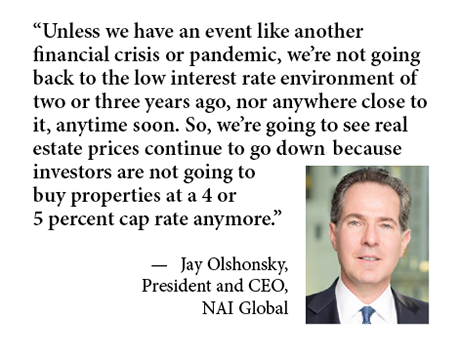

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

Retail

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

Feil Organization Signs New Tenant to 9,000 SF Office, Retail Lease in Metairie, Louisiana

by John Nelson

METAIRIE, LA. — The Feil Organization has signed FastPass Tag and Title LLC to a 9,000-square-foot lease in Metairie, a suburb of New Orleans. The tenant will occupy two suites at 3445 North Causeway Boulevard, a 10-story, 127,858-square-foot office building. One suite will include a retail space where customers can obtain and renew their drivers’ licenses and IDs, while the second space will be dedicated to the company’s back-of-house and office operations. Scott Graf of Corporate Realty represented Feil Organization in the lease transaction.

BRENHAM, TEXAS — SRS Real Estate Partners has brokered the $10.3 million sale of a 63,224-square-foot retail building in Brenham, about 75 miles northeast of Houston, that is leased to Academy Sports + Outdoors. The newly constructed building sits on a six-acre site at 1041 Nolan St. Matthew Mousavi and Patrick Luther of SRS represented the seller, a Texas-based developer, in the transaction and procured the buyer, a San Antonio-based private investor. Both parties requested anonymity.

Unilev Capital Sells 151,709 SF Tri-City Retail Center in San Bernardino, California for $24.3M

by Amy Works

SAN BERNARDINO, CALIF. — Unilev Capital has completed the sale of Tri-City Center, a shopping center in San Bernardino, to DPI Retail for $24.3 million. Built in 1987, the 151,709-square-foot property was fully occupied at the time of sale. Current tenants include 24 Hour Fitness, Curacao, Pollo Campero, Poke Bar, Barber, Cantos Jewelers and Pet World. Bryan Ley and Tim Kuruzar of JLL Retail Capital Markets represented the seller in the transaction.

NEW YORK CITY — JLL has arranged a $33 million loan for the refinancing of 111 West 19th Street, an eight-story, 189,731-square-foot office and retail building in Manhattan’s Chelsea neighborhood. The building was originally constructed in 1901 and comprises eight suites, according to StreetEasy.com. Aaron Niedermayer of JLL arranged the financing through Citigroup Inc. on behalf of the borrower, locally based investment firm The Kaufman Organization.

NEW YORK CITY — Lee & Associates has negotiated the $18.2 million sale of the Clock Tower Building, a 20,000-square-foot historic bank hall located at 46 Lafayette St. in Manhattan’s Tribeca neighborhood. Peter Braus, Brad Schwarz and Cory Gahr of Lee & Associates represented the seller, locally based investment firm Elad Group, in the transaction. Anne-Brigitte Sirois from ART STATE LLC represented the buyer, Jack Shainman Gallery, which plans to new art exhibition venue at the property.

PORTLAND, TEXAS — McLeod Cobb Investments has revealed construction updates and new tenant signings at Oliver’s Way, the firm’s $100 million multifamily and retail development in the South Texas city of Portland. A 128,500-square-foot Target store that will anchor the retail component is nearing completion and will open late this summer. Construction will also soon begin on a 13,800-square-foot freestanding retail building. McLeod Cobb has secured deals with retailers such as Jack in the Box, Brake Check, Raising Cane’s, Chipotle Mexican Grill, Aspen Dental, Five Guys, James Avery and Wells Fargo. The development team expects to begin construction on the apartments later this year.

LEXINGTON, S.C. — Lowes Foods has signed a lease to anchor Platt Springs Crossing, a 50-acre mixed-use development currently underway in Lexington, a western suburb of Columbia, S.C. The Winston-Salem-based grocer will occupy 51,000 square feet at the development. Other tenants will include Chipotle Mexican Grill, Tidal Wave Car Wash, Panda Express and Planet Fitness. An affiliate of NAI Columbia doing business as LLDC Platt Springs LF LLC is the developer of the project, which is scheduled to begin opening early next year. Ben Kelly and Patrick Chambers of NAI Columbia represented the landlord in the lease negotiations with Lowes Foods. The grocery store is scheduled to open in the third quarter of 2025.

CBRE Arranges Sales of Nine Big Lots Retail Locations in California, Florida for $50.7M

by Amy Works

LOS ANGELES — CBRE has brokered the sales of nine individual Big Lots-occupied retail properties to two buyer. Alex Kozakov and Patrick Wade of CBRE represented the seller, a large institutional investor, in the transactions. Robhana Group acquired four properties, totaling 117,494 square feet, for $23.6 million. The assets are: Reliable Properties purchased five locations, totaling 125,439 square feet, for $27.1 million. The properties are: The retail locations were part of a 25-property sale-leaseback portfolio acquired by a large institutional investor in 2023 with Kozakov and Wade representing the seller, Big Lots, in that transaction.

JOLIET, ILL. — CBRE has completed the lease-up of Joliet Marketplace, a 100,000-square-foot shopping center in Joliet. UrgentVet inked the most recent lease for a total of 3,500 square feet. The veterinarian clinic plans to open this spring. The property was formerly occupied by K-Mart and had stood vacant since 2016. IG Capital purchased the asset in 2020 and brought on CBRE’s Sean McCourt, Joe Parrott and Riley McCarron to assist with redeveloping the site. UrgentVet joins Tony’s Fresh Market, Planet Fitness, Tropical Smoothie Café, Charley’s and Ivy Rehab at the center. McCourt and Parrott represented IG Capital in the lease with UrgentVet.