DENVER — Cushman & Wakefield has brokered the sale of Leetsdale Marketplace, a 111,669-square-foot grocery-anchored retail center at 7150 Leetsdale Drive in Denver. Legacy Capital Partners sold the asset to a partnership led by Citivest Commercial for $13 million. Jon Hendrickson and Aaron Johnson of Cushman & Wakefield represented the seller in the transaction.

Retail

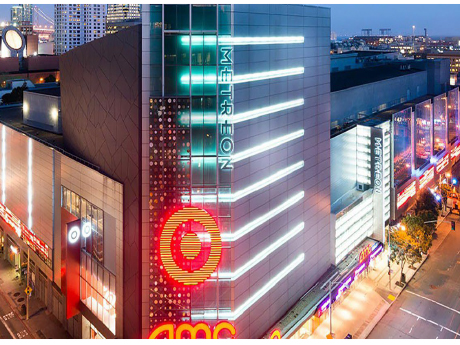

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

ROWLETT, TEXAS — SRS Real Estate Partners has arranged the $13.7 million sale of a 40,000-square-foot retail building in Rowlett, a northeastern suburb of Dallas, that is leased to Crunch Fitness. The gym opened at the building at 3601 Lakeview Parkway last fall under a 15-year, corporate-guaranteed lease. Matthew Mousavi and Patrick Luther of SRS represented both the seller, a multi-state developer, and the buyer, a publicly traded REIT, in the transaction. Both parties requested anonymity.

MIAMI — A joint venture between locally based Torose Equities and Irvine, Calif.-based Sabal Investment Holdings has sold 3480 Main Highway, a 55,000-square-foot office and retail property located in Miami’s Coconut Grove neighborhood. Miami-based Azora Private purchased the property for $61 million, or $1,100 per square foot. The building is fully leased to food-and-beverage concepts Amal and Level 6, which are located on the ground floor and rooftop, as well as three office tenants. In 2025, an affiliate of CGI Merchant Group lost the office building through a UCC auction over $32.5 million in debt, in which Torose Equities and Sabal purchased the loan, according to South Florida Business Journal.

Stockdale Capital Partners Completes Recapitalization of 1.1 MSF Shops at Northfield Retail Center in Denver

by Amy Works

DENVER — Stockdale Capital Partners, in collaboration with UBS’s Global Alternatives – Real Estate, has completed the recapitalization of The Shops at Northfield, an open-air lifestyle center in Denver. Situated on 87 acres, The Shops at Northfield offers 1.1 million square feet of retail, restaurant and entertainment space. Since purchasing the property in 2021, Stockdale has executed a series of initiatives, including securing entitlements for up to 1,500 multifamily units, reletting former anchor boxes to Wayfair and Life Time and completing approximately 350,000 square feet of new leases, including lululemon, Nike, Sephora and a national grocer.

STAMFORD, CONN. — CBRE has negotiated the sale of a 153,416-square-foot shopping center in Stamford, located in southern coastal Connecticut. Whole Foods Market and Saks OFF Fifth anchor the center at 110 High Ridge Road, which is a redevelopment of a former Lord & Taylor department store into a multi-tenant center. Jeffrey Dunne, David Gavin and Travis Langer of CBRE represented the seller, HBS Global Properties, in the transaction. The trio also procured the buyer, an entity doing business as 110 High Ridge Road LLC.

PENNSYLVANIA — Marcus & Millchap has brokered the sale of a portfolio of 10 Dollar General stores in Pennsylvania. The addresses were not disclosed, but the stores are all new construction and are operated under 15-year, triple-net leases. Don McMinn and Andrew Koriwchak of the Taylor McMinn Retail Group of Marcus & Millichap brokered the deal. The seller was a developer, and the buyer was an institutional investment firm. Both parties requested anonymity.

OMAHA, NEB. — Investors Realty Inc. has arranged the sale of Brentwood Square Shopping Center in Omaha for $9 million. Brentwood Square Plaza LLC sold the 224,187-square-foot property to Brentwood I Acquisition LLC. Harbor Freight is the anchor tenant. Ember Grummons and Tim Kerrigan of Investors Realty represented the seller. The transaction also included an 89,359-square-foot land lease.

CORAL SPRINGS, FLA. — Garden City, N.Y.-based Pliskin Realty & Development has acquired Turtle Run Shoppes, an 80,000-square-foot retail center located in Coral Springs, a city in South Florida’s Broward County, for $19.5 million. Built in 1990 and renovated in 2018, Turtle Run Shoppes was 92 percent leased at the time of sale. Tenants include America’s Best Contacts and Eyeglasses, Cycle Gear, My Salon Suite, Smoothie King, La Brasas Bar & Restaurant, the U.S. Postal Service and Ross Dress for Less, which anchors the center. Douglas Mandel, Zach Levine and Cody Hershey of Marcus & Millichap marketed the property on behalf of the seller, Boca Raton, Fla.-based Grover Corlew, and procured Pliskin Realty in the transaction.

SRS Negotiates Sales of Three New Central Florida Retail Properties Leased to 7-Eleven

by John Nelson

TAMPA, FLA. — SRS Real Estate Partners has negotiated the sales of three new retail properties in Central Florida leased to 7-Eleven totaling $28.8 million. Built in late 2025, the three properties are located in Winter Haven, Daytona Beach and Ocoee and comprise modern convenience stores and fueling stations. 7-Eleven occupies all three properties on 15-year, triple-net leases. Patrick Nutt and William Wamble of SRS represented the sellers, Florida-based developers, in the transactions. The Winter Haven and Ocoee properties were sold as a portfolio to a Florida-based family office for a combined $19.2 million. A locally based, private investor purchased the Daytona Beach location, which is situated across from Latitude Landings and Latitude Margaritaville, in a 1031 exchange for approximately $9.5 million.