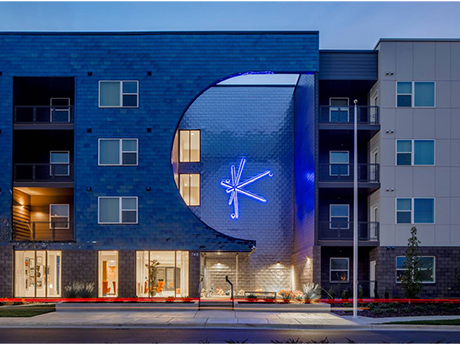

HUNTSVILLE, ALA. — Doster Construction Co., in partnership with Chicago-based developer Heartland Real Estate Partners, has completed the development of Constellation, an apartment community located in downtown Huntsville. Designed by Chicago-based Built Form Architects, Constellation features 219 luxury units in studio, one-, two- and three-bedroom layouts. Construction on the development, which is now open for leasing, began in late 2020. Rental rates at Constellation range from $1,117 to $3,709 per month, according to Apartments.com.

Alabama

MADISON, ALA. — Richmond-based Capital Square has completed the acquisition of FarmHaus Apartments, a 324-unit, Class A multifamily community in the Huntsville suburb of Madison. FarmHaus, a 22-acre property located at 1260 Balch Road, features one-, two- and three-bedroom apartments averaging 973 square feet. Amenities at the community include a pool, hot tub and spa, fitness center, business center, TV and gaming lounge, grilling station and dog park and pet spa. Capital Square acquired the property on behalf of CS1031 FarmHaus Apartments DST, an investment vehicle with plans to raise $55.9 million in equity. Craig Hey and Andrew Brown of Cushman & Wakefield represented the seller, Thompson Thrift, in the transaction. The sales price was not disclosed.

OPELIKA, ALA. — Reich Brothers, a national industrial real estate investment firm, has purchased a 1.6 million-square-foot distribution center in Opelika, a city along I-85 and near Auburn, Ala. The seller and sales price were not disclosed. The facility is the largest multi-tenant distribution center in the Auburn-Opelika market, with 96 dock positions, more than 10 leased suites and standalone buildings ranging from 50,000 to 400,000 square feet. The rail-served property services both the Kia and Hyundai automotive hubs in western Georgia and eastern Alabama, according to Reich Brothers.

MADISON, ALA. — Landmark Properties, the student housing development giant based in Athens, Ga., has broken ground on its first build-to-rent community. The property, named The Everstead at Madison, will be located in the Huntsville suburb of Madison and comprise 231 single-family and cottage-style homes. Finishes for the homes will include quartz countertops, stainless steel appliances, large pantries, hardwood-style floors, full-size washers and dryers, ceiling fans, a walk-in closet for the main bedroom and backyards with private patios. Some units will also feature an attached garage. Community amenities will include a resort-style swimming pool, fitness center, playground, fire pit, grilling area and a dog park. TSB Capital Advisors arranged financing on behalf of Landmark, which expects to deliver first homes in 2023 and complete the neighborhood in 2024.

Marcus & Millichap Brokers $44M Sale of Hills at Hoover Apartments in Metro Birmingham

by John Nelson

HOOVER, ALA. — Marcus & Millichap has brokered the $44 million sale of The Hills at Hoover, a 320-unit apartment community in Hoover, a suburb of Birmingham. Josh Jacobs and Royce Emerson of Marcus & Millichap represented the seller, a family office based in New Jersey, and procured the buyer, a Florida-based multifamily owner/operator. Built in the early 1970s, The Hills at Hoover has recently undergone a significant remodel across several interior units, according to Jacobs. According to Apartments.com, the property features one-, two- and three-bedroom apartments, as well as a business center, clubhouse, fitness center, pool, playground, tennis court and a grilling/picnic areas.

FLORENCE, ALA. — Newmark has brokered the sale of Cox Creek Shopping Center, a 142,044-square-foot retail center that spans 17.3 acres at 396-398 Cox Creek Parkway in Florence, a city in northwest Alabama along the Tennessee River. U.S. Properties Group sold the shopping center to United Properties Corp. for $24 million. Mark Joines and Drew Fleming of Newmark represented U.S. Properties Group in the transaction. Cox Creek was fully leased at the time of sale to Dick’s Sporting Goods, Field & Stream, Petco, Old Navy, Five Below and Ulta Beauty. The property sits directly across from the 675,000-square-foot Florence Mall and near major retailers including AMC Theatres, Walmart, Publix, The Home Depot, T.J. Maxx, Ross Dress for Less, Hobby Lobby, Kohl’s, Academy Sports + Outdoors, Dillard’s and Belk.

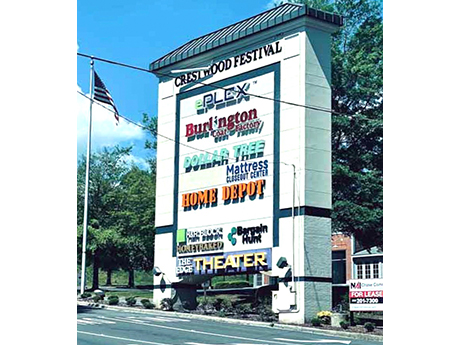

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

HUNTSVILLE, ALA. — RCP Cos. has announced plans for Anthem House, a $110 million mixed-use development in Huntsville’s new MidCity district. The property will feature 330 apartment units, 35,000 square feet of creative office space and 32,000 square feet of street-level retail space. Named for MidCity’s music theme, Anthem House will offer a “residential-meets-hospitality housing solution” with furnished units, shorter lease contracts and hotel-like surroundings and amenities. Most of the major aerospace companies have a presence in Huntsville, which is home to regional employers including U.S. Army post Redstone Arsenal and Cummings Research Park. Additionally, the city offers twice the amount of government jobs per capita than any other city in the country. Huntsville’s workforce demographics feature many remote and contract workers who greatly prefer the multifamily-hospitality niche for their housing. “Currently, Huntsville has a housing deficit that is accentuated by the continued job growth in the market,” says RCP co-founder Max Grelier. “The shift in consumer preferences, particularly among millennials, is driving demand for more hospitality features within real estate projects, including more amenities, hosting events and activities which bring residents together.” U.S. News & World Report named Huntsville as the best place to live in the United States …

Mag Mile Capital Arranges $63M Refinancing of Gulf Coast Hotel Portfolio in Alabama, Florida

by John Nelson

CHICAGO — Mag Mile Capital has arranged a $63 million CMBS loan for the refinancing of a portfolio of nine hotels in the Gulf Coast region of Alabama and Florida. The borrower is A&R Hospitality, an institutional hospitality owner and developer based in Gulf Shores, Ala. The direct lender was not disclosed. The 10-year loan features cash-out proceeds, a loan-to-value ratio of 60 percent, 30-year amortization schedule and four years of interest-only payments. The assets include five hotels in Gulf Shores: Beachside Resort Hotel, Motel 6, Quality Inn, Red Roof Inn and Staybridge Suites. The other four assets include Fairfield Inn & Suites in Orange Beach, Ala.; Home2 Suites in Daphne, Ala.; Home2 Suites in Mobile, Ala.; and Red Roof Inn in Pensacola, Fla.

MADISON, ALA. — KIRCO has delivered and opened Madison Crossings, an independent living and memory care seniors housing community in Madison, about 10 miles from downtown Huntsville. Phoenix Senior Living operates the community, which features an outdoor swimming pool, wellness center, dining experience, pub, beauty salon and spa, yoga studio, outdoor pickleball and bocce ball courts. Madison Crossings comprises 105 independent living apartments and 27 memory care residences. The property represents the 10th seniors housing facility in Alabama operating under the Phoenix Senior Living brand. KIRCO MANIX, a third-party construction services firm and affiliate of KIRCO, completed the construction for Madison Crossings.