ROSWELL, GA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $10.3 million sale of Mansell Oaks, a 43,190-square-foot shopping center in the north Atlanta suburb of Roswell. Zach Taylor of IPA represented the seller, an entity doing business as PLC Mansell LLC, in the transaction. Peachtree Industrial Partners LLLP is the buyer. Mansell Oaks’ tenant roster includes LongHorn Steakhouse, Bird Watcher Supply and Animal Emergency Center of North Fulton. “Well-located, unanchored retail strips with reasonable rents have become nearly as sought after as grocery anchored centers, and the cap rates are reflecting this demand,” says Taylor.

Retail

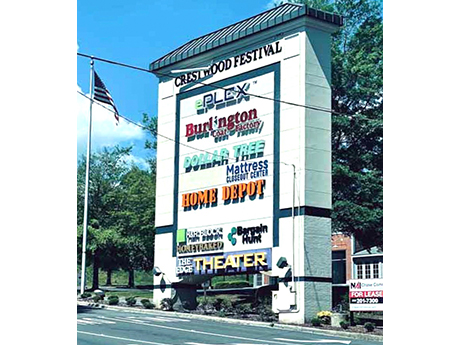

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

BARTLESVILLE, OKLA. — Locally based brokerage firm Stan Johnson Co. has negotiated the $15.3 million sale of Silver Lake Village, an 87,750-square-foot shopping center in Bartlesville, located north of Tulsa. The center was fully leased at the time of sale to 12 tenants, with T.J. Maxx, Ross Dress for Less, Petco and Ulta Beauty serving as the anchors. Margaret Caldwell and Patrick Kelley of Stan Johnson Co. represented the seller, Tennessee-based GBT Realty Corp., in the transaction. The buyer was a Florida-based 1031 exchange investor that requested anonymity.

BURLINGTON, MASS. — Locally based mortgage banking firm Fantini & Gorga has arranged $12.5 million in financing for One Wheeler Road, a 22,000-square-foot retail property located on the northern outskirts of Boston in Burlington. The undisclosed borrower will use the proceeds to redevelop One Wheeler Road and rebrand the property as Gateway Burlington. Casimir Groblewski and Colin Monahan of Fantini & Gorga placed the debt through a direct lender that also requested anonymity. Construction is underway and expected to be complete before the end of the year.

HILO, HAWAII — SRS Real Estate Partners has arranged the sale of a single-tenant retail property located at 715 Kinoole St. in Hilo. A mainland-based private investor acquired the asset from a Hawaii-based private investor for $5.5 million. Cost-U-Less, a warehouse-style retail chain store, occupies the 23,016-square-foot building, which was built in 2002. Nicholas Paulic, AJ Cordero, Matthew Mousavi and Patrick Luther of SRS Real Estate Partners’ National Net Lease Group represented the seller in the transaction.

APPLETON, WIS. — Colliers Wisconsin has brokered the sale of a 70,414-square-foot shopping center in Appleton for $12.9 million. The fully leased property is situated adjacent to the Fox River Mall near Highway 41. Some of the tenants include JoAnn Fabrics, Dollar Tree, Kirkland’s and Chili’s. Adam Connor, Mark Pucci and Heather Dorfler of Colliers represented the seller, an Appleton-based investor group. Prairie Hill Holdings, a Chicago-based private real estate investment firm, was the buyer.

BOYNTON BEACH, FLA. — PEBB Enterprises and joint venture partner Banyan Development have sold Mainstreet at Boynton, a grocery-anchored retail center in Boynton Beach that the companies delivered in 2021. The co-developers sold the 52,152-square-foot property to an entity doing business as West Parkway Realty LLC for $33 million. Danny Finkle and Eric Williams of JLL represented PEBB and Banyan in the sale, which does not include other components of the mixed-use Mainstreet development, such as its 158-unit Congregate Living Facility and numerous outparcels occupied by tenants including Wawa, Aspen Dental and Synovus Bank. Located at 6405 W. Boynton Beach Blvd. in South Florida’s Palm Beach County, Mainstreet at Boynton was fully leased at the time of sale to tenants including Sprouts Farmers Market, AT&T, Crown Wine & Spirits, F45, Capitol Carpet & Tile and GoodVets.

HUNTSVILLE, ALA. — RCP Cos. has announced plans for Anthem House, a $110 million mixed-use development in Huntsville’s new MidCity district. The property will feature 330 apartment units, 35,000 square feet of creative office space and 32,000 square feet of street-level retail space. Named for MidCity’s music theme, Anthem House will offer a “residential-meets-hospitality housing solution” with furnished units, shorter lease contracts and hotel-like surroundings and amenities. Most of the major aerospace companies have a presence in Huntsville, which is home to regional employers including U.S. Army post Redstone Arsenal and Cummings Research Park. Additionally, the city offers twice the amount of government jobs per capita than any other city in the country. Huntsville’s workforce demographics feature many remote and contract workers who greatly prefer the multifamily-hospitality niche for their housing. “Currently, Huntsville has a housing deficit that is accentuated by the continued job growth in the market,” says RCP co-founder Max Grelier. “The shift in consumer preferences, particularly among millennials, is driving demand for more hospitality features within real estate projects, including more amenities, hosting events and activities which bring residents together.” U.S. News & World Report named Huntsville as the best place to live in the United States …

ALGONQUIN, ILL. — FunCity Adventure Park has signed a 35,549-square-foot retail lease to open at River Pointe in the northwest Chicago suburb of Algonquin. The location will be FunCity’s 25th nationwide. FunCity is an indoor entertainment concept that offers activities such as trampolines, laser tag, foam pits, bumper cars, arcades and party rooms. River Pointe is a shopping center anchored by Jewel-Osco. KeyPoint Partners represented FunCity, which currently operates in eight states.

COMMACK, N.Y. — Lidl has opened a 30,000-square-foot store at Mayfair Shopping Center, a 222,000-square-foot regional power center in Commack, located on Long Island. The German discount grocer will backfill a space previously occupied by Stein Mart, which filed for Chapter 11 bankruptcy in 2020. Mayfair Shopping Center’s tenant roster includes Planet Fitness, Runway Clothing, The Crushed Olive and Bagel Toasterie, among others. Levin Management Corp. represented the landlord in the lease negotiations.