WASHINGTON, D.C. — A partnership between Lowe, FLGA and Davenport Group has secured a 99-year ground lease from Howard University to construct a new residential tower on two sites in Washington, D.C.’s Shaw neighborhood currently being used as student parking lots. The 1.9-acre assemblage at 2251 Sherman Ave. and 2047 9th St. NW will be converted into a 525,000-square-foot, 10-story tower housing up to 500 residences, 27,000 square feet of commercial space and an underground parking garage. The partnership is undertaking the development with USAA Real Estate. JLL arranged an undisclosed amount of bridge financing for the land transaction through Eagle Bank. Construction is anticipated to commence in fall 2023. The project is the latest transaction by Howard University to densify its campus while maintaining long-term control of its real estate. Plans for the new housing include units ranging from studios to larger two-bedroom with den floor plans. Approximately 40 units will be designated as affordable housing, with the potential to increase that number to 60 units. Planned amenities include a club room, fitness center and rooftop patio and pool. The unnamed project is also set to include a 25-foot-wide public plaza fronting the future extension of W Street that …

District of Columbia

WASHINGTON, D.C. — JLL’s Hotels & Hospitality Group has negotiated the sale of Mandarin Oriental, Washington D.C., a luxury hotel in the city’s southwest district that spans nine stories and 373 rooms. The sales price was not disclosed. The buyer, London-based private equity real estate manager Henderson Park, has rebranded the hotel as Salamander Washington D.C. under the management of Middleburg, Va.-based Salamander Hotels & Resorts. Gilda Perez-Alvarado, Jeffrey Davis and Stephany Chen of JLL represented the seller, Mandarin Oriental Hotel Group International Ltd., in the transaction. Mark Fisher of JLL arranged an undisclosed amount of acquisition financing on behalf of Henderson Park. Built in 2004 and recently renovated, the hotel overlooks the Tidal Basin and the Washington Channel. Nearby attractions include the National Mall, Washington Monument, Martin Luther King Jr. Memorial, Thomas Jefferson Memorial and the Smithsonian National Museum of Natural History.

WASHINGTON, D.C. — Boston Properties Inc. (NYSE: BXP) has sold 601 Massachusetts Avenue, an approximately 480,000-square-foot office building in Washington, D.C., for $531 million. The buyer was not disclosed, but the Washington Business Journal reports that it was an affiliate of Mori Trust Co., a real estate development and investment firm based in Tokyo. Boston Properties originally developed the 11-story property in 2015. The firm will continue to provide property management services at 601 Massachusetts, which was 98 percent leased at the time of sale. 601 Massachusetts Avenue is situated in Washington, D.C.’s Mount Vernon Triangle neighborhood. Nearby attractions include the White House, Capital One Arena, Metro stations and the Walter E. Washington Convention Center. According to online property listings, the property includes a nine-story glass atrium, onsite fitness center, roof terrace and retail space leased to RPM Italian, Soul Cycle and lunch restaurant Devon & Blakely. Boston Properties structured the disposition as part of a reverse like-kind exchange under Section 1031 of the Internal Revenue Code with its $730 million acquisition in May of Madison Centre, a 37-story office tower in Seattle. “This disposition demonstrates continued investor demand for premier, well-leased office properties,” says Owen Thomas, chairman and CEO …

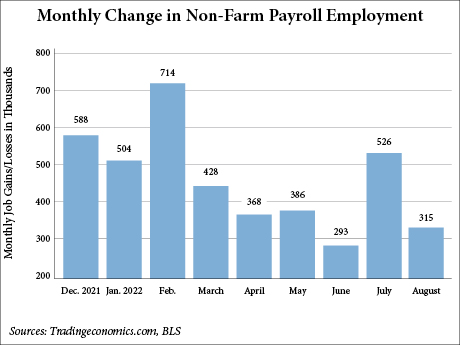

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 315,000 in August, and the unemployment rate ticked up to 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). While in line with Dow Jones economist estimates of 318,000 jobs, August represents the second-lowest monthly gain since April 2021, according to CNBC. Additionally, the 20-basis-point increase in the unemployment rate is the first monthly hike this year. The change in total nonfarm payroll employment for June was revised down by 105,000 jobs, from 398,000 to 293,000, and the change for July was revised down by 2,000, from 528,000 to 526,000, according to the BLS. Professional and business services led all employment sectors in hiring with 68,000 added jobs in August. Healthcare employment rose by 48,000, the retail sector added 44,000 jobs, manufacturing added 22,000 and financial activities added 17,000 jobs. Employment rose in the leisure and hospitality sector by 31,000, which is down significantly from its monthly average in 2022 of 90,000 jobs.

WASHINGTON, D.C. — Grosvenor has obtained an $82.1 million loan to refinance 1500 K Street, a 262,190-square-foot mixed-use building in Washington, D.C. Eastdil Secured arranged the loan through Helaba on behalf of Grosvenor. Built in 1928, 1500 K Street comprises offices and retail space. The property is situated near the McPherson Square Metro station and the White House, as well as Washington, D.C.’s downtown and East End districts. Grosvenor recently invested $20 million to renovate the property, including updates to the lobby, fitness center, tenant lounge, HVAC system, roof and rooftop lounge.

TORONTO AND WASHINGTON, D.C. — Toronto-based commercial real estate services firm Avison Young has signed an agreement to acquire Washington, D.C.-based Madison Marquette’s office and industrial property management, agency leasing and project management service lines. The trio of services will operate under the Avison Young brand as part of the acquisition, which is expected to close in September. Financial terms of the deal were not disclosed. The acquisition includes more than 20 million square feet of affected real estate, as well as 235 team members, including property managers, agency leasing professionals, project managers, building engineers and accountants. The former Madison Marquette staffers will integrate with Avison Young’s existing markets, primarily in Texas and California, the East Coast region and a new Hawaii office. Avison Young will integrate its data analytics, technology and global real estate intelligence platform with Madison Marquette’s trophy assets and institutional clients, such as CenterPoint Energy, Starwood Property Trustand Principal Global Investors. “This is a transformative opportunity for both companies to build on their core strengths to achieve competitive advantage,” says Vince Costantini, CEO of Madison Marquette. “We made the strategic choice to move a portion of our services to Avison Young to better serve our office …

WASHINGTON, D.C. — Potomac, Md.-based Foulger-Pratt has sold a 1,752-unit self-storage facility located at 72 Florida Ave. in Washington, D.C. A partnership between Invesco Real Estate and Baranof Holdings purchased the facility for an undisclosed price. Steve Mellon, Brian Somoza, Craig Childs, Bill Prutting and Jay Wellschlager of JLL represented the seller in the transaction. Built in March 2020, the seven-story property operates under the Extra Space Storage brand and features a 1,000-square-foot office and 400 square feet of restrooms and bike storage. The facility offers electronic access control, 24-hour video surveillance, covered loading areas and two elevators to access the upper floors.

WASHINGTON, D.C. — Mesirow, a financial services firm based in Chicago, has provided the $275 million refinancing for the National Aeronautics and Space Administration (NASA) headquarters offices in Washington, D.C. Located at 300 E St. SW, the nine-story office building spans more than 600,000 square feet and was built in 1991, according to LoopNet Inc. The borrower is a partnership between Hana Alternative Asset Management and Ocean West Capital Partners. Proceeds from the financing provided the partnership with fixed-rate debt that is interest-only for the full term. The loan has a 2028 maturity date, which is coterminous with NASA’s lease. With the funds, the Hana and Ocean West partnership is recapitalizing its equity interest at the property, which is subject to the sixth-largest lease by the General Services Administration (GSA), the federal government’s independent agency that oversees certain operations like office and research space. (The GSA is the leaseholder for NASA.) Mesirow served as placement agent and administrative agent on the financing. Cushman & Wakefield arranged the financing on behalf of the borrower and negotiated terms between the borrower and Mesirow. Mesirow was founded in 1937 and offers credit tenant lease and structured debt products to borrowers. The company’s services …

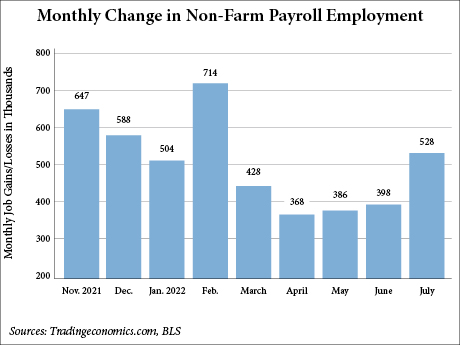

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 528,000 in July, while the employment rate ticked down to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Employment gains more than doubled the prediction of Dow Jones economists, who forecast the U.S. economy would add 258,000 jobs and the unemployment rate would remain unchanged at 3.6 percent for the fifth consecutive month, according to CNBC. July represents the highest monthly employment total since February, which totaled 714,000 jobs. July job gains were led by leisure and hospitality (96,000), an employment sector that remains 1.2 million jobs below pre-pandemic levels in February 2020 (a 7.1 percent loss). Other sectors that saw notable additions last month include professional and business services (89,000), healthcare (70,000), government (57,000), construction (32,000) and manufacturing (30,000). Additionally, the BLS revised job gains in May and June by a combined +28,000 jobs. The change in total nonfarm payroll employment for May was revised up by 2,000 (from 384,000 to 386,000), and the change for June was revised up by 26,000 (from 372,000 to 398,000).

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 528,000 in July, while the employment rate ticked down to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Employment gains more than doubled the prediction of Dow Jones economists, who forecast the U.S. economy would add 258,000 jobs and the unemployment rate would remain unchanged at 3.6 percent for the fifth consecutive month, according to CNBC. July represents the highest monthly employment total since February, which totaled 714,000 jobs. July job gains were led by leisure and hospitality (96,000), an employment sector that remains 1.2 million jobs below pre-pandemic levels in February 2020 (a 7.1 percent loss). Other sectors that saw notable additions last month include professional and business services (89,000), healthcare (70,000), government (57,000), construction (32,000) and manufacturing (30,000). Additionally, the BLS revised job gains in May and June by a combined +28,000 jobs. The change in total nonfarm payroll employment for May was revised up by 2,000 (from 384,000 to 386,000), and the change for June was revised up by 26,000 (from 372,000 to 398,000).