CHICAGO — Mid-America Real Estate Corp. has brokered the sale of a trophy retail property along Chicago’s Michigan Avenue for an undisclosed price. Located at 8 N. Michigan Ave., the property features a long-term lease with Starbucks and is located directly across the street from Millennium Park. Joe Girardi and Emily Gadomski of Mid-America represented the undisclosed seller. The buyer was a foreign high-net-worth family office.

Property Type

VERNON HILLS, ILL. — Bender Cos. and Eastham Capital have acquired Arrive Town Center in the Chicago suburb of Vernon Hills. Built in 2010, the property features 85 luxury apartment units, amenities and 10,000 square feet of ground-floor retail space. Floor plans average 1,200 square feet. Amenities include a lounge, fitness center, storage lockers and heated indoor parking garage. The property will undergo improvements and a rebranding, taking on the new name The Landing at Town Center. Kevin Girard, Zach Kaufman and Bill Baumann of JLL represented the buyer. The seller and sales price were undisclosed.

BLOOMINGTON, MINN. — Burns & McDonnell, an engineering, construction and architecture firm, has signed a 67,000-square-foot office lease at Norman Pointe II in Bloomington. Michael Gelfman and Nate Karrick of Colliers represented ownership. The lease marks one of the largest office leases in the Minneapolis market this year, according to Colliers. Burns & McDonnell previously occupied 45,000 square feet at 8201 Norman Center Drive in Bloomington. Built in 2007, Norman Pointe II is located at 5600 American Blvd. at the I-494 and Highway 100 interchange. The 10-story building totals 331,447 square feet and offers amenities such as a café, 100-person conference center, fitness center, daycare and covered parking. Doug Fulton and Rob Youngquist of Avison Young represented Burns & McDonnell, which secured building signage. Norman Pointe II is now 95 percent leased.

CHICAGO — Kiser Group has arranged the sale of a multifamily property located at 7042 S. Michigan Ave. in Chicago’s Grand Crossing neighborhood for $1.8 million. All of the units have been renovated in the last 10 years, and the property was nearly fully occupied at the time of sale. Aaron Sklar and Noah Birk of Kiser represented the buyer and seller, both of which were long-term owners in the area. The sales price represented a cap rate of nearly 9 percent.

DARIEN, CONN. — Cushman & Wakefield has brokered the sale of Avalon Darien, a 189-unit apartment complex in southern coastal Connecticut. Avalon Darien offers a mix of recently renovated one-, two- and three-bedroom units and amenities such as a pool, fitness center, lounge and playground. Niko Nicolaou, Ryan Dowd, Matthew Torrance, Al Mirin and J.P. Hohl of Cushman & Wakefield, in coordination with Brian Whitmer of RePropCo., represented the seller, AvalonBay Communities, in the transaction. The team also procured the undisclosed buyer. The sales price was also not disclosed.

NEW BRUNSWICK, N.J. — JLL has arranged a $23.3 million in acquisition financing for a 206,069-square-foot industrial property in the Central New Jersey community of New Brunswick. The property consists of six buildings on a 21-acre site that feature clear heights of 19 to 31 feet and a total of 14 dock doors and 15 drive-in doors. Max Custer, Thomas Didio Jr. and Benjamin Morgenthal of JLL arranged the five-year, fixed-rate loan on behalf of the borrower, New Jersey-based investment firm B&D Holdings. The direct lender was not disclosed.

PENNSAUKEN, N.J. — Alternative investment management firm GID has acquired an 111,400-square-foot industrial building in the Southern New Jersey community of Pennsauken. The building at 8290 National Highway, which according to LoopNet Inc. was built on 4.4 acres in 1967, can accommodate one or two tenants and features a clear height of 20 feet, one drive-in door and 15 dock-high doors. The new ownership plans to implement a value-add program to the building, which is currently vacant. The seller and sales price were not disclosed.

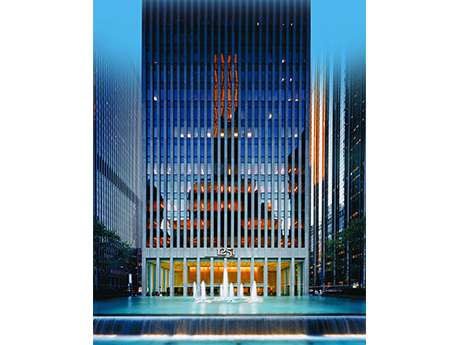

NEW YORK CITY — Daiwa Capital Markets America Inc. (DCMA) has signed a 20-year, 44,100-square-foot office lease in Midtown Manhattan. The financial services firm will occupy the entire 49th floor at 1251 Avenue of the Americas. Erik Schmall and Scott Weiss of Savills represented DCMA in the lease negotiations. David Falk and Peter Shimkin of Newmark represented the landlord, Mitsui Fudosan America. A tenant-only conference facility is under construction at the building, and the lobby was recently renovated. Three new food-and-beverage concepts are also set to open at the building in the coming weeks.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $2.5 million sale of an eight-unit apartment building located at 313 W. 92nd St. on Manhattan’s Upper West Side. Five of the eight units were vacant at the time of sale. Ben Khakshoor of Rosewood represented the buyer, Put Duc Huang, in the transaction. Mike Kerwin, also with Rosewood, represented the seller, the Goldberg Family, which owned the building for 85 years.

Cleveland Browns Propose $2.4B Suburban Stadium Development, City Offers $461M Financing Plan Toward Rehabbing Current Stadium

by Jeff Shaw

CLEVELAND — The Cleveland Browns NFL franchise owner Haslam Sports Group has released renderings and development plans for a new $2.4 billion stadium in the suburb of Brook Park, near Cleveland Hopkins International Airport. The proposal comes on the heels of the City of Cleveland releasing its plan to fund $461 million in renovations to the current lakeside stadium, which has been the Browns’ home for 24 years. Haslam Sports Group is seeking a 50/50 split between its own funding and public financing, regardless of whether it elects to build a new stadium or renovate its existing home. This means the team would seek $1.2 billion in public funding were it to seek a new stadium in the suburbs. The team has not disclosed any plans on how to achieve either the private or public funding for that project. The Browns in particular want an indoor stadium for the notoriously cold and snowy area, and putting a dome on the existing venue is not possible due to flight-path issues from the city’s airport. The City of Cleveland renovation proposal for the current stadium, located in the North Coast Harbor area of downtown Cleveland, would offer $461 million in public money, just under …