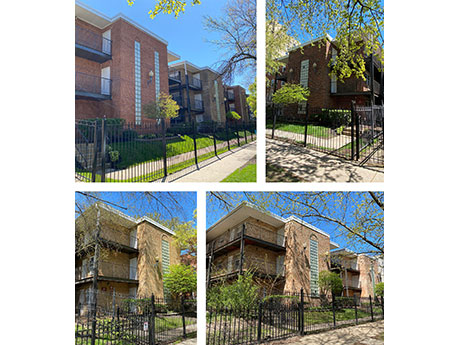

CHICAGO — Kiser Group has brokered the $17.2 million sale of Ravenswood Gardens, a multifamily portfolio consisting of 151 units across seven buildings in the Sheridan Park Historic District of Chicago’s Uptown neighborhood. Katie LeGrand, Lee Kiser and Jacob Price of Kiser brokered the transaction. Initially marketed in summer 2023, the portfolio went under contract but did not close due to market volatility. The seller, continuing its strategic exit from Chicago, revisited the sale in 2024. The buyer plans to reposition the units and rebrand them as Sheridan Park. The buyer assumed the seller’s existing loan, which features an interest rate below 4 percent for the next five years. The buyer now owns more than 400 units in the Uptown neighborhood.

Property Type

KANSAS CITY, MO. — Hunt Midwest has sold a portion of its industrial outdoor storage portfolio at Hunt Midwest Business Center in Kansas City to national industrial outdoor storage firm Alterra IOS. The Philadelphia-based firm purchased 58 acres at three locations along Parvin Road and Arlington Avenue. The facilities include staging lots leased by Adrian Steel, a manufacturer for commercial van and truck equipment, and Ford Motor Co.’s North American Vehicle Logistics Outbound Shipping Center, the waystation for nearly every Ford Transit built in North America. Austin Baier of CBRE represented Hunt Midwest, while Joe Orscheln of CBRE represented Alterra IOS, which now owns more than 250 properties across 30 states.

NAPERVILLE, ILL. — Bucksbaum Properties LLC has acquired River District, a retail and office property in downtown Naperville. Built in 1988, the asset sits on 2.7 acres at the southeast corner of Washington Street and Chicago Avenue. The property totals nearly 59,000 square feet of retail space with tenants such as Rosebud, Fat Rosie’s Taco & Tequila Bar, Chipotle and Five Guys, as well as 12,000 square feet of second-floor office space. The seller and sales price were not provided.

DALLAS — SRS Real Estate Partners has arranged the sale of the $3.7 million ground lease sale of a 4,680-square-foot restaurant in Dallas that is triple-net-leased to Chick-fil-A. The building, which was constructed on 1.5 acres in 2023, is an outparcel to The Shops at Redbird, a 720,000-square-foot development on the city’s southwest side. Matthew Mousavi and Patrick Luther of SRS represented the seller, a Dallas-based developer, in the transaction. The buyer was a Dallas-based 1031 exchange investor. Both parties requested anonymity. The corporate-guaranteed lease has 14 years of term remaining.

WHITELAND, IND. — Sojo Industries has signed a 151,950-square-foot industrial lease in Lot 5 of Mohr Logistics Park in Whiteland, a southern suburb of Indianapolis. Mark Writt of CBRE represented ownership, Mohr Capital. Jim Scott and Steve Shaub of Avison Young represented the tenant, which is a technology company engaged in advanced robotics, mobile manufacturing and modular packaging solutions for delivering packaging and assembly services for the food-and-beverage industry. Sojo maintains production facilities in Pennsylvania, California, Texas and Indiana, along with mobile sites throughout the country. All locations utilize high-speed automated lines and robotics to handle packaging materials. Additional tenants at Mohr Logistics Park include Goodyear, DHL and Turn 14. The industrial park totals 475 acres, and Mohr plans to develop more than 7 million square feet of bulk industrial buildings.

HAMMOND, IND. — Marcus & Millichap has arranged the $2.8 million sale of a 10,122-square-foot retail property net leased to Five Below in Hammond near Chicago. Located at 1035 Indianapolis Blvd., the asset was built in 2024 and is situated on a pad site to a Walmart Supercenter and Ross Dress for Less-anchored retail center. Nicholas Kanich of Marcus & Millichap represented the seller, an Indiana-based retail developer and manager, and procured the buyer, a Michigan-based REIT. Josh Caruana, broker of record in Indiana, assisted in closing the transaction.

SEGUIN, TEXAS — The Boulder Group has brokered the $2.4 million sale of a single-tenant net-leased (STNL) retail property in Seguin, located on the northeastern outskirts of San Antonio. The sale encompassed two buildings that are located across the street from one another and operated under a single lease with Joe Hudson’s Collision Center, an automotive repair operator with more than 200 locations nationwide. Zach Wright and Brandon Wright of Boulder Group represented the seller, a local investor, in the transaction. The buyer was a 1031 exchange investor. Both parties requested anonymity.

ARLINGTON, TEXAS — Lee & Associates has negotiated a 40,018-square-foot industrial lease in Arlington. According to LoopNet Inc., the property at 4100 New York Ave. was built in 2018 and totals 110,468 square feet. Mark Graybill and Reed Parker of Lee & Associates represented the landlord, New York City-based Link Logistics Real Estate, in the lease negotiations. Brian Gilchrist of CBRE represented the tenant, Lapgear, which provides surfaces for office and lifestyle activity usage.

Landmark Properties Delivers 759-Bed Student Housing Community Near University of South Florida

by John Nelson

TAMPA, FLA. — Landmark Properties has delivered The Metropolitan Tampa, a 759-bed student housing development located at 2701 E. Fowler Ave. near the University of South Florida (USF) campus in Tampa. The community offers 276 fully furnished units in studio through four-bedroom configurations. Shared amenities at the property include an outdoor rooftop swimming pool, jumbotron, grilling areas, a gaming lawn, two courtyards, fitness center, study centers and onsite parking. The development also features 1,700 square feet of retail space at the ground level. The development team for the five-story project included Niles Bolton Associates and Landmark Construction, the in-house construction arm of Athens, Ga.-based Landmark Properties.

DAVENPORT, FLA. — JLL has arranged a $69.6 million loan for the refinancing for Phase I of Atlantica at Town Center, a multifamily community located at 1121 Loblolly Lane in the Orlando suburb of Davenport. Phase I of the property, which was delivered in December 2022, comprises 360 units. Gregory Nalbandian, Kenny Cutler and Josh Odessky of JLL arranged the two-year, floating-rate bridge loan through Timbercreek Capital on behalf of the borrowers, Sovereign Properties and Invest Capital Group. Atlantica at Town Center features one-, two- and three-bedroom units ranging in size from 683 to 1,435 square feet, as well as a resort-style pool, gaming lawn, dog park, pet spa, fitness center, yoga and spin room, demonstration kitchen and coworking space.