WASHINGTON, D.C. — Newmark has arranged the sale of Universal North and South, two Class B office buildings encompassing an entire city block near Dupont Circle in downtown Washington, D.C. Bethesda, Md.-based JBG Smith sold the assets to Philadelphia-based Post Brothers for $228 million. Totaling 659,459 square feet, the two-building office complex is located at 1825 and 1875 Connecticut Ave. NW. Universal North is a 12-story, 368,071-square-foot, value-add property, which was 40 percent leased at the time. Universal South is a 10-story, 291,387-square-foot, cash-flowing asset that was 98 percent leased at the time of sale. The project can accommodate an additional 73,428 square feet. Jud Ryan and James Cassidy of Newmark represented the seller in the deal.

District of Columbia

WASHINGTON, D.C. — Ares Management Corp. and MRP Realty have finalized the land purchase and Phase I construction financing for a mixed-income residential development on the site of the current home of the District of Columbia Housing Authority (DCHA) in Washington, D.C. Arkansas-based Bank OZK provided acquisition and construction financing. Construction is slated to begin immediately, with Phase I delivery anticipated in 2024. The project is a joint venture between Ares Management Real Estate funds, MRP Realty, CSG Urban Partners and Taylor Adams Associates. Located at 1133 N. Capitol Street NE in the city’s NoMa neighborhood, Phase I will comprise 430 multifamily units, including 86 affordable units. The multi-phased development will comprise an estimated 1,200 apartments, including a minimum of 244 affordable housing units, at least half of which will be reserved for residents earning 30 percent or less of the area median income. Located two blocks west of the NoMa Metro station, the 0.8-acre plot will give DCHA funding to address its portfolio-wide capital needs and fund a much-needed new headquarters building that will serve DCHA staff and residents. DCHA’s headquarters will now move into the new WMATA headquarters building at 300 Seventh St. SW, where it will occupy …

WASHINGTON, D.C. — Greysteel has arranged the sale of Ravenel and Barclay, two multifamily properties totaling 120 units in the Dupont Circle neighborhood of downtown Washington, D.C. The buyer and sales prices were undisclosed. Situated two doors down from one another, the properties are located at 1610 and 1616 16th St. NW. Built in 1933, Ravenel totals 63 units and contains a mix of studio and one-bedroom apartments. Built in 1926, Barclay totals 57 units and includes a mix of one-bedroom and two-bedroom apartments. Amenities include a fitness center, laundry rooms, package concierge, bike storage, outdoor patio and an onsite management office. Renovations to the lobbies, leasing office, hallways, common areas and unit interiors were completed by the seller upon its acquisition.

Akridge, National Real Estate Development Break Ground on Stacks Residential Project in D.C.

by John Nelson

WASHINGTON, D.C. — Akridge and National Real Estate Development have broken ground on Phase I of The Stacks, a residential development in Washington, D.C.’s Buzzard Point neighborhood. Situated along the Anacostia River in the city’s Capitol Riverfront district, The Stacks will comprise three towers featuring 1,100 apartments and 35,000 square feet of ground-floor retail space. More than 10 percent of the apartments will be income-restricted. Bank OZK provided construction financing for Phase I, which is slated to deliver in 2025. The developers tapped general contractor Clark Construction Group to build Phase I and engaged Gensler, Morris Adjmi Architects, Handel Architects, Eric Colbert & Associates, West 8, Lee & Associates, DXA, HOK and Hickok Cole for the project’s overall design. The Stacks is jointly owned by Akridge, Bridge Investment Group, Blue Coast Capital and institutional funds managed by National Real Estate Advisors, parent company of National Real Estate Development.

WASHINGTON, D.C. — Wegmans, an upscale supermarket chain based in Rochester, N.Y., is expanding in metropolitan Washington, D.C. In early May, the grocer opened an 81,300-square-foot store at 150 Stovall St. in Alexandria, Va., a store that anchors Stonebridge’s Carlyle Crossing mixed-use development. The Alexandria store opened earlier this month and is the 14th Wegmans in Virginia and 107th nationwide. The grocer also plans to open an 85,000-square-foot store within the Halley Rise development in Reston, Va., and an 84,000-square-foot store at the $640 million City Ridge development in northwest Washington, D.C. The City Ridge store will open in July and the Reston store is set to open in early 2023. Wegmans is also opening an 84,000-square-foot store in Wilmington, Del., this fall.

WASHINGTON, D.C. — The National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) have praised the Biden administration on the release of the Housing Supply Action Plan, which aims to alleviate the housing affordability crisis and lower costs for renters. Under the plan, the administration outlined new measures that would produce more housing supply, including more affordable housing units, over the course of the next five years. The plan includes several concepts previously proposed in the Build Back Better bill that passed in the House but stalled in the Senate. Though the NMHC and NAA have acknowledged that there is no “single magic bullet” that can solve the nation’s housing shortage, they underlined that the current crisis is the result of decades of policy failures to address the growing shortage of housing production. In their reaction, both associations point to research conducted by Hoyt Advisory Services that found that the U.S. will need to build an average of 328,000 apartments every year through 2030 to keep up with national demand. That mark has only been achieved five times since 1989. The NMHC and NAA states they are particularly encouraged by specific aspects of the proposed policy. The NAA recently …

WASHINGTON, D.C. — Commercial and multifamily mortgage loan originations increased 72 percent in the first quarter of 2022 compared with the same period last year, according to the Mortgage Bankers Association (MBA). In line with seasonality trends, originations during the first three months of 2022 were 39 percent lower than in the fourth quarter of 2021. By property type, loan originations for hotels increased by 359 percent year-over-year, followed by industrial (145 percent), retail (88 percent), healthcare (81 percent), multifamily (57 percent) and office (30 percent). Among investor types, the dollar volume of loans originated for depositories (banks) increased by 194 percent year-over-year, followed by life insurance companies (81 percent), investor-driven lenders (77 percent), conduit lenders (56 percent), and government-sponsored enterprises Fannie Mae and Freddie Mac (1 percent). Jamie Woodwell, MBA’s vice president of commercial real estate research, says that the year-over-year swing in loan volume is the result of strong demand for the various real estate categories. The veteran economist says rising interest rates could be a fly in the ointment for borrowers for the foreseeable future. The 10-year U.S. Treasury yield closed at 2.93 percent on May 13, up from 1.63 percent at the start of the year. …

ARLINGTON, VA. — Boeing (NYSE: BA) has chosen Arlington as the site for its new global headquarters due to the city’s proximity to Washington, D.C., and strong client and talent base in the region. The aerospace and defense giant is moving its headquarters from Chicago, where the firm plans to maintain a significant office presence. In addition to the corporate relocation, Boeing plans to develop a research and tech hub in Arlington to support and train Boeing employees in the areas of cyber security, autonomous operations, quantum sciences and software and systems engineering. Details about the campus and the construction timeline were not disclosed. Boeing’s stock price closed on Thursday, May 5 at $150.47 per share, down from $229.81 a year ago, a 34.5 percent decline.

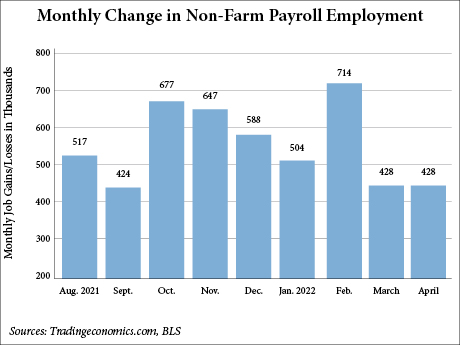

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 428,000 in April, while the 3.6 percent unemployment rate was unchanged from the prior month, according to the U.S. Bureau of Labor Statistics (BLS). Dow Jones economists had projected job gains of 400,000 in April and were expecting the unemployment rate to drop to 3.5 percent, according to CNBC. Once again, the employment sector with the largest gain was leisure and hospitality, which posted 78,000 new jobs last month. The 4.8 percent unemployment rate in the leisure and hospitality sector was the lowest rate since September 2019, though employment remains down by 8.5 percent from February 2020. The BLS reports that average hourly earnings for leisure and hospitality workers was up 11 percent year-over-year last month. Other employment sectors with notable net gains in April included manufacturing (55,000 jobs), transportation and warehousing (52,000) and professional and business services (41,000). Construction, information and government sectors showed little employment change over the past month. Total nonfarm payroll employment in February was revised downward from 750,000 to 714,000, according to the BLS, and the March figure was revised downward from 431,000 to 428,000. With these revisions, employment in February and March combined was 39,000 lower …

WASHINGTON, D.C. — A joint venture between Akridge, National Real Estate Advisors, Blue Coast Capital and Bridge Investment Group has broken ground on the first phase of The Stacks, a 2 million-square-foot mixed-use project in Washington, D.C. Bank OZK is providing a $367 million construction loan for the first phase of the development. William Collins, Bindi Shah, Marshall Scallan and Shaun Weinberg of Cushman & Wakefield arranged the loan. The construction timeline was not disclosed. The first phase of The Stacks will include three rental residential towers totaling more than 1,100 apartments. At full buildout, the master-planned development will offer 2,000 residential units, as well as two hotels, public parks and gathering spaces and about 80,000 square feet of retail space. The property will also feature a variety of creative working spaces, as well as below-grade parking and loading. Gensler, Morris Adjmi Architects, Eric Colber & Associates, Handel Architects, West 8 and Lee and Associates Inc. are the designers for the first phase of the project.