KENNESAW, GA. — Yamaha Motor Co. Ltd. has announced plans to move its U.S. headquarters to the northern Atlanta suburb of Kennesaw after nearly 50 years of operation in Cypress, Calif. Yamaha Motor, which manufactures ATVs, boat engines, jet skis and other motorized products, has a strong presence in Georgia already. The Japanese-based company employs 2,300 Georgians at its 1.3 million-square-foot factory in Newnan and its marine and motorsports divisions in Kennesaw, which includes the 75,000-square-foot Marine Innovation Center that opened in 2023. Yamaha Motor Co. will begin its corporate relocation from California to Kennesaw this year and complete the process in 2028.

Southeast

Lincoln, Principal Purchase Land Near Nashville Airport, Plan 167,133 SF Industrial Project

by John Nelson

NASHVILLE, TENN. — Lincoln Property Co. and Principal Asset Management have purchased a 13.5-acre site at 41 Rachel Road in Nashville. The buyers plan to develop Skybridge 40, a two-building, 167,133-square-foot industrial project at the site, which is located directly across I-40 from Nashville International Airport. Demolition at the site recently concluded and sitework is underway. The co-developers plan to deliver Skybridge 40 by the end of the year or early 2027. The design-build team includes Catamount Constructors (general contractor), Alliance Architects (architect) and Kimley-Horn (civil engineer). Lincoln and Principal have selected John Ward and Abigal Rieck of Cushman & Wakefield to lease the industrial project, which will comprise a 100,597-square-foot building and a 66,536-square-foot building.

ATLANTA — Locally based Third & Urban has unveiled renovation plans for the Atkins Park Collection, a 61,120-square-foot retail portfolio located in Atlanta’s Virginia-Highland neighborhood. Third & Urban purchased the first phase of the Atkins Park Collection in December 2024, which totals 35,370 square feet along North Highland and St. Charles avenues. The firm acquired the second phase, which includes Neighbors, City Church and infill pieces of the block between Greenwood and St. Charles avenues, in September 2025. In partnership with the Virginia Highland District, Third & Urban is planning more than $3 million in building and streetscape improvements for the retail shops. The firm recently completed improvements to the 842 North Highland building, which included new signage, railings and upgraded light fixtures, as well as a new front stair entry and mural. Future building upgrades for 780 North Highland will include updated facades, the addition of an indoor-outdoor courtyard with several retail suites and new food-and-beverage tenants. Construction will begin in late spring. Shelbi Bodner and Lexi Ritter of Bridger Properties will handle retail leasing for the property.

CAPREIT Acquires 157-Unit Build-to-Rent Development Underway in Woodruff, South Carolina

by John Nelson

WOODRFUFF, S.C. — CAPREIT has acquired Hart Townes, a 157-unit build-to-rent residential community located at 339 Hart Townes Way in Woodruff, about 21 miles southeast of Greenville, S.C. The seller and sales price were not disclosed. Construction began last year and is scheduled to wrap up before the end of the year. First move-ins to the community are currently underway. Homes at Hart Townes span in size from 1,570 to 1,693 square feet and include wood floors, stainless steel kitchen appliances, granite countertops, attached garages, 2.5 bedrooms and private patios. Common area amenities include a swimming pool and cabana, as well as onsite property management and maintenance.

How did The Fay hotel in Fayetteville, Ark., save $500,000 mid-construction? How are other apartment, office and mixed-use developments doing the same, across the construction cycle? Developers are increasingly turning to artificial intelligence (AI) to flip the script on the challenge of value engineering that often dumbs-down original design plans. Value engineering is almost a constant in the business: A project is designed and priced during the feasibility and entitlement stage but three, four or five years later when construction starts, prices have jumped while the budget is the same. And prices go up for many reasons, such as materials costs, labor costs or regulatory issues — even for import tariffs, as we’ve seen the past year. But maybe we’re blaming the wrong culprit in giving “value engineering” a negative connotation.Now it’s time for the procurement process to take its turn in preserving value and design. Saving despite tariffsProactive procurement led to a half-million-dollar savings for real estate investor/developer Dwellist at its Fayetteville project. Dwellist is transforming a decades-old motel near the University of Arkansas into The Fay, its first Motelier-branded property, a full adaptive-reuse. Recently, materials ordering was running into cost-overruns that risked putting the overall project over budget. …

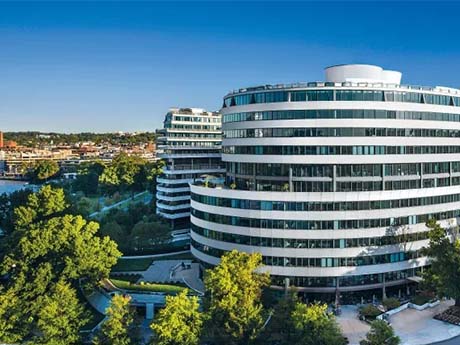

WASHINGTON, D.C. — Stream Realty Partners has arranged the sale of Watergate 600, a 12-story, 316,000-square-foot office building located at 600 New Hampshire Ave. N.W. in Washington, D.C.’s East End district. The buyer and sales price were not disclosed, but the Washington Business Journal reports that an affiliate of locally based Jetset Hospitality purchased the building for $52.5 million. Elme Communities, formerly known as Washington Real Estate Investment Trust, sold the property amid liquidating all of its assets and dissolving its business, according to the Washington Business Journal. Matt Pacinelli, Charlie Smiroldo and Lukas Stanat of Stream Realty represented Jetset in the transaction, while JLL represented the seller. The new owner has tapped Pacinelli, along with Tim McCarty, John Klinke and Josh McDonald of Stream Realty, to handle leasing at Watergate 600, which has a 125,000-square-foot top-block office space available. Amenities at the waterfront office building include a wraparound terrace on the seventh floor offering views of the Potomac River, a new lobby designed by LSM, new conference and event facilities, a modern fitness center and newly updated windows and elevators.

MORRISVILLE, N.C. — Foxfield has purchased 3503 Page Road, a newly built, 57,000-square-foot life sciences building located in Morrisville, about 14 miles west of Raleigh. The seller and sales price were not disclosed. Kryosphere, a biorepository solutions and cold chain logistics user, operates the facility under a 12-year net lease. The company has invested $5 million into the specialized build-out for pharmaceutical-grade cold storage infrastructure, with plans for an additional $5 million investment for equipment upgrades, according to Foxfield. Built in 2025, 3503 Page Road is situated within the World Trade Park industrial park and offers direct connectivity to I-40, I-540 and Raleigh-Durham International Airport. The building features industrial space, lab support and research-and-development space, as well as 24-foot clear heights.

Sands Investment Group Brokers $23.4M Sale of Kroger-Anchored Center in Metro Atlanta

by John Nelson

LAWRENCEVILLE, GA. — Sands Investment Group has brokered the $23.4 million sale of River Exchange Shopping Center, a 273,023-square-foot, Kroger-anchored shopping center located in Lawrenceville, roughly 30 miles northeast of downtown Atlanta. Liam Rowan and Tyler Baughman of Sands represented the seller, a joint venture between BASH Capital, Dragonfly Investments and Baltimore-based America’s Realty LLC, and the buyer, an entity doing business as Vishal River Exchange LLC, in the transaction. SouthState Bank provided acquisition financing. River Exchange was 80 percent leased at the time of sale to tenants including Goodwill, ReStore, Citi Trends, Cato Fashions, Farmers Furniture, Subway, Riverside Pizza and Cosmetic Dental.

TAMPA, FLA. — Benderson Development has begun the transformation of 702 North Franklin Street, a 300,000-square-foot office building in downtown Tampa. The nine-story property was formerly the longtime corporate headquarters building for Tampa Electric (TECO) and Peoples Gas. Benderson has tapped CBRE to lease and market the building’s office space, while Benderson will lease the property’s 20,000 square feet of ground-level retail space. The renovations will include extensive work on the building’s façade, including new signage opportunities for future tenants, as well as interior upgrades.

DURHAM, N.C. — Atlanta Property Group (APG) has acquired North 70 Distribution Center, a 250,000-square-foot, vacant distribution facility located at 224 N. Hoover Road in Durham. This acquisition marks APG’s first industrial investment in the Durham submarket. The seller was not disclosed. Situated in Research Triangle Park along the I-40 corridor, North 70 Distribution Center spans 16 acres and features 26 dock-high doors, two drive-in doors, 22-foot clear heights, tilt-wall construction, LED warehouse lighting, parking spaces for cars and trailers and more than 3 acres of secured outdoor storage. The existing walls and office build-outs allow for single-tenant or multi-tenant configurations, with the ability to accommodate users ranging from approximately 50,000 to 250,000 square feet. Approximately 40 percent of the facility is air-conditioned.

Newer Posts