WASHINGTON, D.C. — JLL Capital Markets has brokered the $95 million sale of 1099 New York Avenue, an 11-story office building located in Washington, D.C. Situated four blocks away from the White House, the property totals 180,878 square feet. The building, which was 95 percent leased to eight tenants at the time of sale, features floor plates averaging 17,500 square feet. A joint venture between affiliates of Quadrangle Development Corp. and FarmView Ventures acquired the property with plans to add a fitness center and reposition the rooftop. Andrew Weir, Jim Meisel, Matt Nicholson, David Baker and Kevin Byrd of JLL represented the undisclosed seller in the transaction.

District of Columbia

Berkadia Arranges $172M Construction Financing for Residential Tower in South Florida

by John Nelson

NORTH MIAMI, FLA. — Berkadia has arranged a $172 million loan to finance the construction of ONE Park Tower by Turnberry, a residential tower located at 2411 Laguna Circle in North Miami. Scott Wadler, Alec Fox, Mitch Sinberg, Brad Williamson and Matt Robbins of Berkadia secured the financing through Bank OZK on behalf of the developer, Turnberry. Upon completion, the community will total 292 condominiums in one-, two- and three-bedroom layouts. Arquitectonica designed the 33-story building. Amenities at the property will include a beach club, fitness center, social deck, spas and concierge service. A construction timeline was not disclosed.

WASHINGTON, D.C. — Apple Hospitality REIT has acquired the AC Hotel by Marriott Washington D.C. Convention Center in Washington, D.C., for $116.8 million. Opened in 2020, the property features 234 rooms at 601 K Street NW. Amenities at the hotel include a 1,500-square-foot fitness center, rooftop bar and restaurant and ground-floor retail space. The seller was not disclosed.

WASHINGTON, D.C. — The National Retail Federation (NRF) has projected that U.S. retail sales will reach between $5.2 trillion and $5.3 trillion this year, which would mark an annual increase of 2.5 to 3.5 percent. The projection was announced today during the organization’s “State of Retail and the Consumer” webinar. The calculation excludes transactions at automobile dealers, gas stations and restaurants, focusing on core retail. Non-store and online sales are included in the figure and expected to account for roughly $1.5 trillion of spending. “The resiliency of consumers continues to power the American economy, and we are confident there will be moderate but steady growth through the end of the year,” says Matthew Shay, president and CEO of the NRF. Sales reached $5.1 trillion in 2023, marking an annual growth of 3.6 percent from 2022.

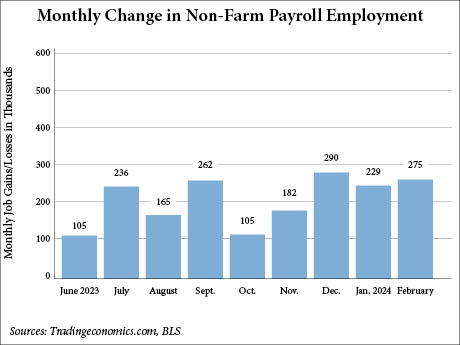

WASHINGTON, D.C. — The U.S. economy saw the addition of 275,000 nonfarm payroll jobs in February, according to the Bureau of Labor Statistics (BLS). This figure exceeds the expectations of Dow Jones economists, which CNBC reports was an increase of 198,000 jobs. The report follows chair of the Federal Reserve Jerome Powell describing the job market as “relatively tight” earlier this week. February’s employment figures are now marginally lower than those of December 2023, which were revised down by 43,000, from 333,000 to 290,000. The BLS also revised down January’s numbers by a more drastic 124,000 jobs, from 353,000 to 229,000. Of the 275,000 jobs added in February, 223,000 were in the private sector. Government employment rose by 52,000, roughly equivalent to the average monthly gain of 53,000 over the prior 12 months. Healthcare and food services and drinking places saw significant increases, with the addition of 67,000 and 42,000 jobs, respectively. The social assistance sector added 24,000 jobs in February, and transportation and warehousing employment rose by 20,000. In the retail trade, change was minimal overall. Merchandise, health and personal care and automotive retail contributed to the overall addition of 19,000 jobs, while losses occurred in the realm of …

Donohoe Development, Aimco Complete Final Phase of $300M Mixed-Use Development in D.C.

by John Nelson

WASHINGTON, D.C. — Donohoe Development, in partnership with Apartment Investment and Management Co. (Aimco), has opened the final phase of Upton Place on Wisconsin, a $300 million adaptive reuse project located at 4000 Wisconsin Ave. NW in Washington, D.C. The mixed-use development features 689 multifamily residences, 65 of which are income-restricted, as well as 100,000 square feet of retail space and an 800-space parking garage. AIR Communities is the property manager for the development’s two apartment communities — the 234-unit The Parc and 455-unit 4K Wisconsin. SK+I Architecture designed the residential buildings, which feature swimming pools, rooftop entertainment space, courtyards, commuter lobbies and social spaces. 4K Wisconsin will also host a 150-room pop-up hotel beginning this spring. Anchor tenants of the retail space include a 55,000-square-foot OneLife Fitness and 30,000-square-foot Lidl grocery store.

WASHINGTON, D.C. — Greysteel has arranged the $48.1 million sale of a portfolio spanning four multifamily properties in Washington, D.C. Greysteel represented the sellers, locally based real estate investors, in the separate transactions, which were completed through D.C.’s Tenant Opportunity to Purchase Act (TOPA). American Housing was the buyer. The properties include a 28-unit apartment building located at 3654 New Hampshire Ave. NW and a 43-unit apartment building located in Penn Quarter at 1126 11th St. NW, which sold for $6.6 and $8.5 million, respectively. The portfolio also includes Newton Towers, a 56-unit apartment building located in Columbia Heights at 1435 Newton St. NW and The Park Regent, a 96-unit apartment community situated at 1701 Park Road NW in Mount Pleasant. Newton Towers was sold for $13.1 million, and The Park Regent traded for $20 million.

WASHINGTON, D.C. — The Federal Trade Commission (FTC), a U.S. government entity that enforces consumer protection laws, has sued to block Kroger Co.’s (NYSE: KR) proposed $24.6 billion acquisition of Alberstons Cos. (NYSE: ACI). Announced in late 2022, the deal would mark the largest supermarket merger in U.S. history. Kroger’s current portfolio includes thousands of stores across 36 states, including stores that operate under the regional banners Fred Meyer, Fry’s, Harris Teeter, King Soopers and Quality Food Centers (QFC), in addition to its Kroger flagship. Albertsons likewise operates thousands of stores across 35 states under names including Haggen, Jewel-Osco, Pavilions, Safeway and Vons, in addition to the eponymous Alberstons shops. According to the FTC, the merger — which, if completed, would result in a portfolio of more than 5,000 stores and roughly 4,000 retail pharmacies — is “anticompetitive.” The commission alleges that executives for both supermarket chains have conceded that Kroger’s acquisition of Albertsons is anticompetitive, with one executive saying the merger is “basically creating a monopoly.” The FTC is also alleging that the deal would “lead to lower quality products and services” and threaten “the ability of employees to secure higher wagers, better benefits and improved working conditions,” according …

WASHINGTON, D.C. — Preliminary estimates from Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations show that commercial and multifamily loan originations in 2023 are down 47 percent compared to 2022. The Washington, D.C.-based organization also reports that originations in fourth-quarter 2023 declined 25 percent year-over-year but increased by 13 percent from third-quarter 2023. The association released its findings during its 2024 Commercial/Multifamily Finance Convention and Expo (MBA CREF), an annual conference that concludes today. Loan volume declined for every property sector and investor type that MBA tracks in 2023. By property type, originations for healthcare properties decreased 67 percent compared to 2022; office properties decreased 65 percent; industrial properties decreased 49 percent; multifamily properties decreased 46 percent; retail properties decreased 27 percent; and hotel properties decreased 10 percent. Among investor types, originations for depositories (i.e. banks and credit unions) decreased 64 percent; originations for investor-driven lenders decreased 51 percent; loans for life insurance companies decreased 39 percent; loans for government-sponsored enterprises, including Fannie Mae and Freddie Mac, decreased 21 percent; and CMBS loans decreased 21 percent.

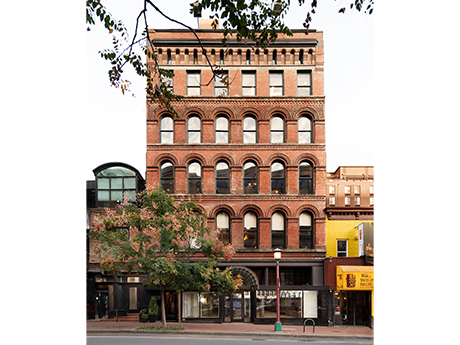

WASHINGTON, D.C. — Marx Realty has delivered The Grogan, a repositioned office building located at 819 7th St. NW in Washington, D.C.’s East End. The New York City-based developer purchased the 21,000-square-foot property in 2018. The renovated asset includes a new façade, canopy and entryways, as well as an upgraded lobby and mezzanine space of the penthouse that includes a café, delineated seating and access to a private terrace. Built in 1891, The Grogan features 12- to 15-foot wood ceilings, exposed brick, wood columns and arched windows, all of which have Marx Realty has restored.