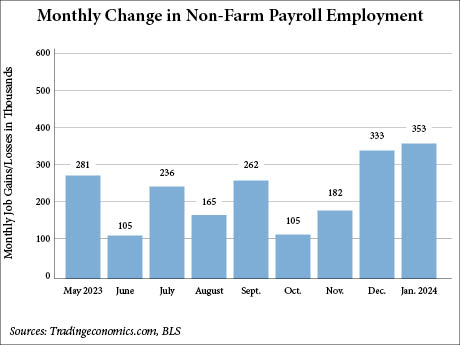

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 353,000 jobs in January, according to the U.S. Bureau of Labor Statistics (BLS). This hike nearly doubled the increased predicted by Dow Jones economists, who forecasted an increase of 185,000 jobs, reports CNBC. The unemployment rate held steady at 3.7 percent for the third month in a row. The BLS also made hefty revisions to its calculation of jobs gained in December 2023. The bureau revised December’s gains to 333,000, an increase of 117,000. The BLS also revised November jobs up by 9,000 jobs to 182,000. The average monthly gain in 2023 was 255,000. Employment growth in January was led by the professional and business services sector, which added 74,000 jobs last month. This far exceeds the sector’s average monthly gain of 14,000 jobs in 2023. Other industries that saw increases in January include healthcare (70,000), retail trade (45,000), government (36,000), social assistance (30,000) and manufacturing (23,000). Employment declined in the mining, quarrying and oil and gas extraction industry. The better-than-expected jobs report comes on the heels of the U.S. economy’s gross domestic product (GDP) posting a 3.3 percent annualized growth rate in fourth-quarter 2023. CNBC reports that …

District of Columbia

The Washington, D.C., metro area, known for its steady and stable economic foundation, stands at the forefront of a transformative period in the U.S. commercial real estate market. Amid the backdrop of an evolving macroeconomic market, it’s essential to recognize the adaptability and resilience of the metro D.C. area’s multifamily market. While recent capital market fluctuations continue to impact asset pricing across multiple sectors, the region’s fundamentals and property level performance have remained strong. According to Berkadia’s third-quarter multifamily market report, rent is up 3.6 percent in the District. Many properties are experiencing strong rent growth, which is anticipated to continue as there is a complete lack of future supply and the bulk of the apartment supply has delivered and is currently in lease-up. While some regions have headwinds that are cause for some investor caution, particularly regarding regulatory concerns, other areas like Northern Virginia are capturing significant interest from buyers and showcasing the region’s ability to still command buyer demand. This is, in many ways, the recurring narrative for the D.C. metro region: resilience supported by concrete fundamentals. Strong foundation In the D.C. metro area, the decline in supply is highly likely to continue to drive a noteworthy increase …

WASHINGTON, D.C. — Jefferson Apartment Group (JAG) and The Fortis Cos. have delivered J. Coopers Row, a 312-unit multifamily development located in the Capitol Riverfront submarket of Washington, D.C. Situated at 1319 S. Capitol St. SW, the building stands at 110 feet across 12 stories. Apartments at the property range from 444 to 1,850 square feet in one-, two- and three-bedroom layouts. Amenities at the development include a rooftop swimming pool, outdoor lounge areas, penthouse-level sky lounge, fitness center, coworking area, maker space, dog run, pet spa and 24-hour concierge service. The community is located one block from the Navy Yard-Ballpark Metro station and is proximate to Audi Field, The Yards, The Boilermaker Shops, the Navy Yard, the Southwest Waterfront and The Wharf.

WASHINGTON, D.C. — The U.S. hotel sector posted its highest average daily rate (ADR) and revenue per available room (RevPAR) on record, according to 2023 data from CoStar. ADR ended the year at $155.62, a 4.3 percent increase compared to year-end 2022, and RevPAR settled at $97.97, a 4.9 percent hike from 2022. Additionally, the U.S. hotel industry enjoyed its highest occupancy levels since 2019. The occupancy rate at year-end was 63 percent, a 60-basis-point increase year-over-year. Among the top 25 markets tracked by CoStar, New York City experienced the highest occupancy rate (81.6 percent, up 8.8 percent year-over-year), ADR ($301.22, up 8.5 percent) and RevPAR ($245.77, a 18.1 percent hike). New Orleans and Miami recorded the only RevPAR decreases, falling 6.8 percent and 6.7 percent year-over-year, respectively.

Avison Young to Acquire Madison Marquette Retail Platform, 6.1 MSF Management Portfolio

by John Nelson

TORONTO AND WASHINGTON, D.C. — Avison Young has entered into an agreement to acquire Madison Marquette’s retail platform for an undisclosed price. The acquisition will include the Washington, D.C.-based firm’s retail property management, marketing and leasing services throughout the United States; and a portfolio comprising more than 6.1 million square feet of properties managed and leased by Madison Marquette. Madison Marquette teams will integrate with those of Toronto-based Avison Young in Los Angeles, New Jersey, Philadelphia, Indiana, Arkansas, Maryland, Virginia, Atlanta and Florida, and the acquisition expands Avison Young’s presence to Seattle. In 2022, Avison Young acquired Madison Marquette’s office and industrial property management, agency leasing and project management service lines. “Avison Young is going all-in into the retail sector, and I am eager to take the firm’s vision of expanding its retail platform to the next level with the help of our strong team of retail leasing, management, marketing and market intelligence experts and Avison Young’s innovative data capabilities,” says Gavin Farnam, principal and managing director of U.S. retail services with Madison Marquette. Farnam will lead Avison Young’s U.S. retail property management and leasing teams.

WASHINGTON, D.C. — Red Oak Capital Holdings has provided a $5.8 million bridge loan for Hawaii Avenue Apartments, an affordable housing property located at 89 and 93 Hawaii Ave. NE in Washington, D.C.’s Brookland neighborhood. The borrower, an entity doing business as Legacy Lofts II & III, will use the funds to acquire and rehabilitate the property into 22 apartments that will be rented under the D.C. Housing Authority’s Choice Voucher Program. The project involves converting the vacant units at the two buildings into 12 two-bedroom and 10 three-bedroom apartments with projected monthly rents of $2,439 and $3,256, respectively. The rehabilitation is expected to be finished within a year, with full stabilization by late 2025, according to Red Oak Capital. The interest-only loan carries a 12-month term with two six-month extension options and an all-in interest rate of 11 percent. The financing was underwritten based on the property’s forecast stabilized value of $8 million.

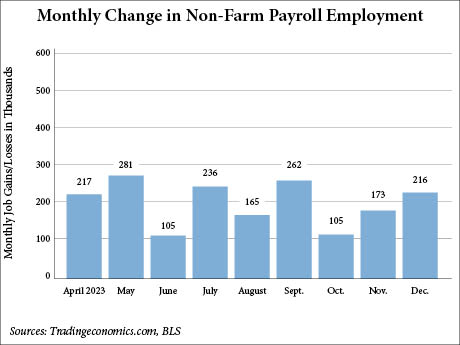

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 216,000 jobs in December 2023, according to the U.S. Bureau of Labor Statistics (BLS). This jump significantly exceeds the one predicted by Dow Jones economists, who expected an increase of 170,000, according to CNBC. This number falls slightly below the 2023 monthly average increase of 225,000, and the unemployment rate remained unchanged at 3.7 percent. Government employment comprised a significant portion of the total, with 52,000 positions added. Growth occurred primarily at a local level as municipal governments added 37,000 jobs, whereas the federal government added 7,000. The BLS calculates the monthly average for government employment growth in 2023 was 56,000 jobs, which is more than double the average of 23,000 in 2022. Ryan Severino, managing director, chief economist and head of U.S. research at BentallGreenOak (BGO), says that government entities were challenged in 2022 because workers had the upper hand in the labor market as the private sector was actively hiring across various categories, which led to more mobility for employees. He says the government sector experienced a market correction of sorts in 2023. “People aren’t leaving jobs as quickly as they once were, and the slowdown …

WASHINGTON, D.C. — Retail spending in November aligned with expectations and portends a strong holiday season, reports the National Retail Federation (NRF). Citing information for November provided by the U.S. Census Bureau, the NRF says that core retail sales — excluding automobile dealers, gasoline stations and restaurants — were up 3.3 percent year-over-year on a three-month moving average. According to the bureau, overall retail sales in November were up 4.1 percent year-over-year. The NRF predicts that holiday retail sales, which fall between Nov. 1 and Dec. 31, will meet the federation’s forecast and increase between 3 percent and 4 percent relative to 2022, reaching between $957.3 billion and $966.6 billion. The Wall Street Journal reports that the deceleration of inflation might “make consumers feel better” and “weigh on retail revenue.” The consumer price index (CPI) slipped from 3.2 percent in October to 3.1 percent in November, according to the U.S. Bureau of Labor Statistics.

State of Play, Brookfield Properties to Open 8,546 SF Flight Club Darts Entertainment Venue in D.C.

by John Nelson

WASHINGTON, D.C. — “Eatertainment” operator State of Play plans to open an 8,546-square-foot Flight Club darts venue in Washington, D.C. Scheduled to open summer 2024 and marking the 13th location for the brand, Flight Club D.C. will be situated at 641 New York Ave. NW within 655 New York, a 756,000-square-foot mixed-use development by Brookfield Properties. Other tenants at 655 New York, which features 79,000 square feet of retail space, include Rumi’s Kitchen, Capital Burger, Pearl’s Bagels, Kinship, Metier and Compass Coffee.

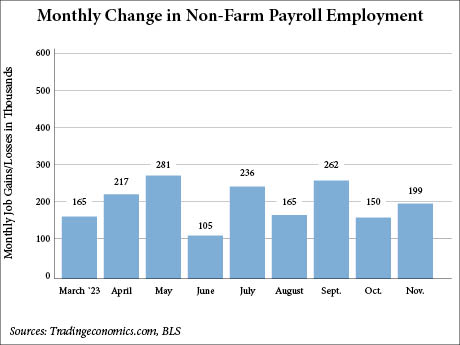

WASHINGTON, D.C. — Total nonfarm employment in the United States rose by 199,000 jobs in November, according to the U.S. Bureau of Labor Statistics (BLS). CNBC reports that the figure slightly beats estimates from Dow Jones economists who predicted an increase of 190,000. This also marks an increase from the 150,000 jobs gained in October but below the average monthly gain of 240,000 over the prior 12 months. Private sector employment constituted 150,000 of the added jobs, with 49,000 jobs added in the government. Healthcare saw a significant increase, with the addition of 77,000 jobs, above the average monthly gain of 54,000 over the prior 12 months. The manufacturing and leisure and hospitality industries added 28,000 and 40,000 jobs, respectively, and the social assistance sector saw a more modest increase of 16,000. Employment in information and transportation and warehousing changed little, and retail trade employment declined by 38,000 jobs. The U.S. unemployment rate in November fell to 3.7 percent from 3.9 percent in October, beating expectations from Dow Jones economists who forecasted the rate would remain unchanged. Employment numbers for September and October saw minimal revisions. The BLS revised September job gains down by 35,000 from 297,000 to 262,000, and …