FAYETTEVILLE, ARK. — The ITEX Group and Time Warp Enterprises have released plans for The Aronson, a build-to-rent (BTR) project in Fayetteville that will be anchored by a new moviegoing concept from Austin, Texas-based theater chain Alamo Drafthouse Cinema. The Aronson’s 214 units will be available as single-family, duplex or triplex configurations. Amenities will include a clubhouse, fitness center, pool, playgrounds, dog parks and bike parking. The project is anticipated to deliver by 2024. The Aronson will be home to Alamo Drafthouse Cinema + Drive-In, developed via a partnership among Catchlight Entertainment, ITEX and Time Warp. In addition to eight indoor movie screens, with a total of 798 reclining theater seats, the concept also includes a permanent outdoor drive-in theater with a beer garden and parking for cars and bikes. The Aronson is named for cinema pioneer and Arkansas native Max Aronson, whose screen name was Gilbert “Bronco Billy” Anderson. Aronson starred in several silent films in the early part of the 20th century as Bronco Billy. He also was a producer on “The Tramp,” a film released in 1915 and recognized as one of Charlie Chaplin’s first well-known performances.

Single-Family Rental

FRISCO, TEXAS — Locally based developer Stillwater Capital has broken ground on a 215-unit build-to-rent residential project in Frisco. The site is located within The Link, a 240-acre mixed-use development that is adjacent to the PGA of America’s headquarters campus. Information on floor plans was not disclosed. Amenities will include a pool, fitness center, resident lounge and a neighborhood park and walking trails. Stillwater Capital has partnered with Robert Elliott Custom Homes on the project, which is slated for full completion in late 2024.

MYRTLE BEACH, S.C. — ACRE and partner ARK Residential have announced plans for The Springs at Arcadia, a 150-unit single-family-rental (SFR) community in Myrtle Beach. Located within the master-planned Arcadia community, the development will offer three- and four-bedroom detached homes ranging in size from 1,500 to 2,300 square feet. Residents will have access to Arcadia’s amenities, which include a clubhouse, pickleball courts and a pool. Construction, which is currently underway, is scheduled for completion in the first quarter of 2024. Preleasing began in January of this year, and Elmington Property Management will manage the community. John Alascio, Chuck Kohaut, T.J. Sullivan and John Spreitzer of Cushman & Wakefield arranged $37 million in financing through Arbor Realty Trust Inc. for the project.

BIXBY, OKLA. — Marcus & Millichap Capital Corp. (MMCC) has arranged $14.7 million in joint venture equity for a 161-unit, build-to-rent residential community in Bixby, a southern suburb of Tulsa. The development will offer one-bed duplexes and two-, three- and four-bedroom farmhouse-style homes. Residences will feature private garages and backyards, and communal amenities will include a pool, fitness center and a clubhouse. Justin Shuart and Travis Headapohl of MMCC structured the equity on behalf of the developer, a partnership led by ACRE Development Partners.

JLL Arranges $33.8M Construction Loan for Villas Goodyear Build-to-Rent Community in Arizona

by Amy Works

GOODYEAR, ARIZ. — JLL Capital Markets has arranged a $33.8 million construction loan for Villas Goodyear, a build-to-rent residential development at 816 S. Sarival Ave. in Goodyear. The borrower is a joint venture between Blue Vista Capital Management and Family Development. Upon completion, Villas Goodyear will feature 151 one- and two-bedroom, freestanding, single-story units with spacious floor plans, simulated wood flooring, quartz countertops, stainless steel appliances and private backyards. Community amenities will include a resort-style pool, fitness center, open turf spaces, outdoor lounge area and grill area. Brian Walsh, Brad Miner and Dave Hunter of JLL Capital Markets secured the three-year, fixed-rate loan through a regional bank for the borrower.

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …

SAN ANTONIO — Locally based developer AHV Communities has completed Farm Haus, a 142-unit single-family rental project in northwest San Antonio. The development’s two-story duplexes are available in two-, three- and four-bedroom homes that range in size from 1,134 to 1,645 square feet. Homes also include private garages and fenced yards. Amenities include a pool, fitness center, community kitchen, bocce courts, dog park and walking trails. Rents start at $2,070 per month.

JLL Arranges $48M in Construction Financing for Build-to-Rent Development in Central Florida

by John Nelson

WILDWOOD, FLA. — JLL has arranged $48 million in construction financing for the development of Solamar Wildwood, a 243-unit build-to-rent development in Wildwood. Churchill Real Estate provided the two-year, non-recourse loan to the borrower, a partnership between TRUSOT Developments and Agador Spartacus Development (AS). Max La Cava, Kenny Cutler and Karim Khaiboullin of JLL arranged the financing on behalf of TRUSOT and AS, which are co-developing several residential projects across Florida. Situated adjacent to The Villages, a master-planned community in Central Florida for active adults, Solamar Wildwood will comprise townhomes and villas with one-, two- and three-bedroom layouts. Homes will feature semi-private backyards, surface parking and private garages. Community amenities will include a resort-style swimming pool, sun deck with cabanas, fitness studio with a yoga room, summer kitchen and a tropical clubhouse.

AcquisitionsArbor Realty TrustBuild-to-RentContent PartnerFeaturesMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Investors Drawn to Single-Family Rentals During Tough Economic Times

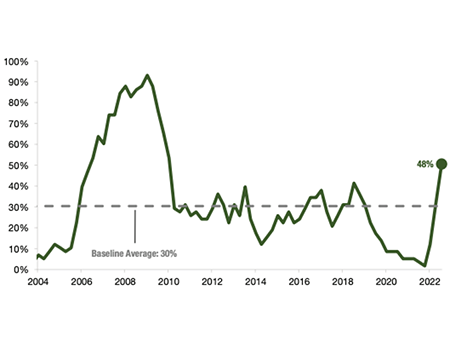

By John Tarantino, Arbor Realty Trust The ongoing expansion of the single-family rental (SFR) market is capturing investors’ interest like never before. Construction starts in the sector topped a record 69,000 units over the past year, while the rate of rent growth remained positive for new leases and accelerated in renewals. That’s according to the third-quarter Single-Family Investment Trends Report Q3 2022, which Arbor Realty Trust recently published in partnership with Chandan Economics. SFR investors want to know what this latest market data reveals about how the sector is weathering economic changes and what it suggests about how their properties are likely to perform in the months ahead. In December, I was privileged to weigh in on these weighty questions as a panelist at Information Management Network’s 10th Annual Single-Family Rental Forum (West) in Scottsdale, Ariz. One of the messages I sought to convey to the audience that day is that single-family rentals have maintained their momentum as well as any corner of the housing market, as our third-quarter report bears out. And while rising interest rates and elevated risk have placed the housing market on shaky ground, SFR is on a secure foundation moving into 2023. With the average age …

MESA, ARIZ. — Scottsdale-based Taylor Morrison has completed the disposition of a 145-unit build-to-rent community located at 250 N. Ellsworth Road in Mesa. San Diego-based Ellsworth Housing Partners acquired the property for $53 million, or $368,055 per unit, and plans to brand the community as The Logan at Ellsworth. Built in 2022, the community features 58 one-bedroom, 650-square-foot units and 87 two-bedroom, 995-square-foot units. In-home features include kitchens with quartz countertops, stainless steel appliances, wood-inspired flooring, high ceilings, dual-pane windows, full-size washers/dryers, walk-in closets and maintenance-free private backyards. The property offers smart-home technology, including satellite TVs with HD and DVR, mobile phone controls, smart-home touchscreen panels, USB outlets, keyless entry, self-monitored security systems with doorbell cameras and door and motion sensor alarms, and smart thermostats. The community features 20 detached garages, as well as 168 covered and 137 uncovered spaces. Onsite amenities include a heated swimming pool and spa, poolside ramadas with outdoors TVs, a fitness studio, an event lawn and a roving patrol. Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca of Northmarq’s Phoenix investment sales team represented the seller in the deal.