICHIGAN — District Capital has arranged a $20 million loan for the refinancing of a 240,000-square-foot flex industrial building in Southeast Michigan. Dave Dismondy of District Capital arranged the loan through a life insurance company. The nonrecourse loan allows for a further relaxed amortization if the lease is extended during the loan term.

CHICAGO — Mid-America Real Estate Corp. has brokered the sale of a fully occupied, multi-tenant retail property in the heart of Chicago’s Streeterville neighborhood for an undisclosed price. The standalone building at 227 E. Ontario St. is leased to Sweetgreen, Nando’s, CorePower Yoga, Big City Optical and Movement Physical Therapy. Joe Girardi and Emily Gadomski of Mid-America represented the undisclosed seller. The Shiner Group was the buyer.

NEW YORK CITY — Philo TV has signed an 8,100-square-foot office lease in downtown Brooklyn. The San Francisco-based provider of streaming services is taking space on the 18th floor of One Willoughby Square, a 34-story building that is the tallest in the borough. Paul Amrich, Neil King, Zachary Price, Alex D’amario and James Ackerson of CBRE represented the landlord, JEMB Realty, in the lease negotiations. Catherine Vilar of The Kaufman Organization represented Philo TV.

ANKENY, IOWA — JLL’s Des Moines commercial real estate leasing team is expanding its presence in central Iowa by opening an additional office in Ankeny. JLL Des Moines will occupy new office space at The District at Prairie Trail, which is owned by DRA Properties. JLL handles the commercial leasing and sales for The District at Prairie Trail. The brokerage firm will continue to maintain its office in downtown Des Moines.

Alexandria Real Estate Equities Sells Life Sciences Facility in Seattle to Fred Hutch Cancer Center for $150M

by Amy Works

SEATTLE — Alexandria Real Estate Equities, through an affiliate, has completed the sale of 1165 Eastlake Avenue East in Seattle’s Lake Union submarket to long-standing tenant Fred Hutch Cancer Center for $150 million. Alexandria developed and delivered the 100,086-square-foot, single-tenant, Class A life sciences building in 2021. Proceeds from the disposition of 1165 Eastlake will be reinvested into Alexandria’s leased development and redevelopment pipeline, which consists of research-and-development centers for top life sciences companies, including Bristol Myers Squibb and Novo Nordisk. As part of the transaction, Alexandria, through an affiliate, entered into a strategic joint venture partnership with Fred Hutch for nearby 1201 and 1208 Eastlake Avenue East, aggregating 206,031 rentable square feet, through a transfer of partial interests from the prior joint venture partner to Fred Hutch. Alexandria’s ownership interest in each 1201 and 1208 Eastlake remains unchanged at 30 percent. Fred Hutch executed early renewals at both properties, including a 15-year lease extension at 1201 Eastlake, where it occupies the entire building. These two life sciences facilities support the cancer center in its efforts to translate cancer and infectious disease discoveries into treatments and cures.

PHOENIX — ViaWest Group has completed the disposition of Canyon Corporate Plaza, a Class A office campus located on 11.6 acres in Phoenix, for an undisclosed price. The buyer is CaliberCos Inc., a Scottsdale, Ariz.-based financial services company in the alternative asset management space. Steve Lindley and Alexandra Loye of Cushman & Wakefield’s Capital Markets team represented the seller in the deal. Canyon Corporate Center offers 311,706 square feet of office space within a transit-oriented location in Phoenix’s I-17 Corridor and close to two stops on the newly opened light rail extension. At the time of sale, the property was nearly vacant.

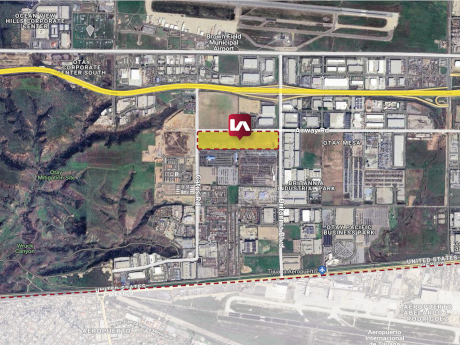

Lee & Associates Negotiates $58M Purchase of Industrial Land in San Diego’s Otay Mesa District

by Amy Works

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

SEATTLE — Gantry has secured a total of $34.3 million of loans to refinance four Seattle-area assets owned by different and unaffiliated entities. Each transaction was placed with one of Gantry’s life company correspondent lenders and each structure provided the borrowers with non-recourse, fixed-rate loans. Mike Wood of Gantry represented three of the borrowers. The financings included: