FREDERICKSBURG, VA. — JLL Capital Markets has arranged joint venture equity for the development of a seniors housing community in Fredericksburg, approximately midway between Richmond and Washington, D.C. Centric Development LLC is developing the property, which will feature 106 assisted living and 36 memory care units. The three-story, 153,000-square-foot property will be situated on a 16.2-acre parcel within an established, regional medical hub. Joel Mendes, Anthony T. Fertitta Jr. and Billy Lichtenstein led the JLL Capital Markets Advisory team. Completion is scheduled for 2025.

Seniors Housing

Confluent, MorningStar Open 81-Unit Observatory Park Seniors Housing Community in Denver

by Jeff Shaw

DENVER — Project partners Confluent Senior Living and MorningStar Senior Living have completed construction of MorningStar at Observatory Park. Located in Denver’s historic Observatory Park neighborhood, the 89,900-square-foot senior living community represents the partners’ 13th joint venture across five states. The five-story, urban infill community offers 58 assisted living and 23 memory care suites as well as 47 underground parking spaces. Firms involved in the project included Hord Coplan Macht as the architect, Shaw Construction as the general contractor and Thoma-Holec Design as the interior designer.

MILWAUKIE, ORE. — Senior Living Investment Brokerage (SLIB) has arranged the sale of Clackamas View, an independent living, assisted living and memory care facility in Milwaukie, just south of Portland. The facility consists of 25 units and was built in 2012. The property totals 15,132 square feet on approximately 1.42 acres of land. The buyer was a private investor that will lease the community to a local operator. The buyer plans to spend money on capital improvements and focus on private pay residents. Jason Punzel, Brad Goodsell, Vince Viverito and Jake Anderson of SLIB handled the transaction. The seller and price were not disclosed.

MCLEAN, VA. — Sunrise Senior Living has opened Sunrise of McLean Village, a seniors housing community located at 1515 Chain Bridge Road in McLean, roughly 15 miles outside Washington, D.C. Comprising 90,000 square feet, the three-story property has the capacity for more than 120 residents and offers assisted living and memory care accommodations. Amenities at the community include a dining room and bistro with a bar, fitness center, library, two sunrooms, an activity room, hair and nail salon and a massage room. The property also features five covered porches, a large outdoor terrace, two rooftop terraces and a public-private garden. Rust | Orling Architecture served as architect, and The Whiting-Turner Contracting Co. was the general contractor for the project.

MassDevelopment Provides $129M in Bond Financing for Opus Newton Seniors Housing Project Near Boston

NEWTON, MASS. — MassDevelopment has provided $129 million in tax-exempt bond financing for the construction of Opus Newton, a 174-unit seniors housing project that will be located on the western outskirts of Boston. The borrower and developer is locally based nonprofit organization 2Life Communities. Construction began in March and is scheduled for completion in mid-2025. Opus Newton, an age-restricted complex with units reserved for renters age 62 and above, is being constructed on four acres at 777 Winchester St. The property will house 62 two-bedroom units and 112 one-bedroom apartments. Amenities will include a library, café, business center, game room, volunteer hub, convenience store, art room, fitness studio and classrooms. In addition, onsite staff will be available to coordinate home and health services based on resident needs. According to the development team, Opus Newton will meet the needs of seniors who earn too much to qualify for affordable housing units but cannot comfortably afford other high-end housing options in the area. Of the property’s 174 units, nine will be reserved for households earning 80 percent or less of the area median income. The market-rate units will partially maintain low rents by using volunteers from the community in place of some …

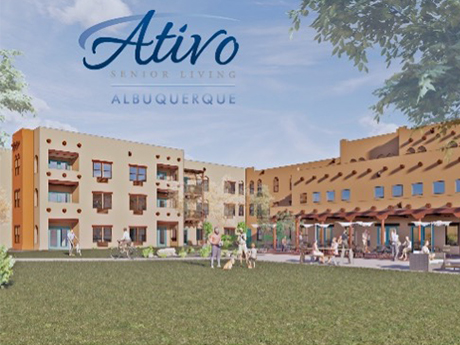

Insight Senior Living Breaks Ground on 144-Unit Ativo of Albuquerque Seniors Housing Community

by Jeff Shaw

ALBUQUERQUE, N.M. — Insight Senior Living has broken ground on Ativo of Albuquerque, a three-story independent living, assisted living and memory care community in Albuquerque. Situated on 6.5 acres, Insight Senior Living will be the operator and Link Senior Development arranged financing. Ativo of Albuquerque will offer 144 apartments. The community is scheduled to open in winter 2024.

ILLINOIS — Greystone has provided $35.7 million in HUD-insured loans for the refinancing of two supportive living facilities in Illinois. The Supportive Living Program in Illinois is an alternative to nursing home care for low-income residents who require mid-range care needs as opposed to skilled nursing. The two properties total 272 units and were built in 2004 and 2005. Eric Rosenstock of Greystone originated the loans on behalf of the borrower, Grand Lifestyles. Both loans feature 35-year terms, 35-year amortization schedules and fixed interest rates.

PHILADELPHIA — A partnership between Pennrose and the Philadelphia Chinatown Development Corp. (PCDC) has broken ground on 800 Vine Senior, a 51-unit seniors housing complex. The five-story project is being constructed at the site of a former parking lot and will house studio, one- and two-bedroom units. Six residences will be reserved for renters earning 20 percent or less of the area median income (AMI), and 20 units will be earmarked for households earning 50 percent or less of AMI. The remaining 25 units will be rented to seniors earning 60 percent or less of AMI. Amenities will include a community room, courtyard and onsite laundry facilities. Completion is slated for summer 2024.

JANE LEW, W.VA. — Senior Living Investment Brokerage (SLIB) has arranged the sale of Crestview Manor Nursing Home, a 72-bed skilled nursing facility in Jane Lew, approximately 115 miles south of Pittsburgh. The property has been family-owned since 1987 and is the only skilled nursing facility in Lewis County. The seller was a private, out-of-state owner that owned Crestview Manor for over three decades. The buyer is a publicly traded REIT utilizing an existing operating partner relationship that has collectively rapidly grown its presence throughout West Virginia. Both parties requested anonymity, and the sales price was also not disclosed. Dave Balow and Patrick Burke handled the transaction for SLIB.

KeyBank Provides $67M Acquisition Financing for Grace Peck Terrace Apartments in Portland

by Jeff Shaw

PORTLAND, ORE. — KeyBank Community Development Lending and Investment (CDLI) has provided $67 million for the acquisition and rehabilitation of the Grace Peck Terrace Apartments, an affordable seniors housing property in Portland. Grace Peck Terrace features 95 one-bedroom units for residents age 62 and older or disabled persons earning no more than 60 percent of the area median income (AMI). The borrower, Home Forward, is a developer, owner and operator of more than 9,500 affordable units in Portland and its surrounding counties. KeyBank’s CDLI group arranged a $27.2 million construction loan, a $21.3 million private placement permanent loan and Low-Income Housing Tax Credit (LIHTC) equity of $18.7 million. The project received local support and engagement through the Oregon State Affordable Housing Tax Credits and Section 8 Project-Based Rental Assistance (PBRA). Kortney Brown and Brett Sheehan of KeyBank CDLI structured the financing.