PHOENIX — Wespac Construction has broken ground for the construction of Sprouts Farmers Market headquarters, a mixed-use campus in north Phoenix. Trammell Crow Co. is developing the project, which was designed by RSP Architects. Keyser and JLL are handling brokerage services for the project. Located within CityNorth near 56th Street and Loop 101, the 180,000-square-foot campus will feature a four-story, 144,500-square-foot Class A office building, a 25,000-square-foot flagship Sprouts grocery store, 11,000 square feet of high-end retail and restaurant space and a three-story parking garage. The campus will also offer modern amenities, including an onsite gym, yoga studio, top-floor deck, Press Coffee café, culinary kitchens, tasting rooms and a garden for chef-driven meals and community events. Sprouts will transition from its current 96,000-square-foot space to the new location by August 2026.

Retail

COSTA MESA, CALIF. — CBRE has arranged the $25.7 million sale of Westport Plaza & Square, a 39,334-square-foot shopping center located in Costa Mesa. Built in 1975 and renovated in 2002 and 2018, the center is situated on 13.7 acres. Tenants at the property — which was 97 percent leased at the time of sale — include Plums Café & Catering, Fleur De Lys, Crumbl Cookies, Common Thread, House of Yogurt, Massimo’s Pizza and LaserAway. Westport Plaza & Square has roughly 54 years remaining on its long-term ground lease. Jimmy Slusher, along with Megan Lanni and Shaya Northrup of CBRE’s NRP-West team, represented both the seller, Newport Beach-based Space Investment Partners, and the buyer, Asana Partners, in the transaction.

Evergreen Devco Completes Construction of Multi-Tenant Retail Buildings in Frederick, Colorado

by Amy Works

FREDERICK, COLO. — Evergreen Devco has completed construction of site infrastructure and two multi-tenant retail buildings at Silverstone Marketplace, a 35-acre shopping center located at Highway 52 and Colorado Boulevard in Frederick. A 123,000-square-foot King Soopers Marketplace, including a French bakery, apparel, fuel station and drive-thru pharmacy, anchors the development. The location is the first King Soopers in Frederick. Silverstone Marketplace also includes 20,000 square feet of shop buildings that are 93 percent leased. Currently signed tenants include Wingstop, Club Pilates, Domino’s Pizza, Cold Stone Creamery, Great Clips, Blue Sky Nails & Lash, Five Guys, Pacific Dental and Chipotle. Chase Bank, Wendy’s and Valvoline will occupy pad sites, starting in early 2026, at the property. G3 Architecture served as architect, Galloway provided civil engineering design, Mark Young Construction handled site work and Epic Construction served as contractor for the shop buildings.

BOLINGBROOK, ILL. — Brookline Real Estate has partnered with Rhino Investments Group to renovate The Promenade Bolingbrook, a 778,000-square-foot shopping center in the Chicago suburb of Bolingbrook. Brookline has been hired to oversee leasing and lead a new vision for the open-air lifestyle center with a refreshed mix of retail, service, restaurants and experiential offerings. Rhino recently acquired an interest in The Promenade Bolingbrook, which is located at Boughton Road and I-355.

WEST BLOOMFIELD, MICH. — WB Pub has signed a lease to open at the 2,625-square-foot former Smashburger space at The Boardwalk shopping center in West Bloomfield Township, a northwest suburb of Detroit. Michael Murphy of Gerdom Realty & Investment represented the landlord and tenant. The new pub will offer food as well as a full bar. Space remains available for lease at the property.

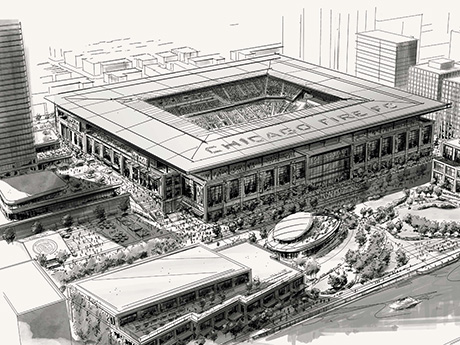

Chicago Fire FC Unveils Plans for New $650M Riverfront Soccer Stadium, Opening Set for 2028

by John Nelson

CHICAGO — The Chicago Fire FC, a Major League Soccer (MLS) franchise, has unveiled plans for a new, privately funded soccer stadium in downtown Chicago. The Wall Street Journal reports the project would cost roughly $650 million to execute. The club and its owner and chairman, Joe Mansueto, plan to debut the new stadium in spring 2028, along with a surrounding entertainment district. “Soccer is the world’s game, and a world-class city like ours deserves a world-class club — with a world-class home to match,” says Mansueto, who purchased the club in 2018. “This new home will serve as a catalyst for job creation, economic development and vibrant community life.” The Chicago Fire did not release financial terms of the development, but Mansueto says that no public funds will be used in the development of the venue, which is designed to seat approximately 22,000 fans for matches. The stadium’s seating capacity can also be expanded for concerts or other community events, according to the project’s website, DearChicago.com. The venue will be situated along the Chicago River just south of Roosevelt Road. The stadium will serve as an anchor of The 78 as it is anticipated to be Chicago’s 78th neighborhood. The …

UNC Health Pardee Breaks Ground on 39,000 SF Adaptive Reuse Clinic in Downtown Brevard, North Carolina

by John Nelson

BREVARD, N.C. — UNC Health Pardee, a health system managed by UNC Health that operates hospitals and clinics in Western North Carolina, has broken ground on a 39,000-square-foot adaptive reuse project in downtown Brevard. The developers behind the project include Riddle Development LLC, Layr LL and Osprey Capital. The team acquired the property, a 1960s-era retail strip center, for $2.6 million. Medalist Capital and United Community Bank are providing construction financing for the redevelopment, which is anticipated to cost $15 million in renovations. Upon completion, the new medical office building will feature 48 exam rooms for primary care services, a retail pharmacy, specialty rotation services, a 50-person conference and community room and a 300-person waiting room and event space. UNC Health Pardee plans to take occupancy in January.

LOS ANGELES — PSRS has arranged a $40 million loan for the refinancing of La Alameda Shopping Center, a 245,000-square-foot property located in the Los Angeles neighborhood of Walnut Park. The 18.3-acre center comprises six building clusters and features Spanish architecture, pedestrian-friendly courtyards, plaza spaces, outdoor seating and a fountain. Tenants at the property include Ross Dress For Less, CVS Pharmacy, Marshalls, Don Chente Bar & Grill, Wingstop, Dollar Tree, Chuck E. Cheese, Panda Express, GameStop, Cold Stone Creamery, Petco and Bath & Body Works. Kostas Kavayiotidis, Mike Davis and Jacob Lee of PSRS arranged the nonrecourse CMBS loan, which carries a 10-year term.

SPRING, TEXAS — Local investment and brokerage firm NewQuest has arranged the sale of Spring Park Village, a 33,060-square-foot shopping center located on the northern outskirts of Houston. Tenants include Boot Barn, Spring Park Dentistry and Jack Vape & Smoke. Dakota Workman of NewQuest represented the seller in the transaction. Marc Peeler of Partners Real Estate represented the buyer. Both parties were limited liability companies.

WAYNESBORO, PA. — CBRE has negotiates the sale of a 117,951-square-foot shopping center in Waynesboro, located in southern Pennsylvania near the Maryland border. Wayne Heights Mall was 92 percent leased at the time of sale, with German discount grocer Aldi serving as the anchor tenant. Chris Munley, Colin Behr, Ryan Sciullo, Casey Benson Smith, R.J. Mirabile and Michael Pascavis of CBRE brokered the deal. The buyer, seller and sales price were not disclosed.