WASHINGTON, D.C. — In 2019, the Metropolitan Washington Council of Governments issued a report stating that the D.C. region — comprising the city, Northern Virginia and suburban Maryland — needed to add 320,000 more housing units between 2020 and 2030, and that at least 75 percent of this new housing should be affordable to low- and medium-income households. Rob Fossi, senior vice president of real estate development at Enterprise Community Development, says the figure has only climbed in recent years due to macroeconomic and local challenges. “In the three years since that report was issued, this demand has only intensified while supply chain interruptions, interest rate spikes and competing resource challenges precipitated by the COVID-19 pandemic have all been challenges to maintain pace,” says Fossi. Enterprise Community Development, an affiliate of Enterprise Community Partners, is the top nonprofit owner and developer of affordable homes in the Mid-Atlantic with a portfolio spanning about 13,000 apartments that house more than 22,000 residents. The firm is actively developing and preserving affordable housing across the region in order to address the demand, which Fossi says shows no signs of abating anytime soon. “There is little doubt that the demand for quality affordable housing will …

District of Columbia

Affordable HousingDistrict of ColumbiaMarket ReportsMarylandMultifamilySoutheastSoutheast Market ReportsVirginia

WASHINGTON, D.C. — Crescent Communities has broken ground on NOVEL 14th Street, a multifamily development located at 2601 14th Street NW in Washington, D.C. Upon completion, the project will feature 197 units in studio, one- and two-bedroom layouts. Amenities at the property will include a Land of a Thousand Hills Coffee & Social location, rooftop pool and clubhouse, ground-level courtyard, fitness center, coworking space and a library. The first residences are scheduled for completion in early 2025. Hord Coplan Macht is serving as architect on the project, with Streetsense providing interior design. Vika Capitol is delivering civil engineering services, Lee and Associates Inc. is providing landscape architecture and J. Moriarty & Associates is acting as general contractor.

WASHINGTON, D.C. — The National Retail Federation (NRF) has reported that retail sales during 2022’s November-December holiday season rose 5.3 percent year-over-year, reaching $936.3 billion. Though the number fell short of NRF’s predictions, which anticipated an increase of 6 to 8 percent, it represents an improvement compared with the 4.9 percent average annual holiday sales growth over the previous 10 years. The calculation, based on data from the U.S. Census Bureau, excludes automobiles, gasoline and restaurant sales and defines the holiday season as Nov. 1 through Dec. 31, 2022. “We knew it could be touch-and-go for final holiday sales given early shopping in October that likely pulled some sales forward plus price pressures and cold, stormy weather,” says Jack Kleinhenz, NRF’s chief economist. “The pace of spending was choppy, and consumers may have pulled back more than we had hoped, but these numbers show that they navigated a challenging, inflation-driven environment reasonably well.” According to the Washington, D.C.-based organization, retail sales were down 0.6 percent in December relative to November, but up 5 percent year-over-year. Overall growth for the year met NRF’s forecast, reaching 7 percent. On Wednesday, the United States Department of Commerce reported that retail sales, including automobile, …

Across the country, investors are facing some difficult hurdles. Rising interest rates, impending economic recession and rising construction costs are making it increasingly difficult for proposed deals to penicl out for investors. These issues, coupled with a swath of non-performing loans that are nearing maturity, have been the first indications we have seen of a bear market in the real estate world, and there are no signs of improvement in the near future. In times of uncertainty, we often see investors adhere to a conservative approach to investment, which normally means increased focus on core markets and assets. One area of focus in which investors have remained bullish is Washington, D.C.’s multifamily market as it continues to thrive, despite turmoil in the larger U.S. economy. Developers broke ground on new multifamily product in excess of 4,000 units for the fourth consecutive quarter, a first for the D.C. market. Multifamily sales volume has not quite matched the bull market of 2021; however, sales in 2022 still outpace most years in the metro’s history. Whether it’s construction on ground-up development of multifamily product, or the purchase of existing multifamily product, the D.C market has not shown any signs of slowing down. For …

Sustained leasing velocity for industrial/warehouse space in the Northern Virginia market, combined with the nearly insatiable demand for data center product, is contributing to developers repurposing existing business communities with this asset class to support demand, as well as companies expanding their geographic footprints into suburban Maryland and Central Virginia to secure space. This trend could be pivoting slightly due to the recent slowdown in leasing activity both locally and nationally as it relates to rising interest rates, the prospects for a looming recession and the possible end of a prolonged real estate cycle. The vacancy rate for industrial/warehouse space in the region currently stands at just over 2 percent. In the last quarter, the Northern Virginia industrial market experienced the largest pipeline in its history with more than 1 million square feet of space delivered, with nearly 5 million square feet of space in the development pipeline. The largest projects are contained within Stafford County as land in Loudoun and Fairfax counties has become unaffordable, or simply unattainable. Triple-net asking rents reached another all-time high of $12.45 per square foot in the third quarter, aided in part by these new deliveries. New space remains scarce and commands a premium, …

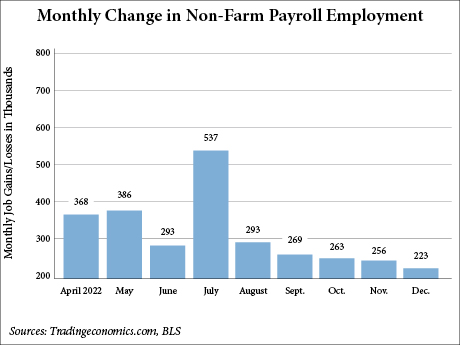

US Economy Added 223,000 Jobs in December With Leisure and Hospitality Sector Leading the Way

by Jeff Shaw

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment increased by 223,000 in December, while the unemployment rate fell to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). The leisure and hospitality industry added 67,000 jobs, leading all employment sectors. The latest employment figures released this morning beat expectations. Economists surveyed by Dow Jones had estimated the U.S. labor market grew by 200,000 jobs in December. Meanwhile, average hourly earnings for all employees on private nonfarm payrolls rose by 0.3 percent in December. Over the past 12 months, average hourly earnings have increased by 4.6 percent, coming in below the 5 percent estimate, an indication that inflation pressures could be easing. In 2022, the leisure and hospitality sector added an average of 79,000 jobs per month, substantially less than the average gain of 196,000 jobs per month in 2021. Employment in the industry remains below its pre-pandemic February 2020 level by 932,000, or 5.5 percent. Healthcare employment increased by 55,000 in December, with gains in ambulatory health care services (+30,000), hospitals (+16,000), and nursing and residential care facilities (+9,000). Job growth in healthcare averaged 49,000 per month in 2022, considerably above the 2021 average monthly gain of 9,000. …

MBA Projects 5 Percent Drop in Commercial and Multifamily Mortgage Financing in 2023, Strong Rebound in 2024

by John Nelson

WASHINGTON, D.C. — The Mortgage Bankers Association (MBA) projects that total commercial and multifamily mortgage borrowing and lending is expected to fall to $700 billion in 2023, a 5 percent decline from an expected volume of $740 billion in 2022. Multifamily lending volume alone is expected to drop to $393 billion in 2023, an 11 percent decline from an expected total of $439 billion in 2022. The projected drop in borrowing and lending reflects current market conditions. Jamie Woodwell, head of commercial real estate research for MBA, which is based in Washington, D.C., underlined that the forecast matched what the association had been hearing from commercial and multifamily mortgage finance professionals, with many indicating the Federal Reserve’s multiple interest rate increases in rapid succession have been a key factor in the projected decline in lending and borrowing activity. At its December meeting, the Federal Reserve raised the benchmark federal funds rate by half a percentage point, a smaller increase than the four consecutive three-quarter-point hikes earlier in 2022. The Fed is showing no sign of slowing rate hikes in 2023, with Chairman Jerome Powell announcing after the meeting that the central bank will continue to raise rates for quite some …

WASHINGTON, D.C. — Nonprofit organization Washington Housing Conservancy (WHC) has acquired Loree Grand, a 212-unit apartment community in Washington, D.C. In partnership with Amazon’s Housing Equity Fund and the Impact Pool, an investment vehicle managed by local developer JBG SMITH, WHC purchased the 10-story community for $71.5 million. JBG SMITH will manage the 195,000-square-foot property on behalf of WHC, which will preserve affordability for moderate- and low-income families and individuals. Bordered by D.C.’s NoMA, Union Market and H Street neighborhoods, the community features units averaging 900 square feet in size. WHC will preserve Loree Grand’s existing 30 inclusionary zoning units for 99 years, create an additional 129 affordable units for residents earning 80 percent of AMI or less and set aside the remaining 53 units for residents earning 120 percent of AMI or less. Eagle Bank provided acquisition financing for the transaction, Amazon Housing Equity Fund provided subordinate financing and Impact Pool provided mezzanine financing. Arnold & Porter provided pro bono legal counsel to WHC.

So much has been made about the future of retail in the United States. Is it dead? Is it back? How has it evolved? No doubt, retail was the sector most affected by the COVID-19 pandemic, and that is also true here in Washington, D.C. If you look at regional data, it appears to be rebounding nicely. The overall market currently boasts a near record-low vacancy rate at just 5.1 percent, according to CoStar Group. Tighter market conditions have helped landlords restore pricing power throughout the District, and asking rents and rent growth have surpassed pre-pandemic highs. When we measure by net absorption, retail demand in the region in 2022 is on pace to reach its highest level since 2016. But numbers don’t tell the whole story as the retail sector’s recovery in D.C.’s downtown market post COVID differs greatly from all of the metropolitan area’s other submarkets in a scenario that can only be described as a tale of two markets. Downtown D.C. So, what’s driving downtown retail these days? Simply, it’s the office market. Retail’s post-pandemic recovery is almost entirely dependent on office workers, and there is no more significant factor at play for its success than corporation’s …

Greysteel Brokers $76.7M Sale of Six-Property Multifamily Portfolio in Northwest D.C.

by John Nelson

WASHINGTON, D.C. — Greysteel has brokered the sale of a six-property multifamily portfolio in Northwest Washington, D.C., totaling 362 apartments. The six properties in the portfolio include Barclay, Ravenel, Park Meridian, Park Marconi, Richman Towers and Sarbin Towers. Van Metre Cos. and institutional investors advised by J.P. Morgan Asset Management sold the portfolio to four different buyers for approximately $76.7 million, three of which were sold to local nonprofit affordable housing provider Jubilee Housing. Kyle Tangney and Herbert Schwat of Greysteel represented the sellers in the transaction. Four of the assets will be preserved as affordable housing. All six properties were sold via an assignment of their respective tenant associations to third-party developers pursuant to D.C.’s Tenant Opportunity to Purchase Act (TOPA).