TUPELO, MISS. — Marcus & Millichap has brokered the sale of Parkway Terrace, a 123-unit apartment community located at 2700 W. Main St. in Tupelo. Preston Cooper, Matt Smith and Wallace Schmuck of Marcus & Millichap’s Birmingham office represented the seller and procured the buyer, both of which requested anonymity. Mickey Davis, the firm’s broker of record in Mississippi, assisted in the transaction, the sales price of which was also not disclosed. Built in 1972, Parkway Terrace features a mix of one-bedroom apartments and two- and three-bedroom townhomes. The units were recently renovated with new flooring, fixtures and appliances.

Property Type

NEW YORK CITY — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged a $50 million loan for a 12-story, 144,000-square-foot office and retail property in Manhattan’s SoHo neighborhood. The newly renovated building spans a full city block from Broadway to Crosby Street in between Houston and Prince streets. Matthew Polci, Steven Buchwald and Rachael Krawiecki of IPA originated the loan through a partnership between Maxim Capital Group, Sabal Investment Holdings and GDS Brightstar. The borrower was a partnership between London-based Chelsfield Group and RAM Holdings.

WEST COXSACKIE, N.Y. — Regional investment firm Winstanley Enterprises has purchased Prime Logistics Center, a 333,386-square-foot industrial property in West Coxsackie, about 25 miles south of Albany. The 30.7-acre site is located within a larger industrial park, and the building previously housed the distribution operations of grocer Save A Lot. Building features include 61 loading docks, two drive-in doors and parking for 77 trailers and 216 passenger vehicles. The seller and sales price were not disclosed. Winstanley plans to make capital improvements and rebrand the property as Mid-Hudson Logistics Center.

IRVINE, CALIF. — Irvine-based IRA Capital, in partnership with funds managed by Oaktree Capital Management, has purchased 12 medical outpatient buildings totaling 600,000 square feet. The transaction includes two separate institutional sellers and features a mix of single and multi-tenant medical buildings in California, Texas, Florida and Oregon. Terms of the transaction were not released. The Class A portfolio is anchored by health systems and medical providers including UC Davis Health, Palomar Health, UCLA, CommonSpirit, Ascension, McKesson and SCA Health, which collectively occupy approximately 50 percent of the space.

SALT LAKE CITY — Stos Partners has entered the Salt Lake City market with the acquisition of an industrial complex located at 900 W. 2900/2950/3100 S in Salt Lake City for $35 million, or $118 per square foot. The name of the seller was not released. Stos Partners plans to immediately implement a capital improvement program to stabilize and re-tenant the asset. Situated on 14.5 acres, the 279,233-square-foot facility features 22-foot clear heights, 49 dock-high doors and 18 drive-in ground-level doors. Eli Priest, Jeff Heaton and Kyle Roberts of Newmark are handling leasing for the property. Alex Harrold of Mathews Real Estate represented Stos Partners in the off-market transaction.

KeyBank Funds $45.4M Financing for Camas Flats Affordable Housing Project in Oak Harbor, Washington

by Amy Works

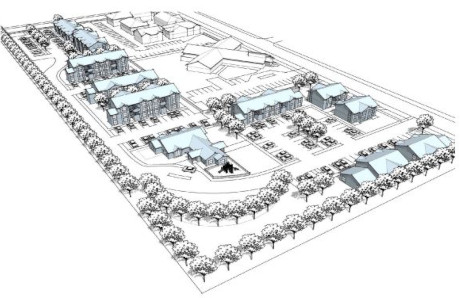

OAK HARBOR, WASH. — KeyBank Community Development Lending and Investment (CDLI) has provided $17.9 million in federal Low Income Housing Tax Credit equity and a $19.3 million construction loan for the construction of Camas Flats, an affordable residential property in Oak Harbor, located on an island north of Seattle. KeyBank Commercial Mortgage Group also arranged an $8.2 million Fannie Mae MTEB permanent loan for the project. Shelter Resources Inc., a Bellevue-based affordable housing developer, is the borrower. Additionally, Opportunity Council (OC) will service as the nonprofit general partner for the project, providing supportive services and case management to tenants on site. Camas Flats will consist of 10 garden-style, walk-up apartment buildings offering a mix of one-, two- and three-bedroom units, as well as one manager’s unit. Community amenities will include a playground, park and community building. The community will provide 81 affordable housing units for residents earning between 30 percent and 80 percent of area median income. Camas Flats will also include eight units that are specifically Permanent Supportive Housing (PSH) for those experiencing homelessness and two units for veterans. For the PSH units, OC will offer full-time case management services that are focused on wellness, medical health and behavioral health …

TEMPE, ARIZ. — LBA Logistics has completed the disposition of University Logistics Center, an industrial and logistics building on nine acres in Tempe. Setna iO and Setnix, an owner/occupier, acquired the asset for $27.5 million. Located at 1345 S. 52nd St., the 112,300-square-foot facility features 3,500 square feet of office space, 32-foot clear heights, three dock-high doors, 10 drive-in load doors, three truck wells, a concrete truck court, 18 new windows, storefront entry for will call, new LED lighting for the interior space and parking areas, secured parking and trailer storage and multiple points of ingress/egress. Additionally, the property offers 494 parking spaces. The buyer plans to use the facility to expand its operations, which focuses on aftermarket aircraft parts supply and high-tech airplane parts machining and repair. Mike Haenel, Andy Markham and Phil Haenel of Cushman & Wakefield represented the seller, while Todd Hamilton of Citywide Commercial Real Estate, along with Denise Stain Chaimovitz of Entre Commercial Realty, represented the buyer in the deal.

Lument Provides $38.8M Freddie Mac Refinancing for Carlton Senior Living Portfolio in California

by Amy Works

FREMONT AND SAN JOSE, CALIF. — Lument has provided $38.8 million in Freddie Mac refinancing loans for Carlton Senior Living, one of Northern California’s largest senior living providers with 11 independent living, assisted living, and memory care communities in operation. The loans are spread across two separate properties — $13.5 million to refinance a 123-unit senior living property in Fremont and $25.3 million to refinance a 126-unit senior living property in San Jose. Both loans feature a fixed interest rate, 10-year term and 30-year amortization. One loan also provides funds for renovations to improve the San Jose property. Lument’s Nick Hamilton and Casey Moore, both based in San Diego, led the transaction.

ROBBINSVILLE, N.J. — Regional brokerage firm Hudson Atlantic Realty has negotiated the $20 million sale of Southside Lofts, a 64-unit multifamily property in the Central New Jersey community of Robbinsville. The seller, Sharbell Development, delivered the property in 2020. According to Apartments.com, Southside Lofts offers one- and two-bedroom units that range in size from 713 to 1,207 square feet and amenities such as a fitness center, lounge and a rooftop terrace. Adam Zweibel of Hudson Atlantic represented Sharbell Development in the transaction and procured the undisclosed buyer.

WEST LAFAYETTE, IND. — Landmark Properties has unveiled plans to build The Standard at West Lafayette, a 678-bed student housing community near Purdue University. The 253-unit project will be situated at the corner of Pierce and West Wood streets adjacent to the east side of Purdue’s campus in West Lafayette. BKV Group is the project architect. Landmark Urban Construction, the in-house general contractor for Landmark Properties, will serve as construction manager on the 13-story project. Completion is slated for fall 2027. The Standard at West Lafayette will offer 18,234 square feet of amenity space, including a rooftop clubhouse with an outdoor heated pool and fitness center as well as a fourth-floor amenity level with seating, a grilling area, gaming lounge and interior courtyard. The community will provide parking for 207 vehicles. The community is the second for Athens, Ga.-based Landmark Properties in Indiana.