WARREN, MICH. — Family Dollar has signed a 10,500-square-foot retail lease to open a store at Village Plaza in Warren, about 20 miles north of Detroit. Located at the northwest corner of 13 Mile and Mound roads, Village Plaza spans roughly 100,000 square feet. Michael Murphy and Bill McLeod of Gerdom Realty & Investment represented the landlord, Shango Enterprise Group. Scott Sonenberg of Landmark Commercial Real Estate Services represented Family Dollar.

Retail

Blue West Capital Arranges $3.4M Sale of Starbucks-Occupied Property in Commerce City, Colorado

by Amy Works

COMMERCE CITY, COLO. — Blue West Capital has arranged the $3.4 million sale of a single-tenant retail property in Commerce City, approximately six miles northeast of downtown Denver. Brandon Gayeski and Robert Edwards of Blue West Capital represented the seller, a Colorado-based partnership. The buyer was a 1031 exchange investor based in Colorado. The 2,340-square-foot property features a drive-thru and was constructed in 2020. Located at 4860 East 60th Ave., Starbucks Coffee occupies the property on a long-term lease.

ROUND ROCK, TEXAS — Edge Realty Partners has arranged the sale of Round Rock Crossing, a 245,592-square-foot shopping center in the northern Austin suburb of Round Rock. Built in phases on 31.5 acres between 2004 and 2006, the eight-building property was 52 percent leased at the time of sale to 18 tenants. The roster includes Best Buy, Michael’s, Dollar Tree, Vitamin Shoppe, Five Guys and Salons by JC. Mart Martindale and Brandon Beeson of Edge Realty Partners represented the undisclosed seller in the transaction. The buyer, Los Angeles-based BH Properties, intends to execute a value-add program at Round Rock Crossing.

Nella Holdings, Tower Investments Buy 371,114 SF Nut Tree Plaza in Vacaville, California

by Amy Works

VACAVILLE, CALIF. — Nella Holdings and Tower Investments, two local family-owned companies, have acquired Nut Tree Plaza in Vacaville. A partnership managed by Dallas-based Dunhill Partners sold the asset for $124.5 million. Located at 1621 E. Monte Vista Ave, the 371,114-square-foot Nut Tree Plaza features 68 retail stores, 17 restaurants and outdoor attractions, including a kiddie train. Current tenants include Nordstrom Rack, ULTA Beauty, Best Buy, PetSmart, Five Below, Cost Plus World Market, HomeGoods, Old Navy, Buffalo Wild Wings, Michaels, Bevmo!, Panera Bread, Peet’s Coffee, See’s Candies, Jelly Belly Candy Store and Jamba Juice. At the time of sale, the property was 96 percent occupied. Dunhill Partners will provide property management services for the retail center. Jimmy Slusher, Philip Voorhees and James Tyrrell of CBRE’s National Retail Partners – West represented the seller, a partnership managed by Dallas-based Dunhill Partners, while DCA Partners facilitated the relationship between the buyers. Citibank and Wells Fargo financed the transaction.

MOUNT PLEASANT, S.C. — Baltimore-based Continental Realty Corp. (CRC) has purchased Sweetgrass Corner, a nearly 90,000-square-foot neighborhood shopping center in Mount Pleasant. New Market Properties, a subsidiary of Atlanta-based Preferred Apartment Communities Inc, sold the property for $17 million. The buyer purchased the property on behalf of Continental Realty Fund V L.P., and a co-investment vehicle related to Fund V, which are both managed by CRC. Built in 1999, Sweetgrass Corner features 13 tenants offering a mix of medical and personal care services, as well as sit-down and fast-casual restaurants. The site was formerly anchored by a BI-LO supermarket that was shuttered as part of a strategic decision by its parent company in 2019. Located at 1909 N Highway 17, the center is adjacent to Mount Pleasant Towne Centre, a 510,000-square-foot regional shopping venue acquired by CRC in 2020. The property is also situated on approximately 10 acres between North Highway 17 and Hungry Neck Boulevard.

HINESVILLE AND BRUNSWICK, GA. — Marcus & Millichap has arranged the sale of two shopping centers in South Georgia for the combined sales price of $7.7 million. The two properties include Veterans Square in Hinesville and Canal Crossing in Brunswick. Constructed in 2018, Veterans Square is located on West Oglethorpe Highway. The property was fully leased at the time of sale to three tenants: Krispy Kreme, Mad Vapes and McAlister’s Deli. Built in 2018, Canal Crossing is located adjacent to the Sam’s Club in Brunswick. The center was fully leased at the time of sale to four tenants: Five Guys, Tropical Smoothie, Great Clips and Fuse Frozen Yogurt. Harrison Creason, Andrew Margulies and Benjamin Kapinos of Marcus & Millichap represented the seller, a limited liability company. John Leonard, Marcus & Millichap’s broker of record in Georgia, assisted in closing this transaction. The buyer was not disclosed.

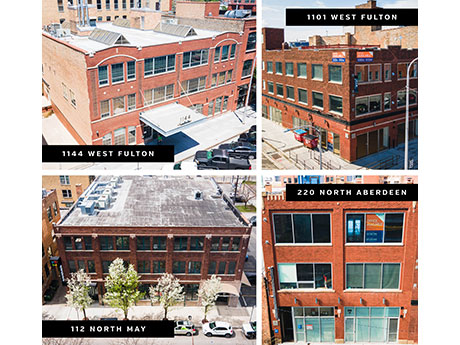

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

SEVILLE, OHIO — Sheetz Inc., a gasoline station, convenience store and coffee shop chain owned by the Sheetz family, has purchased a vacant lot at 350 Center St. in Seville, about 40 miles south of Cleveland. The nearly 12-acre site sold for $1.2 million and will be custom-built for Sheetz. Jerry Fiume and Aaron Davis of SVN Summit Commercial Real Estate Advisors brokered the sale. The seller was undisclosed.

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesMarket ReportsMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ First-Quarter 2022 Economic Rundown by Sector

Lee & Associates’ newly released Q1 2022 North America Market Report scrutinizes first-quarter 2022 industrial, office, retail and multifamily outlooks throughout the United States. This class-by-class review of commercial real estate trends for the first quarter of the year focuses on how real estate is adjusting to long-term post-COVID attitudes. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city), but the overviews offered below provide sweeping looks at the overall health and obstacles for four major commercial real estate sectors. Industrial: Rents Pushed on Strong Demand Strong demand for industrial space throughout North America continued in the first quarter as vacancies fell to record lows and rent growth hit double digits. First quarter net absorption in the United States totaled 92.8 million square feet, which was up 25 percent year over year but down 35 percent from the 143-million-square feet average of the last three quarters of 2021. Annualized rents rose 10.1 percent in the U.S. and the average vacancy rate fell to 4.1 percent. Part of this trend was due to a pause in new construction starts early in the pandemic. However, …

CHATTANOOGA, TENN. — SRS Real Estate Partners has brokered the sale of East Ridge Crossing, a 58,950-square-foot, Food Lion-anchored shopping center in Chattanooga. Hancock White Columns Inc. purchased the property for an undisclosed price. Kyle Stonis and Pierce Mayson of SRS represented the undisclosed seller in the transaction. Tyler Matthews of Austin Sumner Properties represented Hancock White Columns. Built in 1988 and renovated in 2021, East Ridge Crossing was 91 percent leased at the time of sale to national retailers, including e-commerce-resistant service providers. The property is situated about seven miles southeast of downtown Chattanooga and just west of Interstate 75.