WASHINGTON, D.C. — Hoffman & Associates is nearing completion of The Westerly, a 449-unit apartment community in the Southwest neighborhood of Washington, D.C. Set to deliver later this year, the community will include residences in one- and two-bedroom layouts, 20,000 square feet of amenity space and 29,000 square feet of retail space. Committed retail tenants will include Good Company Doughnut Café and Apple Tree Public Charter School. Thirty percent of apartments at The Westerly will be reserved for households earning at or below 30 and 50 percent of the median family income (MFI). Amenities will include a rooftop with a pool deck, terrace, grills and lounge areas, game rooms, TV and library lounges, a 3,900-square-foot fitness center and 2,200 square feet of coworking and meeting space. Leasing at the property, which was designed by Hickok Cole, is scheduled to begin later this summer. The Westerly will be situated three blocks from The Wharf, a $3.6 billion mixed-use development that Hoffman & Associates co-developed, and one block from the Waterfront Metro station.

District of Columbia

WASHINGTON, D.C. — Walker & Dunlop has provided a $108.8 million Fannie Mae loan for the refinancing of Park Chelsea, a 429-unit apartment building located in Washington, D.C.’s Capitol Riverfront neighborhood. The borrower, WC Smith, developed the property in 2016 as the first phase of The Collective, a 1,138-unit apartment development. Brendan Coleman and Connor Locke of Walker & Dunlop originated the financing. Park Chelsea’s amenities include a leasing center, 24-hour concierge, club room/game room, library, conference room and a garden room. Additionally, residents of The Collective have access to amenities across all three phases of the project, including indoor green space with an amphitheater, a full-size basketball court, outdoor singles tennis court and coworking space.

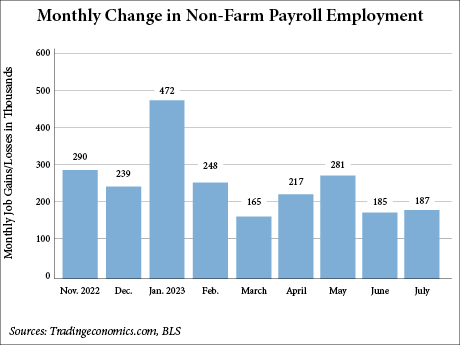

WASHINGTON, D.C. — Total nonfarm employment in the United States rose by 187,000 jobs in July, according to the Bureau of Labor Statistics (BLS). This marks slower growth than predicted by economists, reports CNBC, with the Dow Jones estimating an increase of 200,000. July’s job growth shows little change from June, which the BLS revised down by 24,000 to 185,000. Healthcare added 63,000 jobs in July and social assistance added 24,000 jobs. Employment in financial activities increased by 19,000. Construction employment also increased by 19,000 jobs, and leisure and hospitality fields showed little change, with an increase of 17,000. The unemployment rate remained steady, with a slight decrease to 3.5 percent from the 3.6 percent rate in June.

WASHINGTON, D.C. — Akridge and National Real Estate Development (National Development) have topped out Phase I of The Stacks, a 2.7 million-square-foot mixed-use development in Washington, D.C. Situated in the city’s Capitol Riverfront district and within the Buzzard Point neighborhood, Phase I of the project is dubbed Building B, which is one of three 14-story residential towers coming to the development. The first phase will feature 1,100 apartments, 35,000 square feet of retail space, 300,000 square feet of below-grade parking and loading and a 15,000-square-foot public park. General contractor Clark Construction has finished vertical construction on Building B and will now pivot to finishing concrete operations on Buildings A and C. Bank OZK provided construction financing for the project. The Stacks is jointly owned by Akridge, National Development, Bridge Investment Group, Blue Coast Capital and institutional funds managed by National Real Estate Advisors. The project team expects to fully deliver The Stacks by the end of 2025.

Arctaris Impact Investors Opens $152M Northeast Heights Opportunity Zone Office Project in Washington, D.C.

by Jeff Shaw

WASHINGTON, D.C. — Arctaris Impact Investors LLC has completed Phase I of Northeast Heights, a six-story, 281,000-square-foot office building in Ward 7 of Washington, D.C. The office building is located in a Qualified Opportunity Zone, which is an economically distressed area where new investments may be eligible for preferential tax treatment. The office building is the first phase of a three-phase, $600 million effort to revitalize Ward 7, according to Arctaris’ website. Future phases of Northeast Heights are expected to include a grocery store redevelopment, approximately 1,300 residential units and community spaces. According to Arctaris, the project was catalyzed by D.C. Mayor Muriel Bowser’s mandate for city agencies to use the leasing power of the D.C. government to encourage economic development in historically underserved communities. Northeast Heights was pre-leased to the city’s Department of General Services and will serve as the new headquarters for the agency, which employs approximately 700 people. The Department of General Services was the first city agency to sign a contract for office space east of the Anacostia River under this initiative. “Arctaris is proud to be part of the coalition led by Mayor Bowser, combining forces with like-minded, community-oriented investors to help bring new vitality …

Altus Realty to Convert Downtown D.C. Office Building Into Mint House Flexible Rental Space

by John Nelson

WASHINGTON, D.C. — Altus Realty plans to convert an 11-story office building located at 1010 Vermont Ave. NW into Mint House Downtown Washington, D.C. Set to open in early 2025, the property will encompass 85 apartment-style flexible rental units that Mint House will operate. The spaces will be designed for guests who need accommodations ranging from two days to two months. The rooms will range from studios to two-bedroom units that will include a kitchen with a stove and dishwasher, as well as washers/dryers and work spaces. Amenities will include an onsite fitness facility, meeting space and a café. Altus Realty plans to begin repositioning the former office building this fall. The property is situated near a Metro station, McPherson Square Park, The White House and DuPont Circle. This will be the first location in downtown D.C. for Mint House, which operates 25 flexible rental destinations in 16 states. Mint House recently opened locations in Dallas; Birmingham, Ala., and St. Petersburg, Fla.

WASHINGTON, D.C. — PRP has acquired Spring Valley Village, a 95,000-square-foot shopping center in Washington, D.C.’s Spring Valley neighborhood. The undisclosed seller sold the property for $47.5 million. Originally constructed in 1939 and renovated in 2017, the center comprises six buildings that were 98 percent leased at the time of sale to tenants including Crate & Barrel, Millie’s Restaurant, Capital One Bank, Starbucks, Small Door Veterinary, Compass Coffee and Blue Lane. Spring Valley Village is listed on the National Register of Historic Places.

US Retail Sales Rise in June, NRF Predicts Strong July Activity With Back-to-School Shopping

by John Nelson

WASHINGTON, D.C. — The U.S. Census Bureau reports that overall retail sales in June rose 0.2 percent from May and 1.5 percent from June 2022. Barron’s and other media outlets are reporting that economists had previously forecasted that June sales would grow 0.6 percent from May. The Wall Street Journal reports that the retail sector’s three consecutive months of positive sales activity can be attributed, in part, to inflation easing. The Consumer Price Index, the U.S. Bureau of Labor Statistics’ leading indicator for inflation, rose at an annualized rate of 3 percent in June, the lowest figure since March 2021. The National Retail Federation (NRF), a Washington, D.C.-based advocacy organization for the retail industry, expects the momentum to carry into July as consumers shop for back-to-school items. “Back-to-class spending is one of the most important shopping occasions of the year, and NRF’s consumer research shows that back-to-school and college spending is expected to set new records,” says Matthew Shay, president and CEO of NRF. “Consumers are looking for the best value and deals, and retailers are well-stocked with essential items for families and students.” The NRF’s own calculation of retail sales excludes automobile dealers, gas stations and restaurants in order …

WASHINGTON, D.C. — Texas A&M University has signed a 23,000-square-foot office lease expansion at 1620 L Street, a 171,000-square-foot office building in Washington, D.C. The university, which first signed on at the building in 2020, now occupies approximately 70,500 square feet. Doug Mueller, Evan Behr, Nathan Beach and Thomas Myers of JLL represented the landlord, DivcoWest, in the lease negotiations. Doug Damron and Chris Lucey of Newmark represented Texas A&M. Texas A&M uses 1620 L Street as a “beachhead” location for students in the D.C. area. The building houses the university’s Bush School of Government and Public Service and includes classrooms, conference rooms, study lounges, collaborative/huddle rooms, an admissions center, catering kitchen, snack and beverage stations and a 150-seat theater/lecture hall.

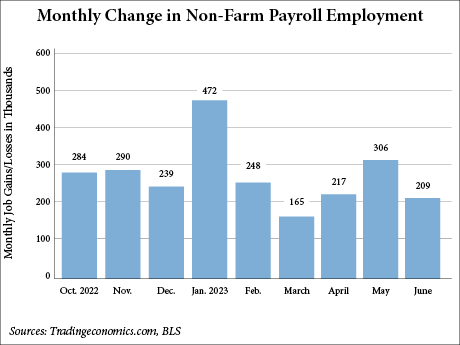

WASHINGTON, D.C. — Nonfarm employment in the United States increased by 209,000 jobs in June, according to the Bureau of Labor Statistics (BLS). The total, which is the lowest figure since December 2020 when jobs fell by 268,000, fell below estimates from economists surveyed by Dow Jones, who had predicted the economy to gain 240,000 jobs last month, according to CNBC. The unemployment rate also ticked down 10 basis points to 3.6 percent. The BLS reports the unemployment rate has ranged from 3.4 to 3.7 percent since March 2022. The June gains were nearly 100,000 fewer than the May total, which the BLS has revised down to 306,000 jobs. The BLS also revised down employment for April, with the two months combining for 110,000 fewer jobs than previously reported. Job gains for 2023 have averaged 278,000 jobs per month, which is a 43.5 percent decline from the average monthly gains of 399,000 jobs in 2022. For June, the government added 60,000 new jobs, most of which was concentrated at the state and local levels. The figure is about average for government job gains in 2023 (63,000 per month) and was the leading employment sector for the month. Government employment is …