MARICOPA, ARIZ. — Northmarq’s Debt & Equity has arranged a $49.5 million construction loan for the development of Honeycutt Run, a build-to-rent residential property in Maricopa. Mesa-based Bela Flor Communities is developing the community. Situated on 19.2 acres at 36351 W. Honeycutt Run Road, Honeycutt Run will feature 209 single-story homes. The site plan is approved for one-, two- and three-bedroom single-family casita-style homes with private, fenced-in backyards. Community amenities will include a swimming pool, clubhouse, fitness center and barbecue areas with fire pits. Brandon Harrington, Bryan Mummaw, Tyler Woodard, Chris McCook and Bryan Liu of Northmarq secured the loan, which was structured at an 80 percent loan-to-cost ratio. Trevor Koskovich, Bill Hahn, Jesse Hudson and Ryan Boyle of Northmarq’s Phoenix Investment Sales team brokered the sale of the fully zoned and entitled land on behalf of the seller, Phoenix-based Suncrest Real Estate & Land.

Single-Family Rental

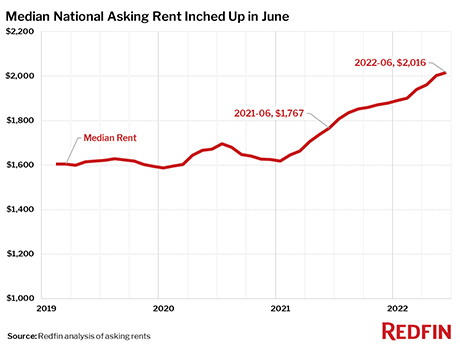

SEATTLE — Redfin, the residential real estate brokerage giant, has reported that the national median asking rent in June is $2,016 per month, a 14.1 percent increase year-over-year. The Seattle-based company analyzed data from 20,000 separate multifamily and single-family properties from its RentPath platform across the top 50 U.S. metro areas. The June figure is a slight increase from May at 0.7 percent, which represents the smallest month-over-month gain since the start of the year. The median asking rate is also the smallest annual increase since October 2021. Daryl Fairweather, Redfin’s chief economist, says while still elevated, the current slowdown in rent growth could be anticipatory on the part of landlords in reaction to overall inflation. (The Consumer Price Index saw its biggest annual gain since 1981 in May, according to the U.S. Bureau of Labor Statistics). “Rent growth is likely slowing because landlords are seeing demand start to ease as renters get pinched by inflation,” says Fairweather. “With the cost of gas, food and other products soaring, renters have less money to spend on housing.” “This slowdown in rent increases is likely to continue, however rents are still climbing at unprecedented rates in strong job markets like New York …

MCKINNEY, TEXAS — AHV Communities will develop a 157-unit single-family rental project in the northern Dallas suburb of McKinney. The development will sit on a 38-acre site along U.S. Highway 380 and will house three- and four-bedroom homes with private backyards and two-car garages. The community will offer several amenities, including a pool, fitness center, dog park, grilling and picnic areas, clubhouse and a bocce ball/game court. Construction is scheduled to begin in early 2023.

FORT WORTH, TEXAS — San Antonio-based developer Embrey has acquired a 22.9-acre site in Fort Worth for the development of a 276-unit single-family residential community. Collection Champions Circle will feature one-, two- and three-bedroom homes, as well as a pool and a clubhouse. Construction is scheduled to begin in late July or early August and to be complete in 2024. Embrey is also the general contractor for the project and will provide onsite property management services upon completion.

ROSHARON, TEXAS — Wan Bridge, a Texas-based developer of build-to-rent residential neighborhoods, is underway on vertical construction of Pradera Oaks, an 812-unit community located south of Houston in Rosharon. Pradera Oaks will offer three- and four-bedroom homes with an average size of 1,750 square feet and two-car garages. Residents will have access to a lake, jogging trail, dog park, playground and splash pad as part of the amenity package. The development team will deliver the community in phases, adding about 300 homes over each of the next three years.

ROUND ROCK, TEXAS — Ohio-based Coastal Ridge Real Estate, in a joint venture with Halstatt Real Estate Partners, will develop a 225-unit build-to-rent residential community in the northern Austin suburb of Round Rock. The site spans 20 acres within the 1,200-acre Avery Centre mixed-use development. The development will feature one-, two- and three-bedroom homes, and amenities will include a pool, resident clubhouse, walking trails, outdoor seating areas and a fitness center. Coastal Ridge will operate the community under its Stillwell brand. A formal groundbreaking ceremony will take place on Tuesday, July 19.

Build-to-RentContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastNorthmarqSingle-Family RentalSoutheastTexasWestern

Build-to-Rent (BTR) Property Type Offers Positive Demand Outlook

By Jeff Erxleben, president, debt & equity at Northmarq Liquidity and an incredibly positive outlook for single-family build-to-rent (BTR) properties is helping to offset some of the turbulence developers are experiencing from rising interest rates. Developers have been ramping up the pace of single-family BTR construction over the past five years with forecasts that call for a record high 60,000 new units to be completed in 2022. That volume shows a steady increase over the 53,000 units completed in 2021 and 49,000 in 2020, according to Northmarq’s recently released Single-Family Build-to-Rent Properties Special Report. Although financing across all property types has been impacted by upward movement in both short- and long-term borrowing rates, the BTR sector is in a good position to shake off those challenges and maintain its growth momentum. Higher construction and financing costs are being offset by rising rents with year-over-year rent increases, that in many areas of the country, are quite substantial. Developers also are finding good access to both debt and equity. The number of lenders that are active in the space is expanding as developers move into new markets and continue to prove out business models and performance with successful lease-up and dispositions. For …

LITCHFIELD PARK AND GOODYEAR, ARIZ. — Chicago-based Blue Vista Capital Management has purchased land for two build-to-rent developments in Litchfield Park and Goodyear. The transaction, representing approximately $102 million in total capitalized value, is part of Blue Vista’s ongoing strategy of providing institutional investors with access to unique and differentiated core plus residential real estate opportunities. Located near the intersection of Dysart and Camelback roads, the Litchfield Park community will offer 153 residences with 54 one-bedroom duplex units and 99 detached two-bedroom, single-family units totaling 137,043 square feet. Situated near the intersection of Sarival Avenue and Yuma Road, the Goodyear community will feature 151 units in a mix of 60 one-bedroom duplexes and 91 detached two-bedroom, single-family units totaling 132,985 square feet. Upon completion, the projects will offer more than 300 homes with secure private gated entrances, private outdoor space, simulated wooden flooring, quartz countertops, stainless steel appliances, in-unit washers/dryers and nine- to 10-foot ceilings. Community amenities will include resort-style pools, clubhouses and outdoor lounge areas with grills.

Haven Realty Capital, Yieldstreet Acquire Build-to-Rent Community in Chattanooga for $28.6M

by John Nelson

CHATTANOOGA, TENN. — Los Angeles-based Haven Realty Capital, in a joint venture with funds managed by New York City-based Yieldstreet, has closed on the first phase of a $28.6 million acquisition of Hartman Hill, a 71-home build-to-rent (BTR) residential community in Chattanooga. The Haven-led joint venture will close on the remaining homes in phases over the next seven months. Hartman Hill is being developed on a 26-acre site at 5005 Dayton Blvd. in the Red Bank neighborhood, approximately eight miles north of downtown Chattanooga. At full buildout, the property will offer three- and four-bedroom homes ranging in size from 1,538 to 2,515 square feet. Each of the two-story homes will offer custom cabinetry with soft-close drawers, quartz countertops, tile backsplashes, stainless steel appliances, private backyards and direct access garages. Common area amenities will include a sports court, bark park and a pet washing station. The new ownership will maintain the landscaping for all homes and common areas.

Affordable HousingBohlerBuild-to-RentContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Build-to-Rent Planning and Entitlements: How to Avoid Challenges

The build-to-rent (BTR) property type has gained significant traction in the commercial real estate market due to increasing interest from tenants, investors and developers. Developers moving into the BTR market before 2020 originally focused on this sector as an “in between” product for future home buyers who weren’t ready to commit to a single location but wanted additional space and amenities. The pandemic fueled tenants’ desires for more privacy and space without the long-term commitment of homeownership, which ignited growth in the sector. As costs for single-family homes continue to rise, the BTR niche also increasingly attracts would-be homeowners who are priced out of the homebuying market — and the growing demand for BTR properties draws the attention of more and more investors and developers. But not all stakeholders are immediately on board with development of BTR properties. The concept is rather new in some markets and local communities have questions about the zoning and operation of these hybrid communities, which are an intriguing mix of single-family concept and multifamily operations. Developers often need to educate municipalities about the BTR concept — and they need to plan BTR properties that work for the local community. This is where Bohler — a land …