BOCA RATON, FLA. — BH Group and PEBB Enterprises have secured $89.9 million in financing for The Eclipse, a 29-acre mixed-use redevelopment in Boca Raton. City National Bank and Abanca provided the new financing, which grew the loan proceeds for the construction financing from $47 million to nearly $90 million. BH Group and PEBB are partnering on the office and retail components of The Eclipse. The companies are also co-developing the 500-unit residential component in partnership with Related Group. The redevelopment includes a Class A overhaul of the project’s existing 405,000 square feet of office space across two buildings, which were formerly the corporate headquarters for retailer Office Depot. Notable office tenants include Atlantic | Pacific Cos., Kanner & Pintaluga, MN8 Energy and ODP Corp. The Eclipse also includes two ground-up retail and restaurant outparcel buildings totaling approximately 21,500 square feet, as well as a nearly 37,000-square-foot Equinox gym.

Property Type

SJC Ventures Breaks Ground on Whole Foods-Anchored Shopping Center in Wesley Chapel, Florida

by John Nelson

WESLEY CHAPEL, FLA. — SJC Ventures has broken ground on Wesley Chapel Station, a 75,968-square-foot shopping center in metro Tampa. A 35,518-square-foot Whole Foods Market will anchor the center, which will be located at the corner of Bruce B Downs and Aronwood boulevards. Other committed tenants include PopUp Bagels, CAVA, Naked Farmer, Petfolk, The Tox and a nail salon. The center has approximately 15,000 square feet of available vacancy, according to SJC Ventures. Adjacent to the shopping center, the Atlanta-based firm is underway on an 85,000-square-foot Life Time Fitness club. The developer expects to open the first stores at Wesley Chapel Station in second-quarter 2027.

Transwestern Acquires Development Site Near Port of Savannah, Plans 528,560 SF Industrial Development

by John Nelson

RINCON, GA. — Transwestern Development Co., along with joint venture partner Transwestern Investment Group, has purchased a 30.7-acre site in Effingham County on behalf of a separately managed account. The ownership group plans to develop two Class A industrial buildings on the site, which is situated within North Gate Industrial Park. The project will include a 240,560-square-foot rear-load building and a 288,000-square-foot front-load building, each designed with 36-foot clear heights, ESFR systems, dock-high doors, multiple points of ingress and egress, 2,500 square foot office suites and ample car parking and onsite trailer storage. Situated near the intersection of Ga. Highway 21 and Old Augusta Road in Rincon, the development will provide direct access to interstates 95 and 16 and offer drayage routes from the Garden City Terminal at the Port of Savannah. The project team includes The Conlan Co., Randall-Paulson Architects and Kern & Co. JLL will provide leasing services. Transwestern plans to begin construction before the end of the year and complete the shell of the two buildings by year-end 2026.

SLIB Negotiates Sale of 140-Unit Seniors Housing Community in Ocean Springs, Mississippi

by John Nelson

OCEAN SPRINGS, MISS. — Senior Living Investment Brokerage (SLIB) has arranged the sale of a seniors housing community located in Ocean Springs along the Mississippi Gulf Coast. Totaling 140 units, the property features 18 independent living apartments, 60 assisted living residences and 62 memory care units. According to SLIB, the community was stabilized at the time of sale. The seller, the partnership that developed the asset, is exiting the seniors housing sector. A Southeast-based owner and operator with an existing presence in the state acquired the community for an undisclosed price. Daniel Geraghty and Bradley Clousing of SLIB brokered the transaction on behalf of the seller.

Marcus & Millichap Brokers Sale of 88-Room Homewood Suites Hotel in Fort Smith, Arkansas

by John Nelson

FORT SMITH, ARK. — Marcus & Millichap has brokered the sale of an 88-room Homewood Suites hotel located at 7300 Phoenix Ave. in Fort Smith. The sales price was not disclosed for the transaction, which is part of a two-property portfolio deal that included a Home2 Suites in Fort Smith. Chris Gomes and Steve Greer of Marcus & Millichap, along with Allan Miller of the firm’s Miller-Gomes Hotel Team, represented the seller, an entity doing business as Heritage Hotel Group LLC, and procured the buyer, a Texas-based entity doing business as FortSmith RA HS Hotel LLC.

SEATTLE — Nonprofit organization Horizon House has secured bond financing for a development project at its senior living campus in the First Hill neighborhood of Seattle. Ziegler arranged the financing, completing the successful pricing of Horizon House’s $600 million Series 2025AB bonds through the Washington State Housing Finance Commission. The bonds are scheduled to close in December. The existing senior living campus currently features 377 independent living apartments and 90 assisted living and memory care residences. The bonds will be used to fund a new, 33-story tower at the property, dubbed the West Tower. Upon completion, the project will add 202 independent living apartments, replacing a West Wing built in the 1980s. Apartment sizes within the West Tower will range from 861 to 2,206 square feet, with one- and two-bedroom layouts. Amenities at the building will include underground parking, resident gardens, a garden lounge, event spaces and a rooftop dining and lounge space. The bonds include short-term, fixed-rate Series B bonds to be repaid at roughly 80 percent occupancy and long-term, fixed-rate Series A bonds amortizing over 36 years through Jan. 1, 2061. “This financing package will directly support resident well-being, staff excellence and our mission to serve both middle-market and …

SAN FRANCISCO — Jonathan Rose Cos. has opened Oscar James Residences, located about 1.4 miles from the 866-acre Hunters Point Shipyard in San Francisco. The project marks New York City-based Jonathan Rose Cos.’ first ground-up development in San Francisco and its second in California. Oscar James Residences was co-developed with nonprofit partner Bayview Senior Services, though the project is conventional affordable housing, not seniors housing. The $132.9 million project was made possible through a combination of public and private funding sources, with Bank of America serving as an equity investor and conventional lender. The two-building complex features 49 one-bedroom, 31 two-bedroom, 23 three-bedroom, eight four-bedroom and one five-bedroom unit. The apartments are reserved for families earning between 30 and 50 percent of the area median income. The John Stewart Co. is the property manager. According to Bayview Senior Services, Oscar James Residences represents the agency’s second multifamily housing development focused on rebuilding the Hunters Point Shipyard to give back to the descendants of shipyard workers and their neighbors. The shipyard was established in 1870 and purchased by the U.S. Navy in 1940. The Navy conducted studies on the impact of nuclear weapons at the site before it was decommissioned in …

SEATTLE — Clarion Partners has sold Walton Lofts, a 136-unit high-rise property located at 75 Vine St. in Seattle’s Belltown neighborhood. The Schuster Group developed the building in 2015. CBRE’s Eli Hanacek, Mark Washington, Kyle Yamamoto and Natalie Kasper represented Clarion. Neither the buyer nor the sales price was disclosed, but Clarion purchased the property in 2016 for about $76 million. Walton Lofts includes studios, one- and two-bedroom units. Amenities include a rooftop lounge with panoramic views of Elliott Bay, the Olympic Mountains and downtown Seattle, a library and a fitness center.

Ethos, Vance Begin Development of 222-Unit Multifamily Project in Vancouver, Washington

by Amy Works

VANCOUVER, WASH. — Ethos Development and Vance Development have broken ground on Ellison Ridge, an apartment property located in Vancouver. Totaling 200,000 square feet, the two- and three-story multi-building property will feature 222 apartments, a pool, fitness center, community kitchen and living room, children’s play area and pickleball court. Twenty percent of the units will be available to residents earning no more than 80 percent of the area median income through the Clark County, Wash., multifamily tax-exemption program. Leeb Architecture of Portland, Ore., designed the project, while Vancouver-based Team Construction is serving as general contractor. Portland-based Ethos Commercial Advisors provided debt advisory services.

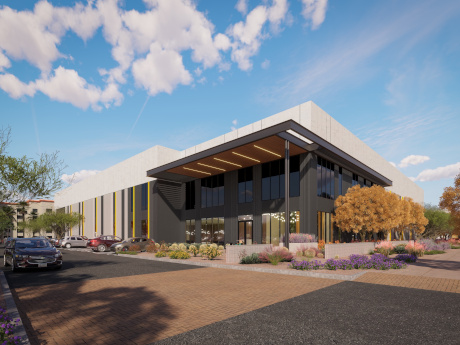

TEMPE, ARIZ. — Creation and LGE Design Build have broken ground on a 6-acre industrial development in Tempe. The project will encompass 120,000 square feet across two buildings, with joint venture partner Pacific Office Automation preleasing one building as its Southwest market headquarters. LGE Design Build is serving as architect and general contractor of the project, overseeing the ground-up construction of Pacific Office Automation’s 75,000-square-foot headquarters, in addition to a 45,000-square-foot building available for lease or sale. The development will feature 32-foot clear heights, a shared truck court and 185 parking spaces, including eight electric vehicle charging stations and 14 bike parking spaces. The project is located at 1400 W. 3rd St. Construction is underway, with completion slated for late 2026.