The multifamily divisions of Fannie Mae and Freddie Mac are off to a slow start this year as the government-sponsored enterprises (GSEs), their network of lending partners and multifamily borrowers contend with rising interest rates. Fannie Mae’s volume of new multifamily business totaled $10.2 billion in the first quarter of 2023, which is a 36 percent decrease from the same period a year earlier when the agency closed $16 billion. Freddie Mac closed $6 billion in new multifamily business in the first quarter, a year-over-year decrease of 60 percent. Seasoned agency lending professionals all point to elevated borrowing costs as the primary reason for the two agencies closing less business thus far in 2023. “The rapid increase in rates across the board has really been a shock to the industry,” says Vic Clark, senior managing director and head of conventional multifamily production at Lument. At its May meeting, the Federal Open Markets Committee raised the federal funds rate to a target range of 5 to 5.25 percent. The fed funds rate is the interest rate that U.S. banks charge each other to lend funds overnight. This time a year ago, the short-term benchmark rate was at a range of 0.75 …

District of Columbia

Affordable HousingDistrict of ColumbiaFeaturesLoansMultifamilySeniors HousingSoutheastSoutheast Feature ArchiveStudent Housing

DCHFA Provides $63.2M Financing for Redevelopment of Affordable Housing Community in D.C.

by John Nelson

WASHINGTON, D.C. — The District of Columbia Housing Finance Agency (DCHFA) has provided $63.2 million in tax-exempt bonds for the rehabilitation of Worthington Woods Apartments in the Washington Highlands neighborhood of Washington, D.C. Originally built in 1944 and renovated in 2002, the property comprises 394 affordable housing apartments. The Worthington Woods Tenants Association acquired the building and selected Montgomery Housing Partnership Inc. and the Anacostia Economic Development Corp. to oversee the $133.6 million overhaul. The DCHFA also underwrote $45.5 million and $9.1 million in federal and local Low Income Housing Tax Credit (LIHTC) equity for the preservation of the affordable apartments. Additionally, the D.C. Department of Housing and Community Development is providing a $38.8 million loan from the Section 108 Loan Guarantee Program for this project. Following the redevelopment, Worthington Woods will feature units in one-, two- and three-bedroom layouts reserved for residents earning 30, 50 and 60 percent of the area median income (AMI). Amenities will include a playground, community room, laundry facilities, onsite tenant services and 156 parking spaces. Communities Together Inc. will provide resident services to tenants.

Tishman Speyer Obtains $150M Construction Loan for Mazza Gallerie Mall Redevelopment in D.C.

by John Nelson

WASHINGTON, D.C. — Tishman Speyer has secured a $150 million construction loan to fund the mixed-use redevelopment of Mazza Gallerie, an obsolete, three-story shopping mall in Washington, D.C.’s Friendship Heights neighborhood. The mall closed its last store this past Christmas, according to local media reports. RBC Capital Markets provided the financing. The reimagined development will comprise 320 rental apartments and 90,000 square feet of retail space, including 20,000 square feet of new ground-level retail space fronting Wisconsin Avenue. Tishman Speyer will maintain the mall’s 70,000-square-foot retail concourse that will once again be anchored by T.J. Maxx. The redevelopment will also maintain over 800 parking spots across four below-grade levels. Demolition of the existing structure is underway, and completion of the residential portion and first wave of new retail openings is anticipated for 2025. The project’s design-build team includes general contractors Davis Construction and Smoot Construction and architects 3XN and Eric Colbert & Associates (architect of record).

WASHINGTON, D.C. — JLL has arranged the sale of The Shay, a 245-unit apartment community located at 1924 8th St. NW in Washington, D.C.’s Shaw neighborhood. Robert Jenkins and Bret Thompson of JLL represented the seller in the transaction. The buyer, seller and sales price were not disclosed, but multiple media outlets have reported that an affiliate of Bernstein Management purchased the asset from Dweck Properties. Built in 2015 about three blocks from the Shaw-Howard University Metro station, The Shay features studio, one- and two-bedroom units with floor-to-ceiling windows, nine-foot ceilings, stainless steel smart appliances and quartz countertops. Community amenities include a heated pool with sundeck, two landscaped rooftop decks with seating and grills, catering kitchen and dining area and a fitness center.

WASHINGTON, D.C. — Whole Foods Market plans to open a new 47,000-square-foot store as part of the Parks at Walter Reed development in northwest Washington, D.C. The store, which will open on June 28, will anchor the 3.1 million-square-foot redevelopment of the historic, 66-acre Walter Reed Army Medical Center. The new Whole Foods will be located at 7130 12th St. NW in The Hartley apartment building. The grocer signed the lease with the ownership group — Hines, Urban Atlantic and Triden Development — in 2019. Whole Foods currently operates more than 500 stores in the United States, Canada and the UK.

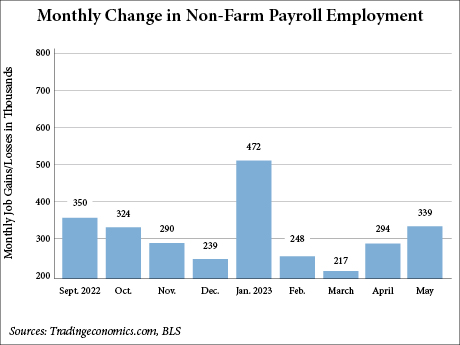

WASHINGTON, D.C. — Nonfarm employment in the United States increased by 339,000 in May, according to the Bureau of Labor Statistics (BLS), with broad-based gains led by the professional and business services sector. Economists surveyed by Dow Jones in advance of Friday’s report had expected job gains of 190,000 in May. The professional and business services sector added 64,000 jobs in May, followed by government (+56,000), healthcare (+52,000), leisure and hospitality (+48,000), construction (+25,000), transportation and warehousing (+24,000), and social assistance (+22,000). The total number of private-sector jobs added for the month was 283,000. The unemployment rate increased from 3.4 percent in April to 3.7 percent in May, and the number of unemployed persons rose by 440,000 to 6.1 million. In May, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents, or 0.3 percent, to $33.44. Over the past 12 months, average hourly earnings have increased by 4.3 percent. “Despite the increase in job growth, two data points in this report show signs of somewhat weaker labor demand,” said Mike Fratantoni, chief economist of the Mortgage Bankers Association (MBA), in a prepared statement. “Wage growth has slowed to 4.3 percent over the past 12 months, and the …

WASHINGTON, D.C. — Urban Atlantic, Triden Development Group, Hines and joint venture partner Bridge Investment Group have opened Common Clover, a fully furnished, 248-room co-living building in Washington, D.C. Situated within The Parks at Walter Reed, a 66-acre mixed-use redevelopment, the property features suites with two to five private bedrooms, fully stocked kitchens, multiple bathrooms and in-unit laundry. Amenities include coworking space, a library, rooftop deck, courtyard with grilling stations, fitness center, game room and club lounge with a bar. The building also includes 21,000 square feet of ground-floor retail space. Rental rates start at $1,207 for a 116-square-foot studio, according to Apartments.com.

With office vacancy rates in the District of Columbia at 20 percent and climbing, officials believe that converting office buildings to residential space is an important component of revitalizing downtown Washington. These complex projects pose both practical and administerial challenges, however. For developers, one important consideration of such a redevelopment is its real estate tax implications. High hopes District leaders announced earlier this year that they hope to add 15,000 residents to the central business district over the next five years – an ambitious goal. The hope is that bringing residents to live downtown will create a more vibrant neighborhood where people live, work, and dine. The stark reality is that the District of Columbia has one of the lowest return-to-office rates in the country. Actual occupancy in the D.C. metro was only 43 percent in mid-April and drops below 25 percent on Fridays, according to Kastle Systems, which tracks office occupancy. Workers simply aren’t returning to Downtown D.C. While residential conversions may be one piece of the puzzle in addressing D.C.’s downtown woes, converting an office building into a residential property is no small feat. Here are a few important factors relating to real estate taxes to keep in …

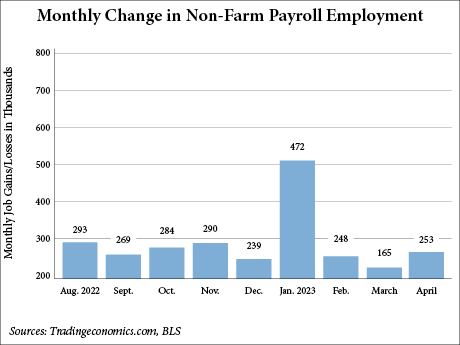

WASHINGTON, D.C. — Nonfarm employment in the United States rose by a total of 253,000 positions in April, according to the U.S. Bureau of Labor Statistics (BLS). This number reflects an increase from last month’s number, beating Wall Street Estimates of 180,000. Employment in February and March was revised down by a total of 149,000. Meanwhile, the jobless rate fell to 3.4 percent in April, matching the lowest reading since 1969. The low unemployment rate keeps upward pressure on wages, which grew 4.4 percent in April from a year earlier, according to The Wall Street Journal. That was slightly higher than a 4.3 percent annual increase in March. Sectors that saw increases in employment included professional and business services, healthcare, leisure and hospitality and social assistance. Average monthly gain in the professional and business services across the prior six months was 25,000, with April seeing the addition of 45,000 jobs. Healthcare employment increased by a comparable 40,000 positions. This is in keeping with the average monthly gain of 47,000 across the prior six months. Leisure and hospitality, social assistance and financial activities added 31,000, 25,000 and 23,000 jobs in April, respectively. Additionally, government employment increased by 23,000. This is a slowdown …

WASHINGTON, D.C. — Monument Realty, along with investment partners JRE Partners and Ghitis Property Co., has opened Sonya, a 14-story apartment community in Washington, D.C.’s NoMa district. The property’s name pays homage to the surrounding South of New York Avenue neighborhood. The 321-unit community is located at 40 Patterson St. and is bounded by First Street NE and Capital Street NE. KGD Architecture designed the property to achieve LEED Silver certification. Sonya offers a mix of studio, one-, two- and three-bedroom apartments, as well as more than 16,000 square feet of amenity space, including a rooftop pool, social club and entertainment spaces, hospitality bars and a fitness center. Rents start at $1,895 per month, according to the property website.