PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side. Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces. Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology. The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence. “The BTR …

Single-Family Rental

NEW BRAUNFELS, TEXAS — Arizona-based developer Empire Group will develop Village at Mayfair, a 215-unit build-to-rent residential project that will be located in the northeastern San Antonio suburb of New Braunfels. The site spans 19.7 acres within Mayfair, a 1,900-acre master-planned development. The project will feature a variety of floor plans, with residences ranging in size from 680 to 1,300 square feet. Homes will be furnished with stainless steel appliances, quartz countertops, walk-in closets and various pieces of smart technology. Residents will have access to amenities such as a pool, fitness center, spa, clubhouse, dog park and outdoor grilling and dining stations. Construction is set to begin in the fourth quarter, with the first homes expected to be available for occupancy by late 2024.

SAN MARCOS, TEXAS — Marcus & Millichap Capital Corp. has arranged $12.5 million in joint venture equity financing for a residential project in San Marcos, located roughly midway between Austin and San Antonio. The development will consist of 210 for-rent, freestanding “micro homes” of modular construction. Homes will come in one- and two-bedroom formats and range in size from 400 to 1,100 square feet. Construction is expected to last about 21 months. Duke Dennis of Marcus & Millichap Capital Corp. arranged the equity financing and partnership on behalf of the lead developer, Casata.

Affordable HousingBuild-to-RentConference CoverageFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Suburbs Are King for Carolinas Multifamily Market, Say InterFace Panelists

by John Nelson

Suburban markets in the Carolinas are the big winners in the current multifamily landscape, both from a new development and rent growth perspective, according to the various panelists at the InterFace Carolinas Multifamily conference. Hosted by InterFace Conference Group and Southeast Real Estate Business, the annual event took place on May 25 at the Hilton Charlotte Uptown hotel. At the end of the leasing and operations panel, moderator Mike Susen, senior director of real estate at Greystar, asked the property managers on stage if they could manage any product type in any Carolinas market, which they would choose. The consensus was their dream assignments lie in the suburbs. “Let’s do mid-rise suburbs, something out toward Matthews or the Mint Hill area,” said Amanda Kitts, senior vice president of property management at Northwood Ravin, referring to the suburbs of Charlotte. “I’d want to do product that those markets haven’t seen yet.” “Suburban product is still really strong right now,” added Bob Moore, co-founder and CEO of FCA Management LLC. “Tertiary markets are going to surprise you. You’ll see opportunities to do some deals where there has been a lot lower supply.” Property managers are keen to handle suburban communities because those …

The construction of new build-to-rent (BTR) homes hit a record in 2022, with more than 14,500 houses completed, according to a RentCafe analysis of Yardi Matrix data. This is a 47 percent increase in deliveries from 2021. Now, approximately 44,700 BTR homes are under construction across America, triple the number of new homes completed in 2022. Prior to 2020, RentCafe notes, only about 6,000 BTR units were completed annually. RentCafe cited data from the firm’s sister company, Yardi Matrix. The data includes properties defined as single-family homes for rent that are in build-to-rent, professionally managed communities covered by Yardi Matrix research. The study is based on data related to BTR communities comprising at least 50 units. “In the wake of the 2008 housing crisis, the number of renter-occupied single-family houses in the United States increased by more than 2.5 million between 2009 and 2016, according to the U.S. Census Bureau,” comments Doug Ressler, manager of business intelligence at Yardi Matrix. “Institutional SFR (single-family rental) growth remains focused on BTR product, as home sales have declined in recent months due to lack of inventory and rising mortgage rates,” continues Ressler. “Although home prices have remained surprisingly firm, the number of homes on the market for …

BRUNSWICK, GA. — Single-family rental operator ARK Homes for Rent has begun leasing Walker Point, a 237-unit build-to-rent residential property in Brunswick, a coastal city about 80 miles south of Savannah. The property features three floor plan options ranging from two to four bedrooms. Amenities will include a clubhouse, fitness center, swimming pool and a dog park. Monthly rents will start at $1,650, according to ARK Homes.

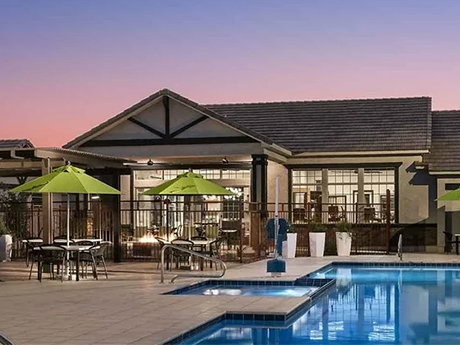

PEORIA AND GLENDALE, ARIZ. — Empire Group has received $120.5 million in financing for two build-to-rent (BTR) communities in the Phoenix metropolitan area. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on both deals. Empire Group received $78.5 million in nonrecourse bridge financing for Village at Pioneer Park, a BTR community in the northwestern Phoenix suburb of Peoria. The bridge loan refinanced the project’s construction loan upon opening and allows Empire Group time to stabilize the asset prior to putting a permanent loan in place. Village at Pioneer Park was built in 2022 and offers 332 units averaging 921 square feet in size, as well as amenities including a clubhouse, pool, fitness center, pet wash station and dog park. Units come in one-, two- and three-bedroom floor plans, according to Apartments.com. The Scottsdale-based developer also received $42 million in nonrecourse construction financing for the Village at Skyline Ranch in Glendale. Located approximately 1.2 miles from Luke Air Force Base and related off-base housing, Village at Skyline Ranch is slated for delivery in 2024. The project will consist of 167 BTR units featuring one- and two-bedroom floor plans. Amenities will include walking paths, a dog park, clubhouse, fitness …

PRINCETON, IND. — Cushman & Wakefield has brokered the sale of Circle Point Villas in Princeton, a city in Southwest Indiana. The sales price was undisclosed. The build-to-rent (BTR) community features 125 homes that average 1,220 square feet. Construction of the 19-acre development concluded this year. George Tikijian, Hannah Ott and Cameron Benz of Cushman & Wakefield represented the seller, Reinbrecht Homes. The asset sold to a joint venture between JMF Capital and Yellowstone Property Group. The deal marks the first investment sale of a purpose-built BTR community in Indiana, according to Cushman & Wakefield.

CYPRESS, TEXAS — Clay Residential, an affiliate of locally based firm Clay Development, has broken ground on Willow at Marvida, a 368-unit single-family rental project in the northwestern Houston suburb of Cypress. The site is located within Marvida, an 856-acre master-planned community by Land Tejas. The development will consist of 134 detached homes and 234 attached villas. Residences will feature three-, four- and five-bedroom floor plans, will range in size from 1,382 to 2,900 square feet and will have fenced-in backyards. Residents will have access to Marvida’s amenity center, which is under construction and will ultimately house a pool, clubhouse, fitness center, playground and a dog park. Full completion is slated for 2026.

Affordable HousingBuild-to-RentGeorgiaMarket ReportsMultifamilySingle-Family RentalSoutheastSoutheast Market Reports

Why Investors Should Love Atlanta’s Multifamily Market

by John Nelson

Like most of the country, the metro Atlanta multifamily market has experienced a dramatic storyline over the past three years. While the continuing plot twists are difficult to predict, important cues suggest Atlanta’s multifamily market will reestablish a solid upward path quicker than many other cities in the country. Economic strength Atlanta’s economic fundamentals make it a favored market for investors, lenders, new residents, and business relocations. Today, metro Atlanta’s population stands at approximately 6 million, growing by 64,940 in 2022. Atlanta also added 126,400 new jobs in 2022. Georgia’s unemployment rate of 3.1 percent is below the national average of 3.6 percent. These figures are a key part of Atlanta’s desirability as an investment market and an indicator of the region’s ability to rebound quickly from cyclical economic disruptions. Record volume Atlanta is a top 10 U.S. market for multifamily inventory and investment. As the nation experienced an 11-year economic expansion after the Global Financial Crisis (GFC), Atlanta’s multifamily sales volume averaged between $7 billion and $9 billion annually. When the pandemic hit in March 2020, most industry participants expected a major transaction pullback. The reality proved different. Sales volume dropped initially but rebounded sharply for a full-year 2020 …