In the digital age, nearly everything is accessible online — entertainment, shopping, friendship, you name it. With a few taps on a screen, we can order three pairs of jeans, have a pizza delivered and carry on a meaningful conversation without ever leaving the couch. Considering that Generation Z — those born roughly between 1996 and 2013 — has grown up immersed in this digital reality, it would be easy to assume they have little interest in traditional, in-person experiences. Surprisingly, the opposite is true. From pop-ups, influencers, to retail, Gen Z are securing their Labubus to their bags and heading out the door to shake up our understanding of successful contemporary retail experiences. After coming of age during COVID, living through what has been called an “epidemic of loneliness,” Gen Z is craving in person experiences more than ever, and where better to go with your friends than the mall? A reported 69 percent of Gen Z shoppers say they prefer shopping in brick-and-mortar stores over online alternatives. However, their renewed interest in physical spaces doesn’t mean a return to retail as we once knew it. Instead, Gen Z is fundamentally reshaping what in-person shopping and entertainment look like …

Restaurant

If there is one defining characteristic of the Raleigh-Durham retail market today, it is scarcity. Exceptionally low vacancy — especially in high-quality, well-located centers — has become the norm rather than the exception, fundamentally reshaping leasing dynamics, rent growth and development strategy across the region. As of third-quarter 2025, overall retail vacancy in Raleigh-Durham stood at approximately 2.4 percent, marking four consecutive years below the 3 percent threshold. Even more telling, spaces under 10,000 square feet posted vacancy closer to 1.8 percent, underscoring just how competitive conditions have become for local and regional tenants. This imbalance between demand and supply has placed landlords in a position of sustained leverage, particularly in grocery-anchored centers, strong neighborhood and lifestyle shopping centers or mixed-use environments. Low vacancy matters because it drives outcomes. Lease-ups are happening faster, concessions are increasingly rare in top trade areas and rents continue to trend upward. For tenants, especially those seeking smaller footprints, waiting to engage often means missing opportunities altogether. For owners, the market rewards proactive asset management and disciplined tenant selection. A clear example of this dynamic is Olde Raleigh Village, a grocery-anchored community shopping center that is currently 100 percent leased. With no vacancy to contend …

Marcus & Millichap Brokers Sale of 33,055 SF Mixed-Use Property in San Diego’s La Jolla Neighborhood

by Amy Works

SAN DIEGO — Marcus & Millichap has arranged the sale of Prospect Square at La Jolla Village, a mixed-use property located in San Diego’s La Jolla submarket. 1025 Prospect LLC sold the asset to 1025 Associates LLC & Wedge 3.0 LLC for $10.3 million. Nick Totah of Marcus & Millichap represented the seller, while Ross Sanchez of Marcus & Millichap represented the buyers in the deal. Located at 1025 Prospect St., Prospect Square at La Jolla Village features 33,055 square feet of ground-floor and second-floor retail and restaurant space, third-floor office space and a three-story subterranean parking garage. Current tenants include Cody’s Restaurant, Beeside Balcony, The Agency, Arjang Fine Art, Blueprint Equity and Patient Partner. Originally built in 1984, the property was renovated in 2022 and 2024.

Morgan, Casto Net Lease Buy Land in Southeast Florida, Plan Aldi-Anchored Shopping Center

by John Nelson

PORT ST. LUCIE, FLA. — A partnership between Morgan Co. and Casto Net Lease has acquired 15 acres in Port St. Lucie, a city in southeast Florida’s St. Lucie County. The duo plans to develop a new shopping center anchored by Aldi on the site. The center will also include outparcels designated for McDonald’s, Circle K and AutoZone, as well as outparcels that are currently available for sale or lease. Scott Copeland of On Course Development represented Morgan and Casto Net Lease in the land deal. The seller and sales price were not disclosed. The buyers plan to break ground on the shopping center before the end of the year and deliver the property in 2027.

FLOWERY BRANCH, GA. — The Taylor McMinn Retail Group of Marcus & Millichap has brokered the sale of a restaurant in Flowery Branch leased to Whataburger. The restaurant was built in 2024 and sold to a local buyer that purchased the property all-cash in a 1031 exchange. Don McMinn and Andrew Koriwchak of Taylor McMinn Retail Group represented the seller, a repeat developer for the Whataburger brand, in the deal. Both parties requested anonymity. Whataburger has 14 years remaining on its ground lease, which features rent increases in the initial term as well as extension options. “This marks our fourth new Whataburger closing in the Atlanta MSA over the past 12 months, and we are currently marketing an additional location in Buford, Ga.,” says McMinn. “Demand for well-located QSR [quick-service restaurant] assets remains strong as 1031 exchange and private capital continue to re-enter the net lease market. Capital targeting the QSR sector is driven by long-term leases, rent escalations and attractive drive-thru locations.”

CHICAGO — Fine dining restaurant and bar concept Espiritu has signed a lease to open a roughly 10,000-square-foot ground-floor space at One East Wacker, a Chicago office building owned by AmTrustRE. Espiritu comes from the restaurateurs behind Chicago Cut Steakhouse and Cerdito Muerto, Matt Moore and Emidio Oceguera. The dining concept blends classic Chicago dishes with a modern Mexican flair. In addition to 10,000 square feet of indoor space, the restaurant will include 2,200 square feet of adjoining outdoor patio area along Wacker Drive. Dana Moyles of Dana Moyles Real Estate Services represented Espiritu in the lease, while John Vance and Will Winter of Stone Real Estate represented the landlord. AmTrustRE has also secured three new office leases at the property, including Flight Centre Travel Group (USA) Inc., the Trade Commission of Spain in Chicago and the Consulate General of Bosnia and Herzegovina in Chicago. Signed to 7,216 square feet of office space on the 13th floor, Flight Centre Travel Group is one of the world’s largest global travel agencies. JLL’s Sarah Silva and Bess Cooney represented the tenant. The Trade Commission Office of Spain, of the Government of the Kingdom of Spain, will occupy 4,326 square feet on the …

JOHNS CREEK, GA. — A new wave of retailers has joined the tenant roster at Medley, a new 43-acre mixed-use redevelopment underway in Johns Creek, about 27 miles north of Atlanta. Locally based Toro Development Co. recently announced the newcomers, which will include Shake Shack, Trader Joe’s, Kontour Medical Spa, Moop’s Boutique and Northern China Eatery. Previously announced concepts include Sephora, High Country Outfitters, BODYROK, Petfolk, CRÚ Food & Wine Bar, Fadó Irish Pub, Summit Coffee, Five Daughters Bakery, Drybar Shops, Minnie Olivia Pizzeria and Clean Your Dirty Face, among others. Set to debut officially around Halloween, Medley will offer 164,000 square feet of retail, restaurant and entertainment space; 833 luxury townhomes and apartments; The Hotel at Medley, a 150-room boutique hotel set to open in 2028; 110,000 square feet of lifestyle office space; and a 25,000-square-foot plaza. The project is located at the intersection of Johns Creek Parkway and McGinnis Ferry Road and was once a suburban office hub for State Farm Insurance.

LANSING, MICH. — Pita Way has signed a 1,400-square-foot lease to open at The Marketplace at Delta Township in Lansing. Michael Murphy of Gerdom Realty & Investment represented the tenant. The transaction marks the sixth Pita Way location that Gerdom helped the tenant secure in the past year. Eric Unatin of Mid-America Real Estate Group represented the undisclosed landlord.

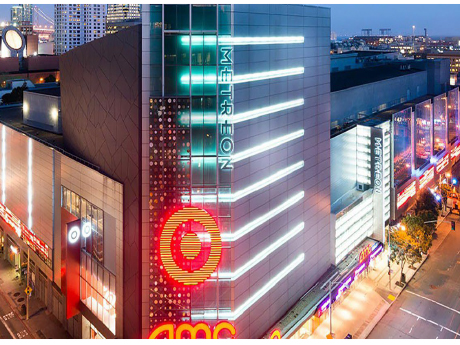

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

SRS Negotiates Sales of Three New Central Florida Retail Properties Leased to 7-Eleven

by John Nelson

TAMPA, FLA. — SRS Real Estate Partners has negotiated the sales of three new retail properties in Central Florida leased to 7-Eleven totaling $28.8 million. Built in late 2025, the three properties are located in Winter Haven, Daytona Beach and Ocoee and comprise modern convenience stores and fueling stations. 7-Eleven occupies all three properties on 15-year, triple-net leases. Patrick Nutt and William Wamble of SRS represented the sellers, Florida-based developers, in the transactions. The Winter Haven and Ocoee properties were sold as a portfolio to a Florida-based family office for a combined $19.2 million. A locally based, private investor purchased the Daytona Beach location, which is situated across from Latitude Landings and Latitude Margaritaville, in a 1031 exchange for approximately $9.5 million.

Newer Posts