ATLANTA — CP Group has rebranded CNN Center, an iconic 1.2 million-square-foot office and retail building in downtown Atlanta, to The Center. The property has served as the headquarters for CNN for over 40 years and also features a large food court on the ground level that connects to State Farm Arena, home arena of the NBA’s Atlanta Hawks. The site also includes the Omni Atlanta Hotel at Centennial Park. CP Group plans to overhaul the former CNN Center to become a hub of world-class retail, dining, content creation and entertainment uses. CP Group has tapped Coleman Weatherholtz of Healey Weatherholtz Properties as The Center’s retail leasing agent and Jeff Keppen and Nicole Goldsmith of CBRE to handle office leasing. In 2021, CP Group purchased CNN Center from AT&T, the former parent company of CNN, in a sale-leaseback transaction that expires this year.

Retail

REYNOLDSBURG, OHIO — The Cooper Commercial Investment Group has brokered the $5.4 million sale of Livingston Avenue Center, a 101,621-square-foot shopping center in the Columbus suburb of Reynoldsburg. The fully leased property is home to tenants such as Save-a-Lot, Big Lots and Urban Air. Dan Cooper of Cooper Group represented the seller, a private investment group out of California. The Midwest-based buyer purchased the asset at a cap rate of 8.19 percent.

OAK BROOK, ILL. — Graycor Construction Co. has completed Wonderverse, a 45,000-square-foot entertainment space at Oakbrook Center in suburban Chicago. The project features a hybrid of physical and multi-media experiences, interactive installations, attractions and experiences, allowing visitors to step into their favorite Sony Pictures stories. Sony is the project’s owner. The space includes escape rooms, virtual reality adventures, bumper cars, racing simulators, an arcade and speakeasy. The project team included Scenario as the owner’s representative and EXP as the architect of record.

LOS GATOS, CALIF. — Marcus & Millichap has brokered the sale of a retail property, located at 52 N. Santa Cruz Ave. in Los Gatos, just south of San Jose. The asset traded for $4.5 million. Built in 1985, the 4,401-square-foot property is fully occupied and offers six commercial spaces. Yuri Sergunin and J.J. Taughinbaugh of Marcus & Millichap’s Palo Alto office represented the undisclosed seller and procured the undisclosed buyer in the deal.

CLINTON TOWNSHIP, MICH. — Andiamo Pasta & Chops will open at The Mall at Partridge Creek in Clinton Township, a northern suburb of Detroit. The restaurant comes from Michigan-based Joe Vicari Restaurant Group. The concept will be something new for Michigan restaurants, but the idea will be mirrored off Joe Vicari’s Andiamo Italian Steakhouse in Las Vegas. Andiamo Pasta & Chops is slated to open this summer in the 7,670-square-foot space formerly home to Brio Italian Grille at 17430 Hall Road. Renovation plans call for the space to be completely redesigned and reconfigured around a central bar, which will become the centerpiece of the new restaurant. There will also be a lounge area, two dining rooms and a separate banquet area. The Mall at Partridge Creek is a 640,000-square-foot, open-air shopping center that is home to more than 80 stores, restaurants and entertainment sites. The mall is leased and managed by Spinoso Real Estate Group.

SHAWNEE, KAN. — Five Guys will open a 2,300-square-foot restaurant at 10 Quivira Plaza in Shawnee, approximately 10 miles southwest of Kansas City. The location, slated to open in June, marks the 13th restaurant for Five Guys in the Kansas City area. Erin Johnston of Copaken Brooks represented ownership on an internal basis. Five Guys joins other retailers Westlake Hardware, Big Biscuit, Vintage Stock and Price Chopper at the shopping center, which is located on the northwest corner of Shawnee Mission Parkway and Quivira Road.

PHOENIX — Wespac Construction has completed work on three mixed-use buildings at Culdesac Tempe, a car-free, mixed-use development at 2025 E. Apache Blvd. in Tempe, just east of Phoenix. Situated on 17 acres, Culdesac Tempe will feature 44 apartments and 24,000 square feet of retail space. The site underwent extensive clearing, grading and utility installation. Additionally, a 2,500-square-foot restaurant shell and tenant improvement were constructed for Cocina Chiwas, a full-service restaurant. Key features include a 6,700-square-foot fitness facility and the 4,700-square-foot Market Building that spans three levels and features 16 apartments. DAVIS and Opticos designed the project, which Culdesac owns and developed.

Marcus & Millichap Arranges $11.2M Refinancing for Joann-Occupied Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $11.2 million in refinancing for a single-tenant retail building, located at 1000 S. Central Ave. in the Los Angeles suburb of Glendale. Joann, a fabric and crafts retail chain that recently declared bankruptcy, occupies the property. Ron Bayls of Marcus & Millichap Capital Corp. arranged the 10-year loan, which includes a 5.97 percent interest rate with a 30-year amortization and 50 percent loan-to-value ratio.

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

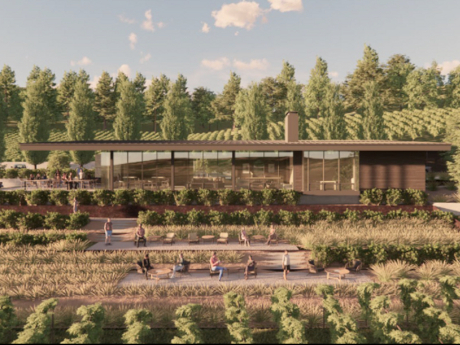

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.

ORLANDO, FLA. — Futura and Linkvest Capital have completed the construction of Nona Cove Self Storage, a 130,000-square-foot development featuring self-storage and retail space at 14800 Narcoossee Road in the Lake Nona neighborhood of Orlando. The facility — which comprises 122,000 square feet of self-storage space and 8,000 square feet of retail space — is part of the first phase of Futura at Nona Cove, a 17-acre mixed-use project anchored by a new 260-unit apartment community. Managed by Extra Space, Nona Cove Self Storage includes 1,046-square-foot bays with a gated drive-thru and is currently 57 percent leased.