WASHINGTON, D.C. — International law firm Fried Frank has signed a 10-year lease extension to continue to occupy 103,000 square feet at Lafayette Tower, an 11-story office building located at 801 17th St. NW in Washington, D.C. The firm will continue to occupy floors five through eight through at least 2037. Fried Frank is an original tenant of the building, which was delivered in 2010 and is currently undergoing renovations that include updates to the fitness center and rooftop terrace, as well as the addition of an indoor lounge and event space. Kyle Luby, Matt Pacinelli and Andy Eichberg of Stream Realty Partners represented the landlord, an affiliate of Morgan Stanley Real Estate Advisor, in the lease negotiations. Chau Leung, Mark Minich Jr., Tim Dempsey, Ramneek Rickhy and Stephen Siegel of Stream Realty represented the tenant. Lafayette Tower is currently 90 percent leased, with several speculative suites available ranging from 3,900 square feet to 8,000 square feet, according to Stream Realty.

District of Columbia

Lowe, Mitsui Fudosan America Complete 492-Unit Apartment Project at Mixed-Use Redevelopment in D.C.

by John Nelson

WASHINGTON, D.C. — Lowe and joint venture partner Mitsui Fudosan America Inc. have completed Gallery 64, a 492-unit apartment building in southwest Washington, D.C. The 12-story project is the final piece of the 500,000-square-foot mixed-use redevelopment of the former Randall Junior High School, which includes the Rubell Museum DC that opened in October 2022. “The focus and inspiration for the repositioned historic Randall School is arts and culture, which is expressed in every component of the campus, including the Gallery 64 apartments,” says Mark Rivers, executive vice president of Lowe. “With specially commissioned works of contemporary art showcased throughout the building, Gallery 64 residents will be immersed in a one-of-a-kind, arts- and culture-focused living environment.” Located at 64 H Street SW, Gallery 64 features studios to three-bedroom apartments, as well as 19 two-story townhomes. The apartments feature contemporary finishes, floor-to-ceiling windows and smart thermostats, and many have private patios or balconies. Monthly rental rates range from $1,927 to $5,306, according to the property website. Gallery 64’s community amenities include a music and podcast recording studio and a programmed maker space. Rooftop amenities include a resort-style pool, fire pits, grilling stations, dining niches and a dog walk. Other amenities include game …

WASHINGTON, D.C. — Barings has provided a $101.5 million bridge loan for the refinancing of the existing construction loan on the Courtyard/Residence Inn by Marriott in downtown Washington, D.C. The dual-brand hotel opened in November of 2018 and features 504 rooms. Located across from the Walter E. Washington Convention Center, the 11-story property was developed by Quadrangle Development Corp. and Capstone Development LLC. The hotel’s amenities include a restaurant, fitness center, convenience store, meeting space, kitchen and complimentary breakfast for guests, according to the hotel’s website.

WASHINGTON, D.C. — Commercial real estate and multifamily mortgage borrowing and lending totaled $816 billion in 2022, which is an 8 percent decrease from the record $891 billion set in 2021, according to the Mortgage Bankers Association’s (MBA) 2022 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation report. The Washington, D.C.-based organization forecasted a year ago that 2022 commercial real estate and multifamily originations would exceed $1 trillion. MBA reports that the 2022 volume was the second highest annual total and represents a 33 percent increase from the $614 billion volume in 2020. Jamie Woodwell, MBA’s head of commercial real estate research, says that originations started the year off strong but got sidetracked. “[Borrowing and lending] dropped off because of rising interest rates, uncertainty about property values and increased questions about the economy and some property fundamentals,” says Woodwell. “A key question for 2023 is when the market will have stabilized enough for the logjam in new deal activity to break.” Bank lending bucked the trend, increasing by 12 percent to $409 billion. Government-sponsored entities Fannie Mae and Freddie Mac had the second highest originations volume at $128 billion, followed by life insurance company and pension funds, private label CMBS …

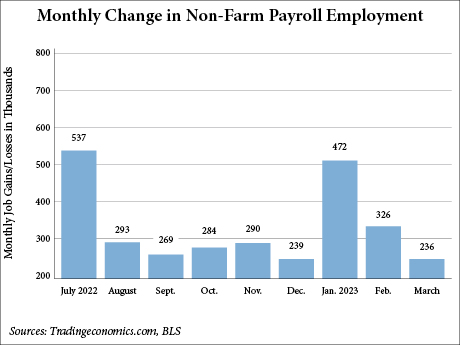

WASHINGTON, D.C. — Nonfarm payroll employment increased by 236,000 jobs in March, according to the U.S. Bureau of Labor Statistics (BLS). The number, which reflects a slowdown in growth relative to February — which saw the addition of 326,000 jobs — largely aligns with the predictions of economists. According to CNBC, the figure marks the lowest monthly gain since December 2020, following moves by the Federal Reserve to cool labor demand in the interest of combating inflation. The number also falls below the average monthly gain of 334,000 jobs for the previous six months. Leisure and hospitality added 72,000 jobs in March, 24 percent below the average monthly gain for the prior six months (95,000). Food-and-beverage represented the bulk of the growth, adding 50,000 jobs. Government and professional and business services employment grew by 47,000 and 39,000 jobs, respectively. Healthcare added 34,000 jobs, with growth in home health services, hospitals and nursing and residential care facilities. Employment in transportation and warehousing increased marginally, adding 10,000 positions. Employment in the retail trade saw a decrease of 15,000 jobs. The unemployment rate also decreased slightly, coming down to 3.5 percent from 3.6 percent. Unemployed persons totaled 5.8 million.

WASHINGTON, D.C. — Marcus & Millichap has arranged the $8 million sale of Carleton Terrace Apartments, a 32-unit multifamily community located at 2371-2377 Champlain St. NW in Washington, D.C. Built in 1915, the property, which has been owned by the seller’s family for over 100 years, totals 30,900 square feet and is situated on a 19,876-square-foot, RA-2 zoned lot. Units at the three-story building include 28 one-bedroom and four two-bedroom apartments. Dennis Cravedi and Marty Zupancic of Marcus & Millichap brokered the transaction on behalf of the seller, an entity doing business as Carleton Terrace LLC. The buyer, a private investor, purchased the property through a collaborative TOPA (Tenant Opportunity to Purchase Act) process with the current tenants.

WASHINGTON, D.C. — A joint venture between Jefferson Apartment Group and The Fortis Co. has topped out J Coopers Row, a 12-story multifamily project located at 1319 S. Capitol St. SW in Washington, D.C. Upon completion, the development will comprise 312 apartments in one-, two- and three-bedroom layouts. Ranging in size from 474 to 1,260 square feet, the units will feature stainless steel appliances, nine-foot ceilings, plank flooring and in-unit washers and dryers. Amenities at the community will include a rooftop swimming pool, gaming area, fitness center, yoga studio, coworking space, a maker’s studio, dog run, pet spa and 24-hour concierge service. The development is situated one block from the Navy Yard-Nationals Stadium Metro Station and will offer views of the Potomac River. Jefferson Apartment Group and Fortis plan to deliver J Coopers Row in the fourth quarter.

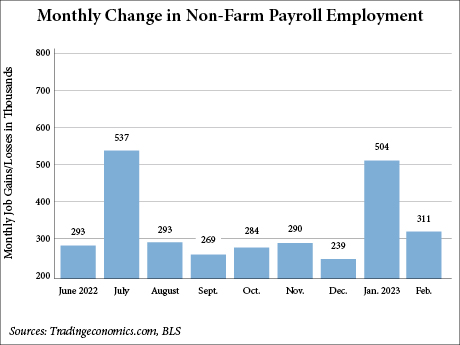

WASHINGTON, D.C. — Nonfarm employment in the United States rose by 311,000 jobs in February, according to the U.S. Bureau of Labor Statistics (BLS). This number marks a slowdown from January, in which 504,000 jobs were added to the economy, but surpassed expectations from Dow Jones economists who estimated that the economy would add 225,000 jobs in February, according to CNBC. (The January jobs total was revised down by 13,000 jobs, from 517,000 to 504,000.) The unemployment rate also experienced a slight elevation in February, reaching 3.6 percent, a 20-basis-point increase. Long-term joblessness accounted for 17.6 percent of overall unemployment, remaining relatively unchanged from previous months. Leisure and hospitality, retail, government and healthcare experienced notable job gains. Leisure and hospitality — though still below its pre-pandemic level of employment by 2.4 percent — added 105,000 jobs. Retail and government added 50,000 and 46,000 jobs, respectively. Declines in employment were observed in the information and transportation and warehousing industries, which saw a collective loss of 47,000 jobs. Carlos Vaz of CONTI Capital projects that the strong jobs reports thus far in 2023 may portend further interest rate hikes by the Federal Reserve. “Despite the decrease in job growth from the previous …

WASHINGTON, D.C., AND ROCKLEDGE, MD. — KLNB has acquired Edge Commercial Real Estate, a Rockledge-based brokerage with offices in Maryland, Virginia and Washington, D.C. The move increases the size of the Washington, D.C.-based commercial real estate brokerage firm by 20 percent and serves as KLNB’s entry into the multifamily brokerage arena. KLNB is adding 32 total employees, 18 of which are brokers who specialize in multiple facets of office, industrial, tenant representation and multifamily investment sales. Six of the brokers will be immediately installed as principal partners at KLNB. “The acquisition of Edge fits perfectly in our timeline for smart and disciplined progression,” says Marc Menick, president of KLNB. “By acquiring Edge, we will be able to do virtually everything we’re already known for, but at an even higher level and a wider reach. And in the case of multifamily, this opportunity brings the KLNB customer experience to a whole new sector that we have wanted to approach for some time.” Additionally, KLNB will fold Edge’s property management division, which oversees a 1 million-square-foot portfolio, into its KLNB Asset Services platform, a joint venture between KLNB and Divaris Real Estate. Terms of the transaction were not disclosed.

US Economy Added 517,000 Jobs in January, Nearly Tripling Expectations From Economists

by John Nelson

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment increased by 517,000 in January, while the unemployment rate fell to 3.4 percent, according to the U.S. Bureau of Labor Statistics (BLS). The monthly figure nearly triples the estimate from Dow Jones economists of 187,000 jobs, according to CNBC. Additionally, the outlet reports that the January unemployment rate is the lowest jobless level for the U.S. economy since May 1969. Just like the December report, the leisure and hospitality sector was the leading job creator in January with 128,000 new jobs. This surpasses the monthly average for the sector in 2022 of 89,000 jobs. Despite the recent gains, the leisure and hospitality industry still falls below its pre-pandemic employment level by 2.9 percent, or 495,000 jobs, according to the BLS. Government added 74,000 jobs in January, led by state government education with 35,000 new jobs. The BLS attributes the increase to the return of University of California workers after their strike ended in December. Other notable gains were seen in professional and business services (+82,000 jobs), healthcare (+58,000), retail trade (+30,000), construction (+25,000) and transportation and warehousing (+23,000). The BLS also revised its November and December jobs report summaries to the tune …