WASHINGTON, D.C. — Northmarq has brokered the sale of a 4,403-square-foot retail condo on the ground floor of the Metropole Condominiums located at 1515 15th St. NW in downtown Washington, D.C. Built in 2008 in the city’s Logan Circle neighborhood, the property was fully leased at the time of sale to TD Bank. Isaiah Harf of Northmarq represented the seller, a private investor based in Maryland, in the transaction. The California-based, 1031 exchange buyer acquired the asset for approximately $7.6 million.

District of Columbia

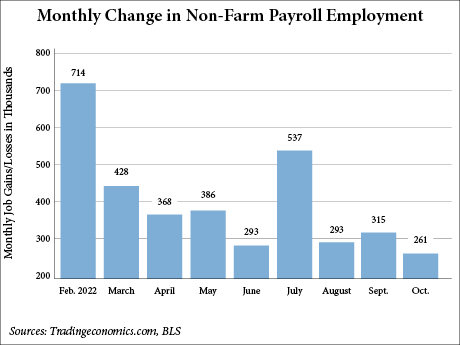

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 261,000 in October, and the unemployment rate ticked back up 20 basis points to 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). Monthly job growth has averaged 407,000 year-to-date in 2022, compared with 562,000 per month in 2021. The October performance beat the Dow Jones estimate of 205,000 but the economists expected the unemployment rate to remain at 3.5 percent, according to CNBC. Healthcare led all employment sectors in adding October jobs with 53,000, which is slightly ahead of its average monthly gain thus far this year (47,000). Professional and businesses services added 43,000 jobs in October and manufacturing grew by 32,000. Leisure and hospitality added 35,000 jobs, which is far below the sector’s average monthly job gain over the first nine months of the year (78,000). Additionally, the BLS revised the employment gains for August down by 23,000, from 315,000 to 292,000. The September figure was revised upward by 52,000, from 263,000 to 315,000.

Sun Belt Markets Dominate Top 10 ‘Markets to Watch’ in 2023, According to Emerging Trends Report

by John Nelson

WASHINGTON, D.C. — A variety of Sun Belt markets once again lead the “top markets to watch” in 2023 for overall real estate prospects, with Nashville ranking No. 1 for the second consecutive year in the annual Emerging Trends report issued by the Urban Land Institute (ULI) and PwC US. Using proprietary data and insights from more than 2,000 real estate industry experts across 80 tracked markets in the United States and Canada, Emerging Trends pegged the Music City as a “supernova” market due to its evolution from an 18-hour city to a “24-hour metropolis.” In the past couple years, Nashville has attracted Amazon and Oracle to build new office campuses, and two weeks ago the NFL’s Tennessee Titans and the Metropolitan Government of Nashville and Davidson County agreed to terms for a new $2.1 billion football stadium in the East Bank district that could attract events such as the Super Bowl and College Football Playoff. The private investment is in response to the Nashville MSA posting a 21 percent population growth rate in the past decade, according to the latest U.S. Census data. The Emerging Trends report noted that the pandemic has reinforced these migration trends as workers from …

WASHINGTON, D.C. — Redbrick LMD has received a $142.5 million construction loan for the development of The Douglass, a 750-unit residential project in Washington, D.C.’s Bridge District. Brian Gould of Chatham Financial arranged the loan through Citizens Bank on behalf of Redbrick. The Douglass will feature 40,000 square feet of retail space, and about 80 of the apartments will be reserved as affordable housing. The Douglass will be the first building constructed in the Bridge District, which comprises eight acres. Upon completion, the 2.5 million-square-foot project will be developed as a mixed-use neighborhood with a focus on sustainability and wellness. The Douglass is designed to target net zero carbon from operations and to meet or exceed International Future Living Institute (IFLI) and LEED Platinum standards.

Mitsui Fudosan America Reaches Deal With Industrious for 40,653 SF Space at Homer Building in D.C.

by John Nelson

WASHINGTON, D.C. — Mitsui Fudosan America (MFA) has signed a partnership agreement with Industrious, a flexible workplace company, for the use of 40,653 square feet of space at The Homer Building, an office building located at 601 13th St. NW in Washington, D.C. Located on the 12th floor, the space will feature private offices and a total of over 500 seats. The Industrious space at The Homer is scheduled to open in early 2023. Located atop Metro Center Station in D.C.’s East End neighborhood, The Homer Building features a rooftop deck, modernized elevator mechanicals and cabs, a four-level parking garage, full-service fitness center and a Panera Bread and coffee shop on the ground level.

WASHINGTON, D.C. — Standard Real Estate Investments LP, a minority-owned national real estate investment and development firm with offices in Washington, D.C., and Los Angeles, has purchased the Senator Square and East River Park shopping centers in northeast Washington D.C. The centers span 13 acres and are entitled and programmed for a $650 million mixed-use redevelopment that will bring 1,500 residential units, including approximately 300 affordable housing units, and 120,000 square feet of retail space to D.C.’s Northeast Heights district. National Housing Trust is developing 110 of the project’s 300 affordable housing units in a standalone building. The Black Economic Development Fund, which is managed by affiliates of the Local Initiatives Support Corp., and Forbright Bank provided construction financing for the development. The site is located within walking distance of the Minnesota Avenue Metro Station and near a build-to-suit office project that Trammell Crow Co. is developing for the District of Columbia’s Department of General Services. The construction timeline for the development was not disclosed.

WASHINGTON, D.C. — Foulger-Pratt has broken ground on Paxton, an affordable housing development located at the intersection of Benning Road and 16th Street in northeast Washington, D.C.’s Kingman Park district. The $101 million project will feature eight studio, 87 one-bedroom, 16 two-bedroom and 37 three-bedroom rental apartments upon completion, which is set for April 2024. A majority (133 units) will be reserved for households earning at or below 50 percent of the area median income (AMI). The remaining will be reserved for households earning at or below 30 percent of AMI and are designated as “permanent supportive housing.” All residents will have access to services through Hope Multiplied, a locally based nonprofit providing community development, health-and-wellness and socio-economic programs. Residents in the permanent supportive housing units will receive support services through Community of Hope, a local organization working to end family homelessness and improve health. Financing partners for Paxton include the District of Columbia Housing Finance Agency, which issued $46.9 million in tax exempt bonds and underwrote $42 million in D.C. and federal Low Income Housing Tax Credit (LIHTC) equity, in addition to a $29 million Housing Production Trust Fund loan from the D.C. Department of Housing and Community Development. …

WASHINGTON, D.C. — Law firm Cravath, Swaine & Moore LLP has signed a 21,065-square-foot office lease at 1601 K St. in Washington, D.C. The firm will occupy the entire third floor of the 11-story office building. The D.C. space will serve as the second domestic location for the law firm, which has offices in New York and London. Kyle Luby, Andy Eichberg and Matt Pacinelli of Stream Realty Partners represented the unnamed landlord in the transaction. Lou Christopher, Asher Inman, Jordan Brainard O’Neil, Lewis Miller, Andrew Sussman and Munish Viralam of CBRE represented the tenant in the lease negotiations. Stream also provides property management and construction management services for building ownership, which plans to debut two new speculative suites next year.

US Economy Adds 263,000 Jobs in September, Unemployment Rate Contracts to 3.5 Percent

by John Nelson

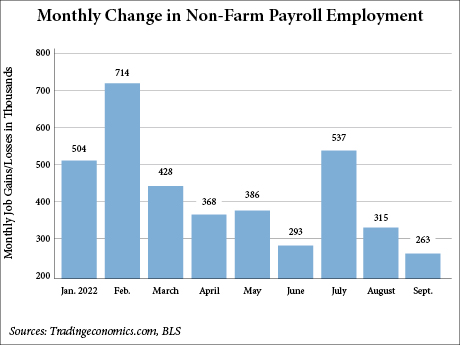

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 263,000 in September, and the unemployment rate contracted 20 basis points to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Monthly job growth has averaged 420,000 year-to-date in 2022, compared with 562,000 per month in 2021. The September performance fell narrowly short of the Dow Jones estimate of 275,000 but exceeded expectations for the unemployment rate, which the economists expected to remain at 3.7 percent, according to CNBC. Leisure and hospitality added 83,000 jobs in September, which is on par with the average monthly job gain over the first eight months of the year. Other notable gains were in the healthcare sector (+60,000), professional and business services (+46,000), manufacturing (+22,000) and construction (+19,000). Additionally, the BLS revised the employment gains for July upward by 11,000 to 537,000; the August figure was unchanged at 315,000. Lawrence Yun, chief economist for the National Association of Realtors, says the job gains in September for the office-using sectors were encouraging, but he emphasizes that the lack of office workers in downtown districts will continue to have a ripple effect on other economic sectors. “The traditional office-using jobs in the professional business …

Enterprise Community Development Purchases Skyland Apartments in Southeast D.C. for $25.7M

by John Nelson

WASHINGTON, D.C. — Enterprise Community Development Inc., an affiliate of Enterprise Community Partners, has closed on its $25.7 million purchase of Skyland Apartments, a 224-unit community in the Randle Heights neighborhood of Southeast Washington, D.C. Originally built in 1939, the “naturally occurring affordable housing” (NOAH) community comprises one- and two-bedroom duplexes and one-bedroom flats, as well as 10,000 square feet of commercial space. Enterprise Community Development’s acquisition from W.C. Smith was executed through the District of Columbia’s Tenant Opportunity to Purchase Act, which the residents began in 2019 before being delayed by the COVID-19 pandemic. EagleBank and Capital Impact Partners provided acquisition financing. Winn Management is currently serving as property manager for Skyland Apartments. Enterprise Community Development will focus on the property’s redevelopment and rehabilitation efforts in collaboration with residents to keep rents affordable.