WASHINGTON, D.C. — Marcus & Millichap has brokered the sale of a 26-unit apartment building located at 2724 11th St. NW in the Columbia Heights neighborhood of Washington, D.C. The transaction follows a decade of legal disputes and a Chapter 11 bankruptcy filing by the seller. Nick Murray, Marty Zupancic and John Slowinski of Marcus & Millichap arranged the sale. The undisclosed buyer plans to implement a redevelopment at the property. The sales price was not disclosed.

District of Columbia

LOS ANGELES — Thorofare Capital Inc., a Los Angeles-based affiliate of asset management platform Callodine Group LLC, has provided a $125.9 million loan for a medical office portfolio in greater Washington, D.C. The portfolio comprises eight properties totaling more than 705,000 square feet, the majority of which are situated on or adjacent to hospital campuses. Thorofare Capital provided the three-year, floating-rate loan to the borrower, an investment vehicle managed by Chicago-based Harrison Street. Felix Gutnikov, Jacob Yi and Nicholas Krueger of Thorofare Capital originated the financing. John Nero, Ben Appel, Jay Miele and Michael Greeley of Newmark’s Healthcare Capital Markets Group arranged the loan.

WASHINGTON, D.C. — Newmark has arranged a 27,581-square-foot office lease at 11 Dupont, a six-story, 153,228-square-foot office building in Washington, D.C.’s Dupont Circle district. The tenant is American Enterprise Institute (AEI), a public policy think tank. Brendan Owen, Ed Clark and Max Planning of Newmark represented the landlord, The RMR Group, in the lease transaction. Mark Wooters and Aaron Pomerantz of Cushman & Wakefield represented AEI. The RMR Group recently completed a multimillion-dollar renovation to 11 Dupont.

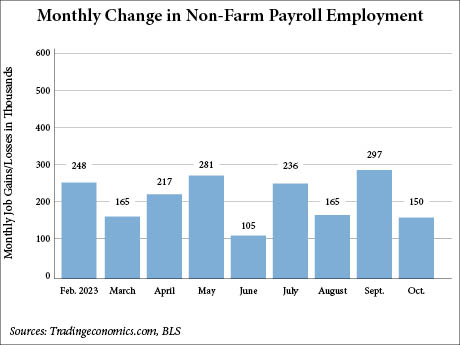

WASHINGTON, D.C. — Total nonfarm employment in the United States rose by 150,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). This figure both marks a notable decline from September, which saw the addition of 297,000 jobs, and falls short of expectations for October. Previously, Dow Jones economists predicted a rise of 170,000 for the month, reports CNBC. October’s employment gain is also below the average monthly gain of 258,000 over the previous 12 months. While the sectors of healthcare, government and social assistance saw job gains, manufacturing jobs decreased, which the BLS report attributes to strike activity. Manufacturing employment decreased by 35,000 positions, including a decline of 33,000 in motor vehicles and parts manufacturing. Healthcare, government and social assistance added 58,000, 51,000 and 19,000 jobs, respectively. Construction employment also increased, with the addition of 23,000 jobs. Leisure and hospitality and professional business services saw more modest gains, adding 19,000 and 15,000 jobs, respectively. Other industries saw minimal changes. The unemployment rate ticked up from 3.8 percent in September to 3.9 percent in October, and is the highest unemployment rate since January 2022. Some experts predict that the cooler job market reflected in the report portends …

WASHINGTON, D.C. — The RMR Group has completed the redevelopment of 20 Mass, a mixed-use building located at 20 Massachusetts Ave. in Washington, D.C. Office Properties Income Trust, an affiliate REIT of RMR Group, owns 20 Mass. The former government office building now houses the 274-room Royal Sonesta Washington, D.C. Capitol Hill hotel, which includes the new 200-seat French restaurant Bistro Du Jour; 183,000 square feet of upper-level office space; a 14,500-square-foot penthouse amenity space; and 13,800 square feet of retail space. The LEED Gold-certified property also features a new glass curtain wall façade and a 10-story atrium. The design-build team includes general contractor DPR Construction and architect Leo A. Daly. CBRE is the exclusive office leasing broker at 20 Mass, and JLL is responsible for retail leasing.

WASHINGTON, D.C. — Rockrose Development will complete the 245,000-square-foot renovation of three office properties located in Washington, D.C., this fall. Located within the Dupont Circle neighborhood, the project includes buildings located at 1900 M St. Northwest, 1146 19th St. and 1140 19th St. Together, the renovated properties will comprise “The Row on 19th.” John Skolnik and Michael Katcher of Cushman & Wakefield are exclusively leasing the project on behalf of Rockrose.

WASHINGTON, D.C. — Berkadia’s Affordable Housing division has arranged a $37.8 million low-income housing tax credit (LITHC) investment for the construction of Northwest One Phase II, an affordable housing multifamily community in Washington, D.C. Upon completion, the development will total 212 units in a mix of studio, one-, two-, three- and four-bedroom layouts for residents earning between 30 and 60 percent of the area median income (AMI), with 11 units reserved for individuals who were previously homeless. Amenities will include a business center, clubhouse, fitness center, laundry room and a game room. Berkadia secured the financing on behalf of the developer, a joint venture between MRP Realty, CSG Urban Partners and Taylor Adams Associates.

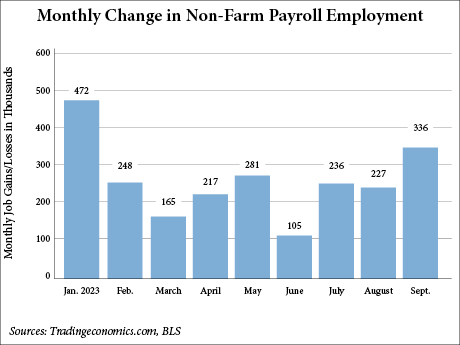

WASHINGTON, D.C. — Total nonfarm payroll employment in the United States rose by 336,000 jobs in September, reports the U.S. Bureau of Labor Statistics (BLS). According to The Wall Street Journal, this growth beats the expectations of economists and could signal another interest rate increase by the Federal Reserve before the end of the year. Sectors that experienced notable growth include leisure and hospitality, government, healthcare, professional, scientific, technical services and social assistance. Leisure and hospitality and government employment added 96,000 and 73,000 jobs, respectively, which is above the average monthly gain for both sectors. Employment in the transportation and warehousing and information sectors changed little. The unemployment rate also remained unchanged at 3.8 percent. The BLS additionally revised the employment numbers for July and August. July’s employment gain was revised to 236,000, up from 156,000 initially. The August figure was revised to 227,000, up from 187,000 initially. Together, the revisions total an increase of 119,000 jobs.

WASHINGTON, D.C. — A public-private partnership between American Campus Communities (ACC) and Georgetown University has broken ground on the redevelopment of Henle Village, an existing residence hall on the university’s campus in Washington, D.C. Following renovations, the community will offer an additional 278 beds, bringing the property’s bed count to 740. The residence hall will offer apartment-style units with kitchens and in-unit bathrooms. The project, which is expected for completion in summer 2025, is targeting LEED Platinum certification. The development team for the project includes RAMSA Robert A.M. Stern Architects and John Moriarty & Associates.

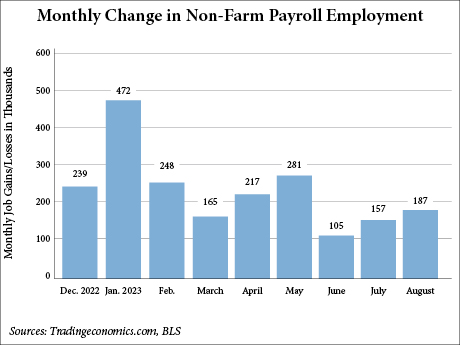

US Economy Adds 187,000 Jobs in August, Beating Expectations But Falling Below Average Growth

by John Nelson

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 187,000 in August, according to the Bureau of Labor Statistics (BLS). These findings reflect greater growth than anticipated, with economists previously predicting an increase of 170,000, according to CNBC. Despite this, 187,000 remains below the average monthly gain of 271,000 over the prior 12 months. The healthcare, leisure and hospitality and social assistance sectors added 71,000, 40,000 and 26,000 positions, respectively. Construction employment increased by 22,000, and employment in the professional and business services saw a modest increase of 19,000. Transportation and warehousing lost 34,000 jobs in August, and employment in other sectors saw little change. The unemployment rate for August is 3.8 percent, marking a 30-basis-point increase from July and the highest unemployment level since February. Additionally, the BLS significantly revised down the nonfarm employment numbers for June and July. With revisions, combined employment in the two months was 110,000 lower than previously reported. According to CNBC, the August report largely aligns with Federal Reserve’s expectations, and the central bank is expected to refrain from increasing interest rates at its September meeting. However, the Fed is expected to make a final increase for the year in October.